Z-HAILTM

The Science of Hail, Engineered for Insurance

Z-HAIL quantifies hail risk by modeling how roof complexity, condition, climatology, and accumulated exposure interact—validated on historical claims to deliver the most accurate, property-level view of risk.

Quantifying the Impact of Accumulated Damage

Z-HAIL models how roof complexity, condition, accumulated damage, and local climatology shape hail losses over time. Built and validated on real claims, it delivers transparent, insurer-grade accuracy for pricing, underwriting, product design, and reinsurance decisions.

62X Predictive Lift

Z-HAIL outperforms traditional hazard and weather-based hail models in predicting real-world claim outcomes.

IBHS Research-Backed

Developed in collaboration with the Insurance Institute for Business & Home Safety (IBHS), capturing how roofs accumulate and express hail damage over time.

Property-Level Precision

Models how roof complexity, condition, and local climatology interact to drive hail loss—yielding property-level scores insurers can use for pricing, rating, and intra-territory segmentation.

Trained on Historical Claims

Built and validated on verified hail losses across diverse geographies, ensuring accurate, explainable, and regulator-ready performance.

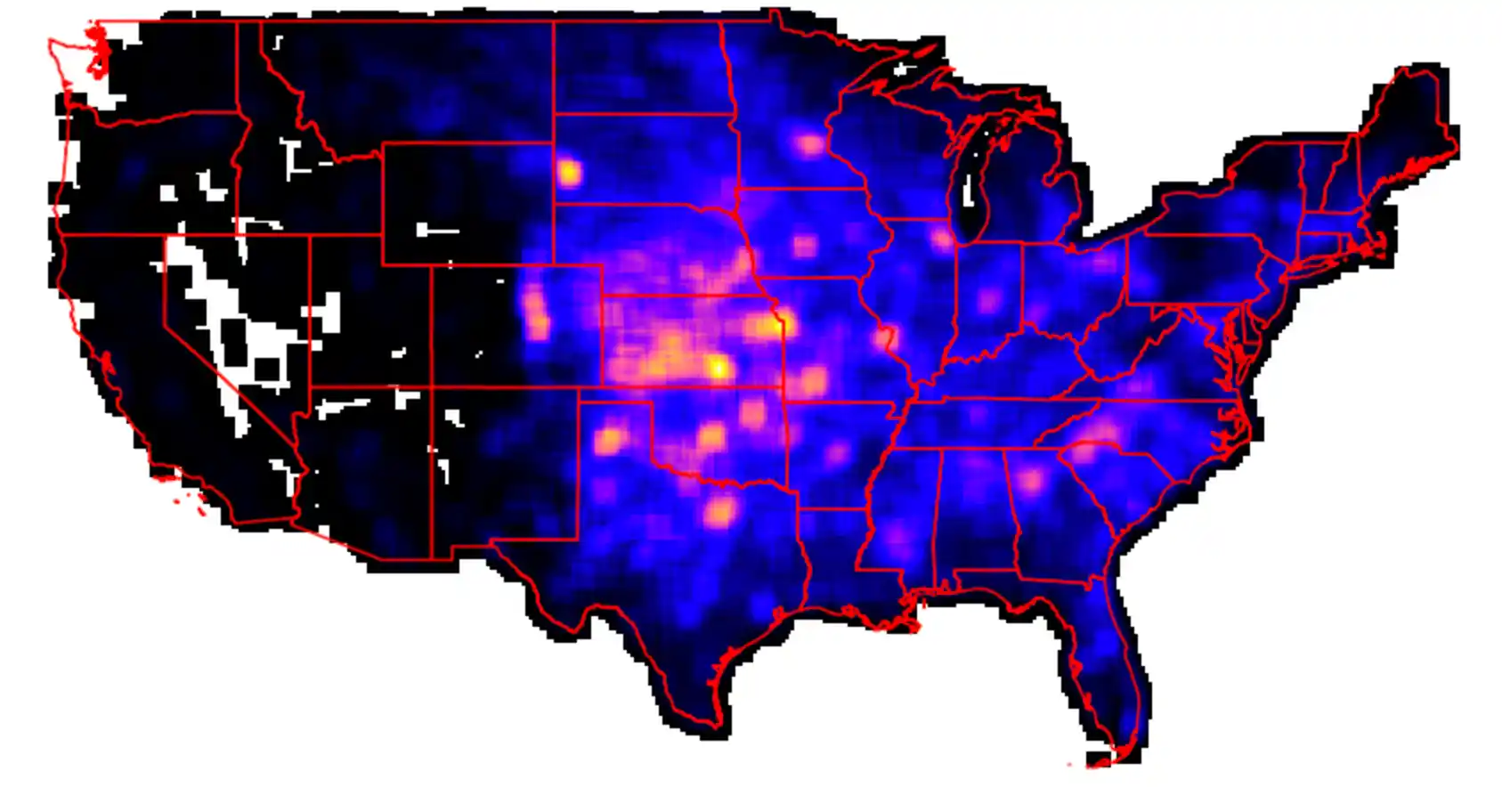

Nationwide Coverage

Provides property-level hail risk scores across all 48 contiguous U.S. states.

