Resources

-1.png)

Unlocking Insurance Access for Half a Million Homes and Business Owners

ZestyAI's property-level risk models are helping insurers expand sustainable coverage in wildfire- and storm-prone regions.

ZestyAI helped carriers and insurers of last resort extend coverage to over 511,000 properties previously deemed uninsurable in 2024. This year, ZestyAI aims to double its impact, helping to bring coverage options to over a million families and businesses, ensuring that those in catastrophe-prone regions have access to sustainable, risk-aligned insurance.

A 2024 Deloitte survey found that nearly a quarter of homeowners in high-risk states are struggling to find coverage, while over half cite affordability as a growing concern—underscoring the industry’s need for granular insights that support underwriting and pricing decisions aligned with true property-level risk.

“For too long, insurers have had to make high-stakes decisions with incomplete information,” said Attila Toth, Founder and CEO of ZestyAI. “Advanced AI models are changing that. With granular, property-specific risk insights, insurers can close protection gaps and build a more resilient market.”

Traditional risk assessment methods rely on territory- or ZIP code-level evaluations, overlooking the property-level characteristics that drive risk. This approach leads to adverse selection, inaccurate pricing, and widespread market withdrawal.

ZestyAI replaces this approach with transparent, AI-powered models that integrate climatology, geospatial data, historical losses and structural attributes to deliver precise views of wildfire, hail, and wind risk, among other perils.

The results:

- Clear mitigation guidance to help policyholders take action.

- Risk-aligned premiums that support responsible market expansion.

- Improved underwriting precision through AI-driven risk scores and near-complete U.S. coverage.

- Optimized loss cost controls via more effective deductible, Actual Cash Value (ACV), and coverage strategies.

- A supportive experience for carriers, families, and businesses—enabling faster decisions, better communication, and greater confidence in coverage options.

- Streamlined inspections that lower expenses and improve efficiency.

ZestyAI collaborates closely with regulators to ensure transparency, validation, and model oversight. Its wildfire model, Z-FIRE, is approved across all Western states, while its severe convective storm models have gained broad acceptance from Texas to Colorado and throughout the Midwest and Great Plains.

As regulators support the use of advanced models, they are also paving the way for smarter risk-based pricing and proactive mitigation—revitalizing insurance’s core mission: protecting the livelihood of home and business owners and their communities.

.png)

2025 Storm Risk Webinar Now Available On Demand

Stream our webinar for a preview of severe convective storm risk in 2025 and see how AI-driven insights can help you stay prepared.

Severe convective storms are becoming more frequent and costly, putting pressure on insurers to refine underwriting and risk management strategies.

On April 2, our experts covered:

- Key drivers behind increasing severe storm losses

- What La Niña means for the 2025 season

- How AI-powered risk models improve risk segmentation

- Live Q&A – Get expert answers to your toughest questions!

Missed the live event? Stream now!

EarthDaily Analytics Partners with ZestyAI for Advanced Property Risk Insights

Earth Observation data meets AI to address rising climate risks and enhance insurance decision-making.

ZestyAI has partnered with EarthDaily Analytics (EarthDaily), a global provider of Earth Observation analytics and data.

Through this partnership, ZestyAI’s advanced models—including Z-FIRE™, Z-HAIL™, Z-WIND™, and Z-STORM™—will be available through EarthDaily’s Ascend platform, delivering geospatial data, risk modeling, and post-event insights to insurers.

With the insurance industry facing escalating challenges from climate-driven catastrophes and increasing pressure to accurately price risk, ZestyAI’s models provide granular, property-level risk data. These models analyze factors like vegetation density, construction materials, and historical weather patterns to offer insights beyond traditional methods.

“At EarthDaily, we’re committed to delivering cutting-edge property insights to customers navigating today’s climate risks,” said Rachel Olney, VP of Insurance at EarthDaily.

With advanced AI models covering wildfire, hail, wind, and property data, ZestyAI is an ideal partner to support our mission.

"By including their advanced analytics in our Ascend platform, we’re excited to empower clients to take proactive steps in managing and mitigating risk with confidence."

ZestyAI’s solutions achieve nearly 100% hit rates, offering actionable insights that insurers and businesses can trust. By bolstering the data available in the Ascend platform with property-level insights, the partnership provides decision-makers with a new level of clarity to mitigate risks, improve underwriting, and allocate resources more effectively.

