Z-FIRETM

The Standard for Wildfire Risk

Z-FIRE uses AI and real-world loss data to deliver unmatched accuracy in property-level wildfire risk scoring—including the threat of urban conflagration. Built for insurers and approved for rating and underwriting in wildfire-exposed states nationwide.

Wildfire Risk Scores You Can Trust

Z-FIRE combines aerial imagery, expert fire science, and proprietary modeling to deliver accurate, property-level wildfire insights. Trusted by leading insurers and approved by regulators, Z-FIRE supports rating, underwriting, and portfolio decisions.

44X Predictive Power

Z-FIRE outperforms traditional regional models by 44X in predicting property-level wildfire risk.

40% California Share

Z-FIRE is trusted by carriers, insuring 40% of the California homeowners market.

DOI Approved

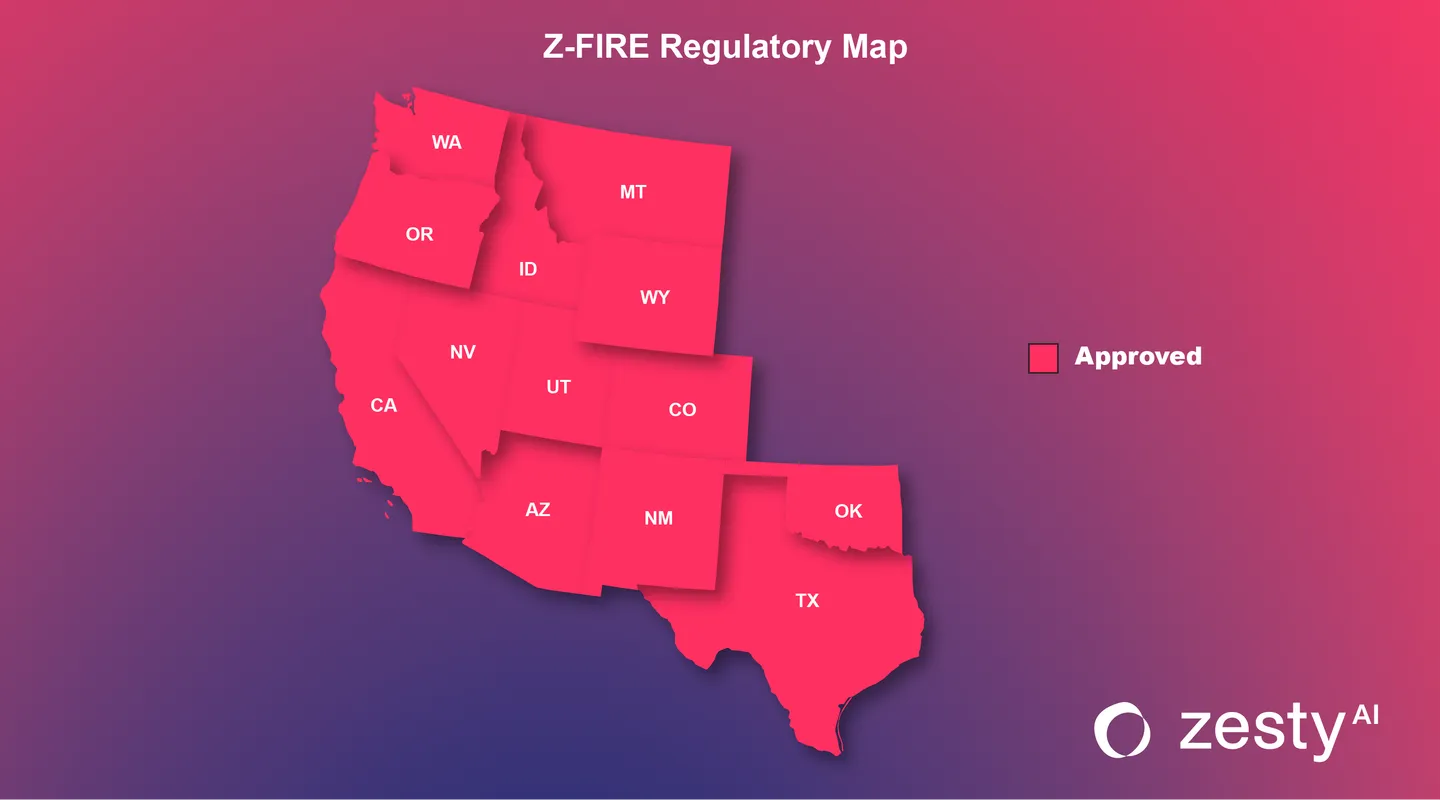

Regulatory-approved for use in rating and underwriting in every wildfire-prone state in the western U.S.