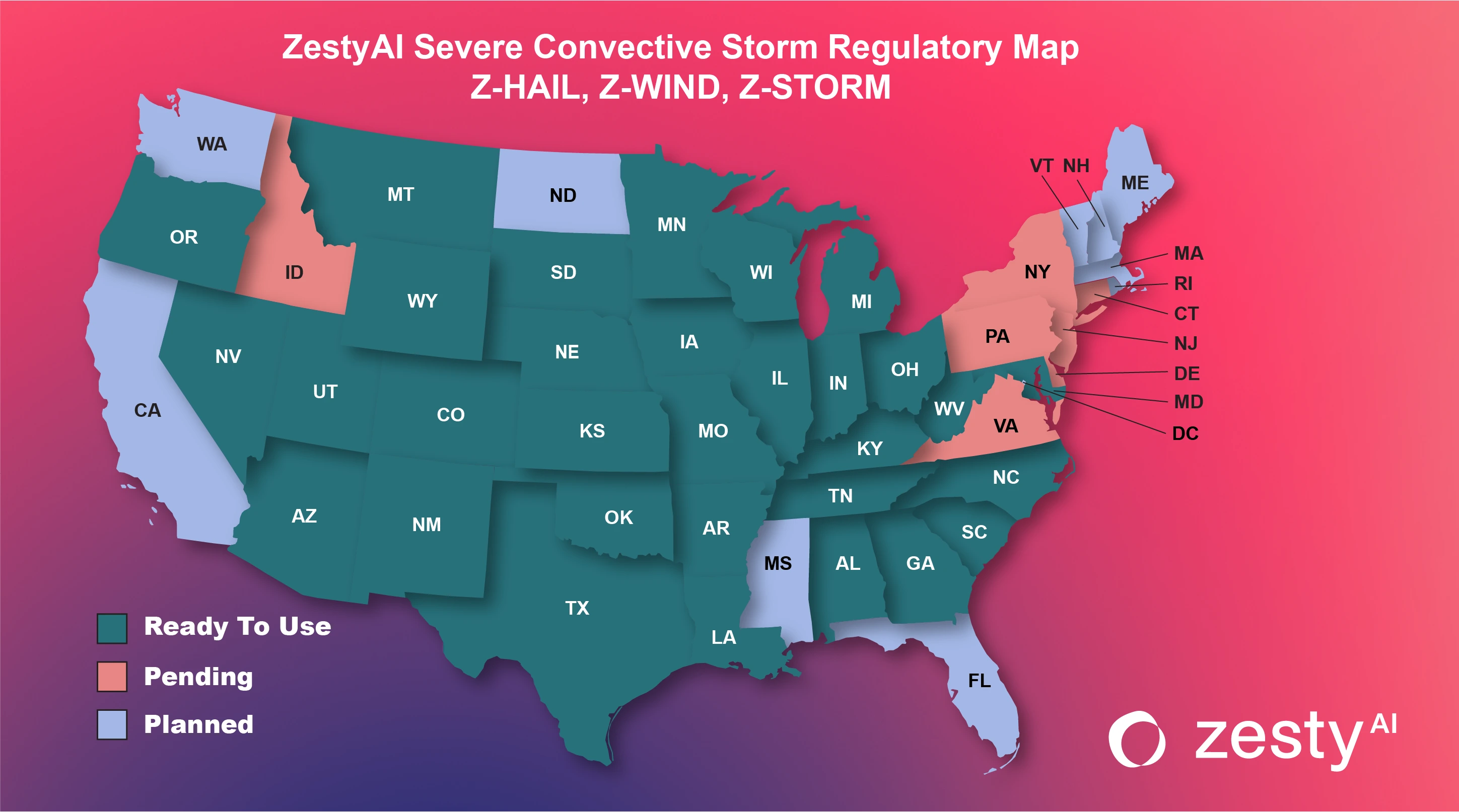

Regulator Approved

Regulator-reviewed and approved for underwriting and rating across the Midwest, Great Plains, and Southern states, Z-HAIL provides transparent risk scores and top drivers for filings, pricing, and product decisions.

Z-HAIL Claim Frequency Score: Property-Level Likelihood of Hail Damage

Z-HAIL’s Claim Frequency Score estimates the probability of hail damage at the property level, capturing how roof complexity, condition, and local climatology contribute to the likelihood of loss.

Carriers use Z-HAIL to refine underwriting and pricing, manage exposure, and target inspections efficiently.

Z-HAIL Claim Severity Score: Quantifying How Bad the Damage Will Be

Z-HAIL’s Claim Severity Score predicts the expected magnitude of hail-related loss once damage occurs. Built and validated on verified claims, it accounts for accumulated damage and structural vulnerability.

It helps carriers set accurate deductibles, align coverage, and manage loss cost.

Hear How Z-HAIL Strengthens Underwriting

Underwriting Manager Rick Smith explains how granular, AI-driven property insights help his team write profitably in hail-prone regions.

How Z-HAIL Works

Z-HAIL is purpose-built using roof-level data, climatology, and claims-validated machine learning to capture how hail damage accumulates and manifests on physical structures. Every step, from data ingestion to model governance, is engineered for precision, explainability, and insurance-grade reliability.

Diverse, High-Quality Inputs

Aerial Imagery Insights

AI-derived data on roof materials, shape, slope, and degradation from high-resolution aerial imagery.

Local Climatology

Historical hail frequency, intensity, and size distributions at the regional level to capture how local weather patterns drive exposure.

Building Attributes

Roof materials, area, and the presence of solar panels account for variations in resilience and repair cost.