The collaboration exemplifies the growing importance of innovative technology in the insurance and property management sectors, especially as global climate risks continue to evolve.

Roof Age in Rate Filings is Down: What’s Taking Its Place?

For the first time in two decades, regulatory filings using Roof Age have declined as a new standard emerges.

For years, insurers asked:

“How old is this roof?”

Now, the real question is:

“How will this roof perform?"

The way insurers assess roof risk has evolved significantly over the past two decades. What began as a simple Roof Age-based surcharge has transformed into a sophisticated approach that considers real-time condition, storm resilience, and structural complexity.

A closer look at SERFF regulatory filings traces the first recorded use of Roof Age back to 2004 when The Hartford introduced Roof Age-based pricing in Iowa.

At the time, the insurer applied a flat 10% surcharge to roofs 26 years and older—a figure that now seems outdated, as many carriers won’t insure roofs older than 15 years.

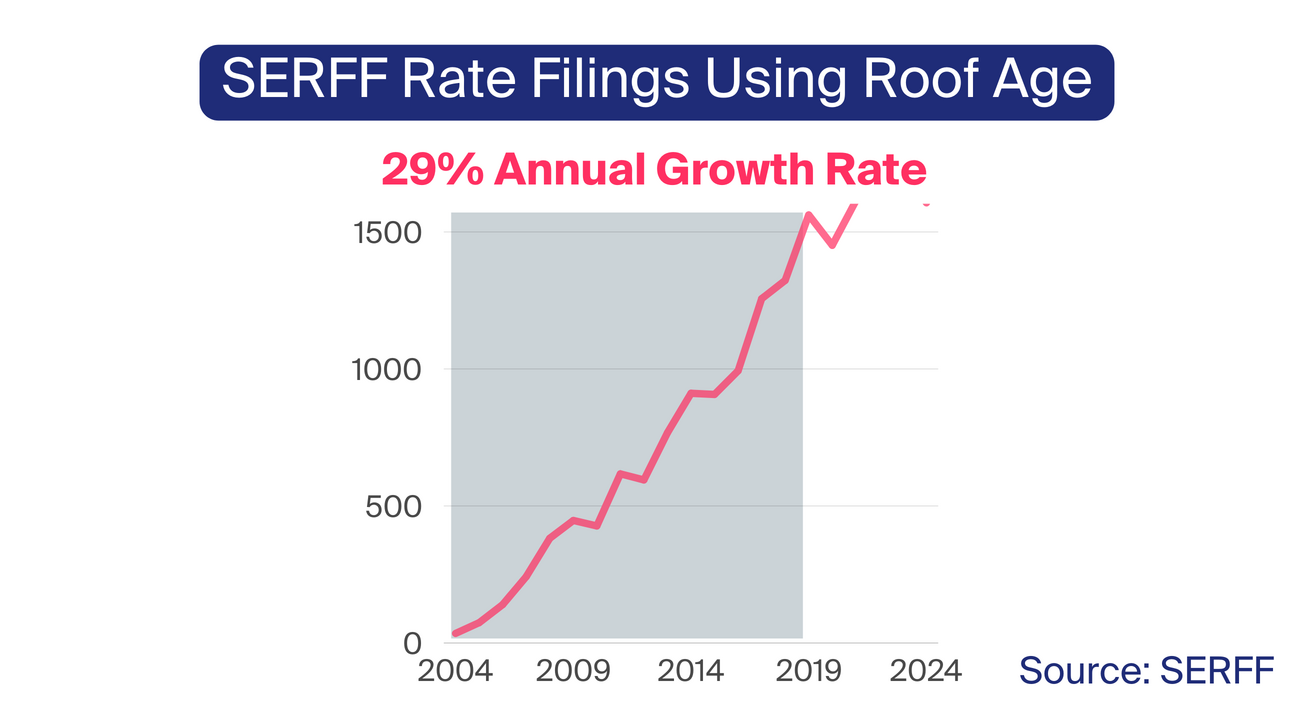

Roof Age quickly became a key rating factor—by the 2010s, Roof Age adoption in rate filings surged, growing at an annual rate of 29%.