20 Years of Wildfire Events

Trained on the largest historical wildfire loss database in the industry, derived from wildfire events over the past two decades.

Nationwide Coverage

Z-FIRE delivers property-level wildfire risk scores across 100% of the U.S.

Backed by Science

Built on the latest fire science and structure-ignition research from the Insurance Institute for Business & Home Safety (IBHS).

Neighborhood Score (Level 1): Regional Exposure, Quantified

Evaluates the likelihood that a property will fall inside a future wildfire perimeter, based on regional fire behavior, vegetation, topography, and suppression capacity.

Property Score (Level 2): Structural Vulnerability, Quantified

Predicts the likelihood that a structure will ignite given wildfire proximity, using roof characteristics, defensible space, and other property-specific features.

Mastering Wildfire Risk with Z-FIRE

When the traditional methods of assessing wildfire risks, which were once standard in the industry, began to show their limitations, Heritage Insurance turned to the precision of Z-FIRE.

How Z-FIRE Works

Z-FIRE combines deep fire science with advanced AI to deliver trusted wildfire risk scores. From historical fire behavior to property-level details, every input is selected and tested to reflect real-world outcomes insurers can count on.

Diverse, High-Quality Inputs

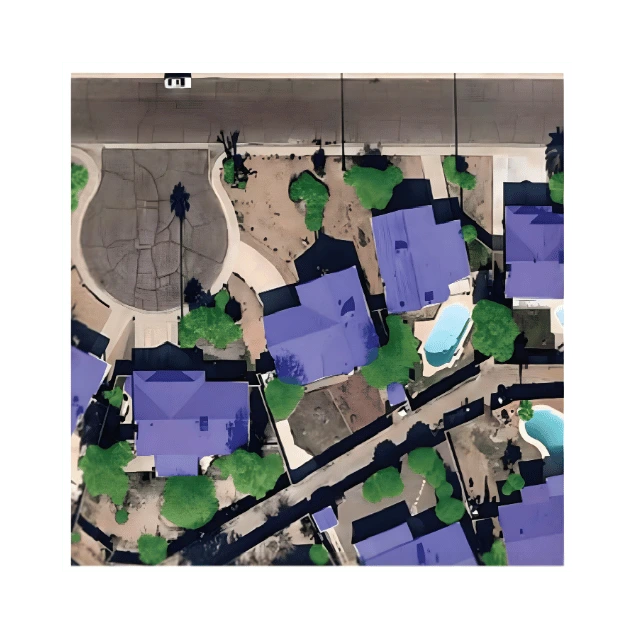

Aerial Imagery

Up-to-date views of rooftops, vegetation, and property condition.

Topography & Vegetation

Terrain slope, fuel load, and proximity to dense vegetation.

Climatology Data

Heat, wind, and drought conditions that fuel fire spread.

Fire Suppression Zones

Response capacity and proximity to firefighting infrastructure.

Historical Fire Patterns

Data from two decades of wildfires to understand ignition and spread patterns.

Turning Raw Data into Insight

Z-FIRE uses advanced AI to transform raw spatial, visual, and contextual data into predictive features. Every variable is stress-tested for statistical value, interpretability, and alignment with fire science.

Structural Characteristics

Analyzes building materials and construction codes in effect at the time of build.

Defensible Space & Surroundings

Assesses vegetation density, overhang, and nearby building density to understand fire spread risk.

Topography & Climatology

Evaluates slope at both the property and community level, along with local temperature and precipitation.

Suppression Capacity

Accounts for fire station proximity, road access, and community suppression resources.

.webp)

Purpose-Built for Wildfire Risk

Z-FIRE is built using gradient boosted machines trained on more than 1,500 historical wildfire events. Our models assess how property-specific characteristics and environmental conditions interact with real fire behavior to produce scores that are accurate, explainable, and designed for insurance use.