Verified Loss Data

Claims and exposures from carriers across all major hail regions and roof types—used to train and validate the model.

Turning Physical Data Into Predictive Insight

Z-HAIL transforms roof, building, and climatology inputs into predictive features that quantify hail vulnerability. Each variable is tested for predictive strength, interpretability, and geographic consistency.

Roof Architecture & Materials

Analyzes roof material, slope, and shape to determine how design affects hail resistance.

Accumulated Damage Modeling

Quantifies how repeated hail exposure contributes to material wear, hidden damage, and increased future loss potential.

Regional Climatology Context

Accounts for local storm frequency, intensity, and recurrence to differentiate exposure by geography.

Roof Penetration & Additions

Identifies structural vulnerabilities such as skylights, vents, and solar panels, features that increase the likelihood or severity of hail damage.

Dynamic Intelligence for Real-World Risk

Z-HAIL uses gradient boosted machines trained on carrier-verified hail losses across diverse geographies. The model quantifies how roof condition, structure, and regional climatology combine to predict both loss frequency and severity with actuarial precision and explainability—supporting pricing, underwriting, and intra-territory risk splitting where traditional territories fall short..

Trained on Carrier Data

Developed using a large, multi-carrier dataset representing all major hail-prone regions in the nation.

Gradient Boosting Machines

Captures nonlinear relationships between roof condition, structure, and exposure for stable, predictive performance.

Mitigation-Aware Scoring

Z-HAIL scores can be recalculated in real time when verified mitigation is completed, such as roof replacements or material upgrades, ensuring model outputs always reflect current property conditions.