If you fast forward just 10 years after The Hartford’s initial filing, you’ll find a stark contrast in how roof risk was assessed. By 2014, The Hartford’s rate filing in Iowa contained 51 pages of actuarial tables, detailing various roof materials and rate adjustment factors for age.

This shift reflected a broader trend—Roof Age moved from a simple surcharge to a more nuanced risk model that accounted for material durability, wear patterns, and structural longevity.

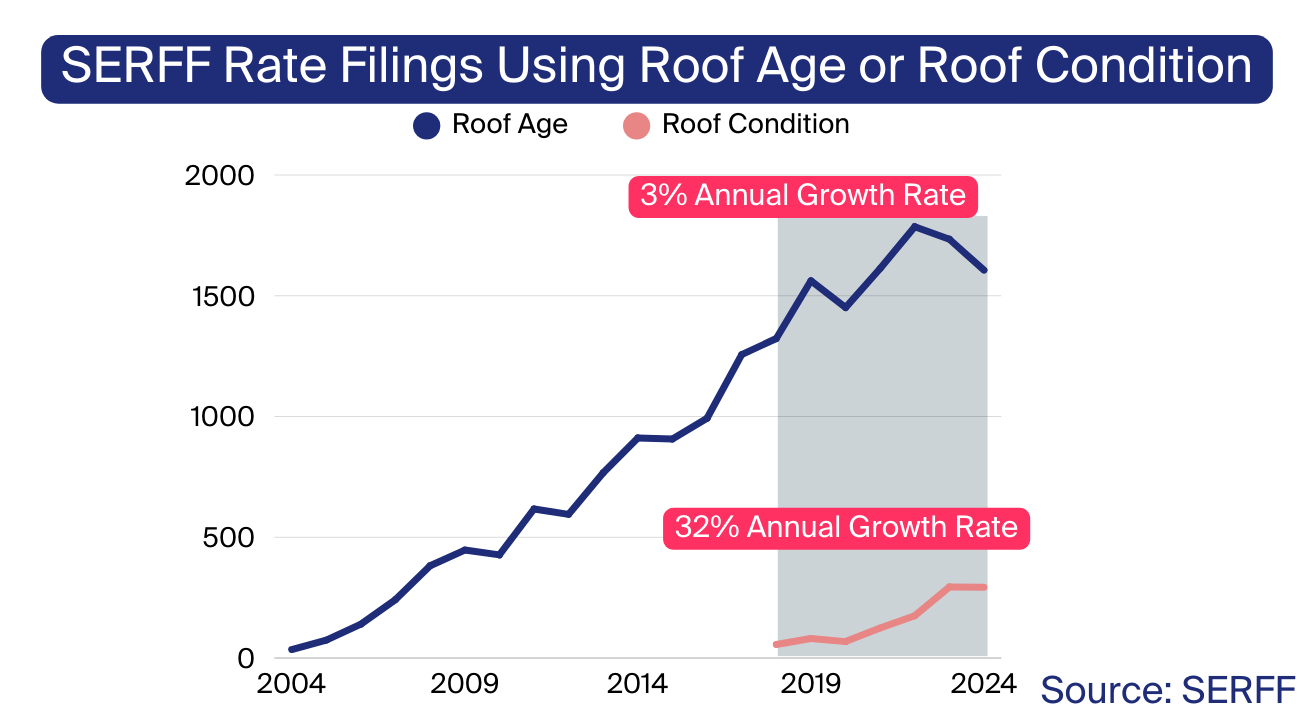

By 2018, insurers began looking beyond Roof Age, and that’s when Roof Condition first appeared in regulatory filings.

Over the past five years, its adoption has surged 32% annually, outpacing Roof Age at its peak. Insurers also began incorporating roof complexity variables, such as pitch and facets, to further refine their risk assessment models.

These advancements provided a more nuanced view of risk, moving beyond the assumption that all old roofs posed the same level of hazard.

Now, for the first time in two decades, Roof Age is plateauing. Over the past two consecutive years, we've seen a decline in the number of filings incorporating Roof Age, bringing its usage close to 2019 levels.

This decline suggests that carriers are moving toward more sophisticated approaches, leveraging real-time condition assessments rather than relying solely on the number of years since installation. After all, a 10-year-old roof in poor condition can present a greater risk than a 20-year-old roof that has been well-maintained—and insurers are recognizing the importance of capturing these distinctions.