Trained on Real Fire Events

Built on the largest wildfire loss database in the industry, spanning 20+ years and 1,500+ events.

Gradient Boosted Machines

Captures nonlinear interactions between variables to produce highly predictive, stable risk scores.

Transparent Risk Drivers

Delivers the top contributing risk factors for each score to support underwriting and appeals.

Mitigation Simulation

Carriers can simulate mitigation actions or adjust scores during appeals using a controlled override process.

Tied to Expected Loss

Scores align with average annual loss (AAL) metrics for easy integration into rating models.

Built to Earn Trust

Z-FIRE has undergone rigorous testing and regulatory scrutiny to ensure it meets the highest standards for performance, fairness, and transparency. Our validation process includes annual wildfire season performance benchmarking, expert review, and documentation designed for both regulators and internal governance.

Regulatory Approved

Z-FIRE is approved for use in rating and underwriting across all western wildfire-prone states.

Annual Wildfire Benchmarking

Each year, Z-FIRE is evaluated against all new wildfire events to confirm accuracy and calibration.

Independent Review

Subject to expert third-party evaluations to verify methodology, fairness, and technical soundness.

Transparent Documentation

DOI-ready summaries, variable lists, and risk driver explanations support regulatory and internal review.

Ready for Filing, Built for Scrutiny

Z-FIRE is designed to meet the highest actuarial and regulatory standards for use in rating, underwriting, and portfolio management.

With approvals across the western U.S., Z-FIRE comes ready for deployment with all the technical documentation, rate support, and compliance testing needed for immediate DOI submission.

DOI Approved

Approved for use in rating and underwriting across all western wildfire-prone states.

Actuarial Standards

Complies with ASOP 12, 23, 25, and 38 to support sound actuarial practices.

Model Documentation

Detailed technical documentation available to support regulatory review and filings.

Rate Filing Support

Pre-approved relativities and rating factors available to streamline adoption.

Bias Testing Completed

Fairness, bias, and discrimination testing performed in alignment with DOI guidance.

Zero IT, Full Transparency

Z-VIEW is a web-based application that delivers instant access to Z-FIRE risk scores, top risk drivers, aerial imagery, and mitigation simulation tools for any address.

No IT integration required—Ideal for underwriters, actuaries, and field teams alike, Z-VIEW puts Z-FIRE insights at your fingertips from day one.

For system-wide deployment, ZestyAI offers batch processing and API integration across underwriting, renewal, and reinsurance workflows.