Transparent Risk Drivers

Provides visibility into the top contributing factors driving each score, supporting underwriting review and regulatory transparency.

Aligned With Average Annual Loss (AAL)

AAL-calibrated scores plug directly into pricing, underwriting, and reinsurance workflows, enabling finer intra-territory risk segmentation.

Built to Earn Regulatory and Market Trust

Z-HAIL undergoes rigorous validation, benchmarking, and review to ensure accuracy, fairness, and transparency.

Claims-Based Validation

Benchmarked against carrier loss experience across multiple geographies to confirm predictive stability.

Independent Review

Subject to internal QA and third-party validation for fairness, performance, and transparency.

Transparent Documentation

Comprehensive DOI-ready documentation includes variable definitions, model methodology, and performance metrics.

Regulatory-Ready

Developed in alignment with actuarial standards (ASOP 12, 23, 25, 38) to support filings for use in rating, underwriting, and product design.

Ready for Filing, Designed for Transparency

Z-HAIL meets the highest actuarial and regulatory standards for use in rating, underwriting, and product development.

Reviewed and approved for use across the Midwest, Great Plains, and South, Z-HAIL is supported by comprehensive documentation, fairness testing, and model governance designed to meet DOI expectations for explainable, data-driven modeling.

DOI Reviewed and Approved

Approved for use in rating and underwriting across hail-prone states, with additional regulatory reviews in progress.

Actuarial Standards

Developed in alignment with ASOP 12, 23, 25, and 38 to ensure actuarial soundness and regulatory compliance.

Model Documentation

Comprehensive technical documentation, validation summaries, and variable-level detail available to support filings and DOI review.

Rate Filing Support

AAL-aligned risk metrics available to streamline adoption into approved rating plans.

Bias and Fairness Testing

Extensive testing performed in accordance with DOI guidance to ensure fair, unbiased outcomes across regions, construction types, and demographic variables.

Mitigation Transparency

Supports verified roof upgrades and material improvements, ensuring that completed mitigation is accurately reflected in model outputs and filings.