With severe convective storm-related insured losses reaching $58 billion in 2024, traditional risk assessment methods can no longer keep up.

A new paradigm is emerging, where advanced AI-driven risk models provide the precision and resilience needed to navigate an increasingly volatile climate.

At ZestyAI, we’re helping insurers make this shift with models like Z-STORM, Z-HAIL, and Z-WIND, which are already filed and approved in 14 states, including Texas, Colorado, Illinois, Oklahoma, and Louisiana.

Those who embrace these innovations will gain a competitive edge—reducing loss costs, improving operational efficiency, and ultimately shaping the future of risk assessment in property insurance.

Report: Severe Convective Storm Preview 2025

Get the insights to manage risk in 2025 before claims surge.

Severe convective storms (SCS)—including tornadoes, hail, and damaging wind events—resulted in $58 billion in insured losses across the U.S in 2024.

Insurers face a dual challenge: navigating the uncertainty of storm patterns while ensuring their portfolios remain resilient enough to absorb the financial strain from clustered, high-loss events.

Research with IBHS confirms that SCS damage accumulates over time, particularly affecting rooftops after multiple exposures to intense storm activity. As housing stock deteriorates, insurers must reassess their portfolios to ensure underwriting, rating, and loss cost controls align with their risk appetite and maintain premiums that accurately reflect evolving exposure.

Get ahead of rising storm risks with expert insights that help you strengthen underwriting, risk assessment, and claims management.

$2.15 Trillion in Property Value at Risk as Wildfire Exposure Expands Across the U.S.

ZestyAI Identifies 4.3 Million U.S. Homes with High Wildfire Risk.

A staggering $2.15 trillion worth of U.S. residential property is at high risk of wildfire damage, according to a new AI-powered analysis from ZestyAI, the leader in climate and property risk analytics. The study, which assessed 126 million properties nationwide, found that 4.3 million individual homes face heightened wildfire risk—far beyond traditionally recognized high-risk areas.

Using advanced AI models trained on over 2,000 historical wildfires, ZestyAI mapped wildfire exposure at the property level, integrating satellite and aerial imagery, topography, and structure-specific characteristics. While California leads the nation with $1.16 trillion in wildfire-exposed property, other states such as Colorado ($190.5 billion), Utah ($100.3 billion), and North Carolina ($71.2 billion) also face significant risk.

Wildfire Risk is a Nationwide Challenge

While the Western U.S. has historically seen the most severe wildfire activity, ZestyAI’s findings confirm that high-risk properties exist across the country. States like North Carolina (4.6% of homes at high risk), Kentucky (2.9%), Tennessee (2.3%), and even South Dakota (11.0%) are now seeing increased wildfire exposure.

As more homes and businesses are built in fire-prone landscapes, the Wildland-Urban Interface (WUI) continues to expand. This, combined with intensifying climate conditions, is driving higher insurance costs and growing availability concerns. Today, one in eight U.S. homeowners already lacks adequate insurance coverage, and that number is expected to rise.

AI Expands Insurance Access in High-Risk Areas

Attila Toth, Founder and CEO of ZestyAI said:

"Wildfires are threatening more properties than ever before, with billions of dollars in exposure even in areas many people don’t associate with fire risk. Yet, too many homeowners are finding themselves uninsured or underinsured just as these disasters become more frequent and severe. Insurers have traditionally relied on broad, regional models that don’t account for individual property characteristics."

"That means some homeowners are denied coverage even when their true risk is much lower than their neighbors'.’"

AI-driven risk analytics are reshaping the way insurers assess wildfire exposure. By providing granular, property-specific insights, we’re helping insurers make smarter underwriting decisions—keeping coverage available in high-risk areas while ensuring that homeowners who take mitigation steps are recognized.

Last year, our models helped insurers extend coverage to 511,000 properties that had previously struggled to secure insurance due to outdated risk models. In 2025, we expect that number to reach a million, ensuring that even in high-risk areas, responsible homeowners have access to protection when disaster strikes.

Ready to see how ZestyAI works on your book of business?

Tell us a little about your needs. We'll show you how we reduce losses and help you price with precision.