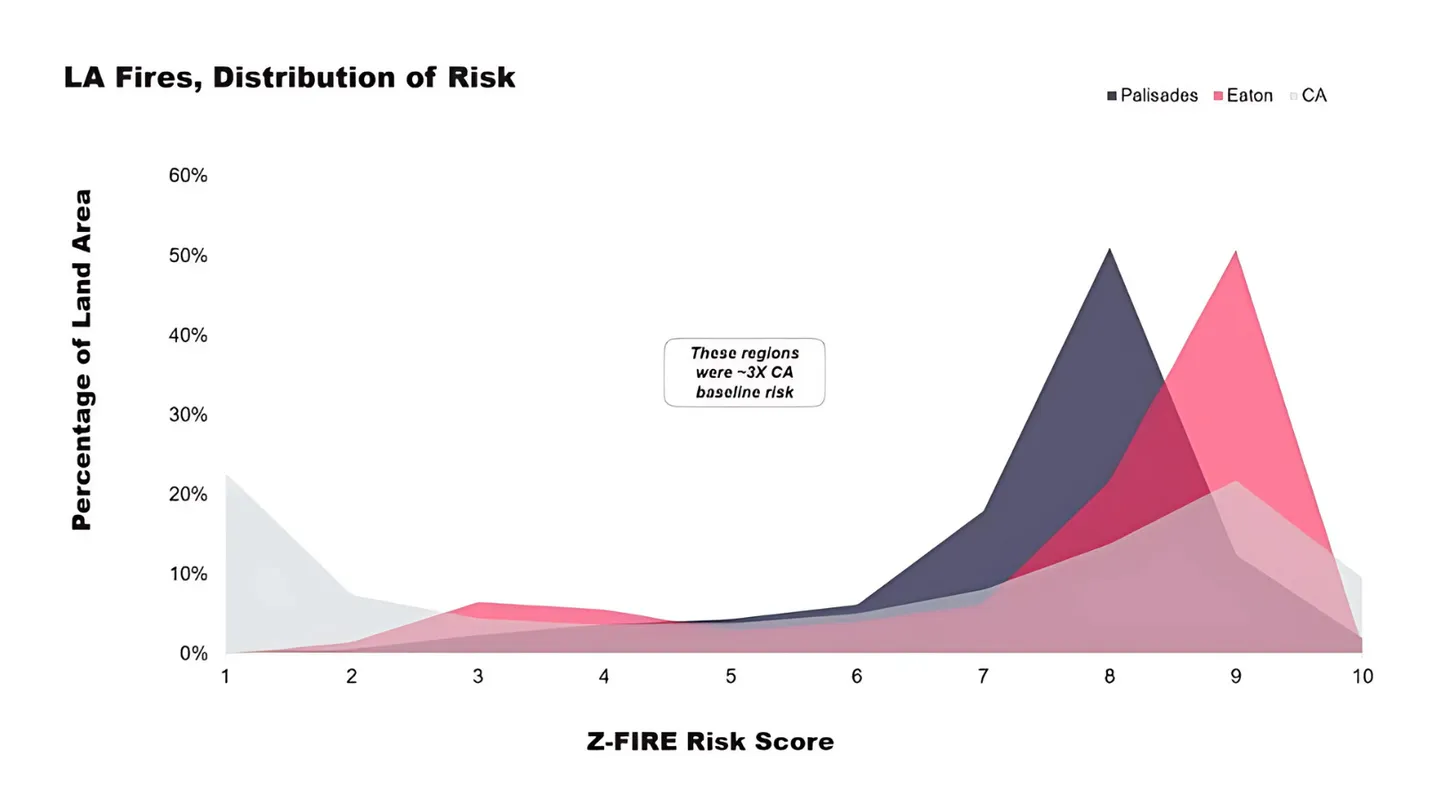

Proven Accuracy in Urban Conflagration Wildfire Events

Z-FIRE correctly identified 94% of the area impacted by the Palisades Fire and 87% of the Eaton Fire as high or very high risk.

Even in a dense urban fire with 60% overall destruction, the model showed that the highest-risk homes were 50% more likely to be destroyed than the lowest-risk, demonstrating precise property-level differentiation.

“ZestyAI’s model has outperformed our homegrown wildfire risk model.”

Brian Hall

Vice President, Products and Underwriting, Berkshire Hathaway Homestate Companies

“Partnering with ZestyAI equips us with data-driven insights needed to price risk accurately, reward mitigation, and sustain our role as a long-term solution in California.”

Todd Brickel

Senior Vice President, Chief Risk and Product Officer, California Casualty

“A modern solution like Z-FIRE allows us to leverage the power of AI to generate a clear picture of not only how likely it is that a home might be exposed to a wildfire, but also the probability of its damage."

B.J. Pitts

Senior Assistant Vice President, Amica Mutual Insurance

"ZestyAI’s Z-FIRE model brings the level of insight we need to confidently assess risk and offer coverage in areas at risk of wildfire."

Michael McCright

Vice President, Pricing and Risk Management, Kin Insurance

“After switching to Z-FIRE, I sleep better at night.”

Mélicie Desflots-Rosenheim

Director, Risk Management, Heritage Insurance

.webp)

“Z-FIRE enhances our current wildfire risk assessment tools, increasing our teams’ confidence in writing more business for the independent agents who represent us while giving more coverage options.”

Scott Schuler

Senior Vice President, Personal Lines, The Cincinnati Insurance Companies

“Z-FIRE will better align rates with risk and promote wildfire risk mitigation practices that will make communities safer and more resilient.”

Victoria Roach

President, California FAIR Plan

See Wildfire Risk with Proven Accuracy

Z-FIRE combines AI and real-world loss data to help carriers assess wildfire exposure, reward mitigation, and strengthen filings with regulator-approved precision. Book a demo today.