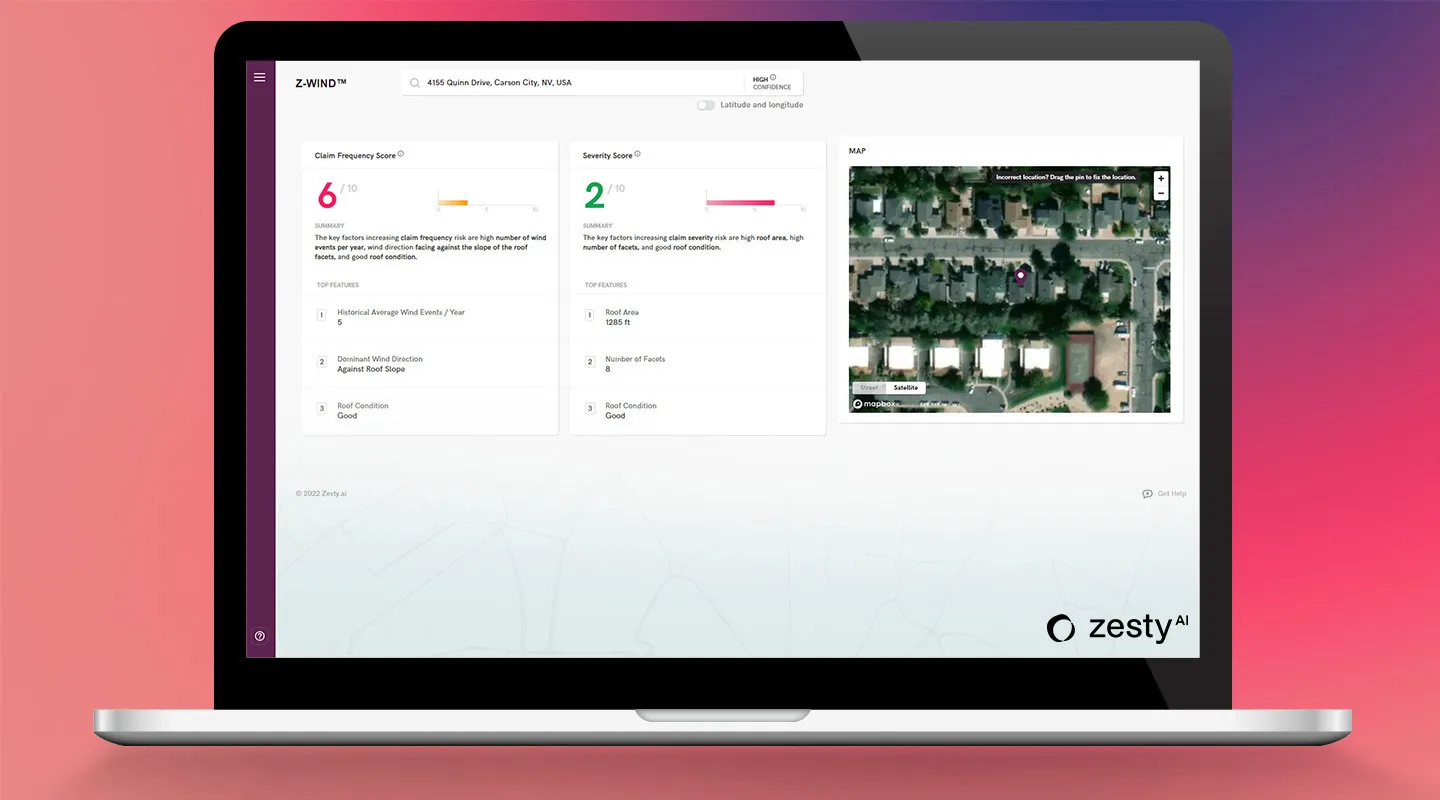

Instant Insight. No Integration.

Z-VIEW delivers instant, web-based access to Z-HAIL risk scores, roof imagery, and top risk drivers; no IT setup required. Underwriters use it to review roof condition, explore property-level hail risk, and understand that factors influencing each score.

All Z-HAIL insights are also available through the ZestyAI API, enabling direct integration into pricing, underwriting, and portfolio workflows.

“Expanding our use of ZestyAI’s hail and wind models reaffirms our commitment to precision and efficiency in landlord underwriting.

These insights help us make informed decisions quickly and manage exposure with greater confidence.”

Datha Santomieri

Co‑Founder & COO, Steadily

“One of the most meaningful ways we protect our customers and their homes is to work with them to understand and mitigate risk.

Adding property insights and climate models for hail and wind will give us a comprehensive view of risk, allowing us to better serve our customers.”

Rebecca L. Stolte

Assistant Vice President, Amica Mutual Insurance

“ZestyAI’s models will help us bring greater fairness and resilience to the market while equipping homeowners with practical mitigation guidance."

Kelly Campbell

Executive Director. Colorado FAIR Plan

“ZestyAI’s AI-powered risk models offer the kind of granular, verified intelligence that strengthens risk evaluation across a broad spectrum of perils, from climate-related threats to non-weather water."

Brian Voorhees

Chief Operating Officer, Applied Home National Underwriters

Milliman Analyzes ZestyAI’s Z-HAIL Model

Modernizing Homeowners Rate Plans in the Age of Changing Climate Risk

In a whitepaper commissioned by ZestyAI, Milliman performed an analysis of how ZestyAI’s Z-HAIL risk score could be used to identify property risk exposure to hail.

The study concluded that ZestyAI’s Z-HAIL risk score effectively categorizes properties by their hail risk exposure. Over a period of seven years, properties with a Z-HAIL score of 10 had a reported loss ratio of 50.4% compared to only 2.4% for properties with a Z-HAIL score of 1, which corresponds to a highest to lowest loss ratio lift of 21X.

%20(3).webp)

See Hail Risk with Property-Level Precision

Z-HAIL models hail damage at the property level, so you can predict loss and price accurately across your portfolio —for underwriting, product design, and reinsurance decisions. Book a demo today.