Reports & Research

Explore proprietary research packed with data, insights, and real-world findings to help carriers make smarter decisions.

Future-Proofing Insurance: How to Prepare for Intensifying Wildfire Seasons

As ZestyAI unveils its annual Wildfire Season Overview, we can see that insurers are in a pivotal position to navigate the ongoing threat.

The insurance industry has been grappling for years with the skyrocketing losses caused by wildfires. As ZestyAI unveils its annual Wildfire Season Overview, we can see that insurers are in a pivotal position to navigate the ongoing threat.

Wildfire Risk Isn’t Going Anywhere

While we are currently experiencing a brief reprieve from the wildfire devastation of the last few years, the ongoing threat of wildfire remains at an all-time high.

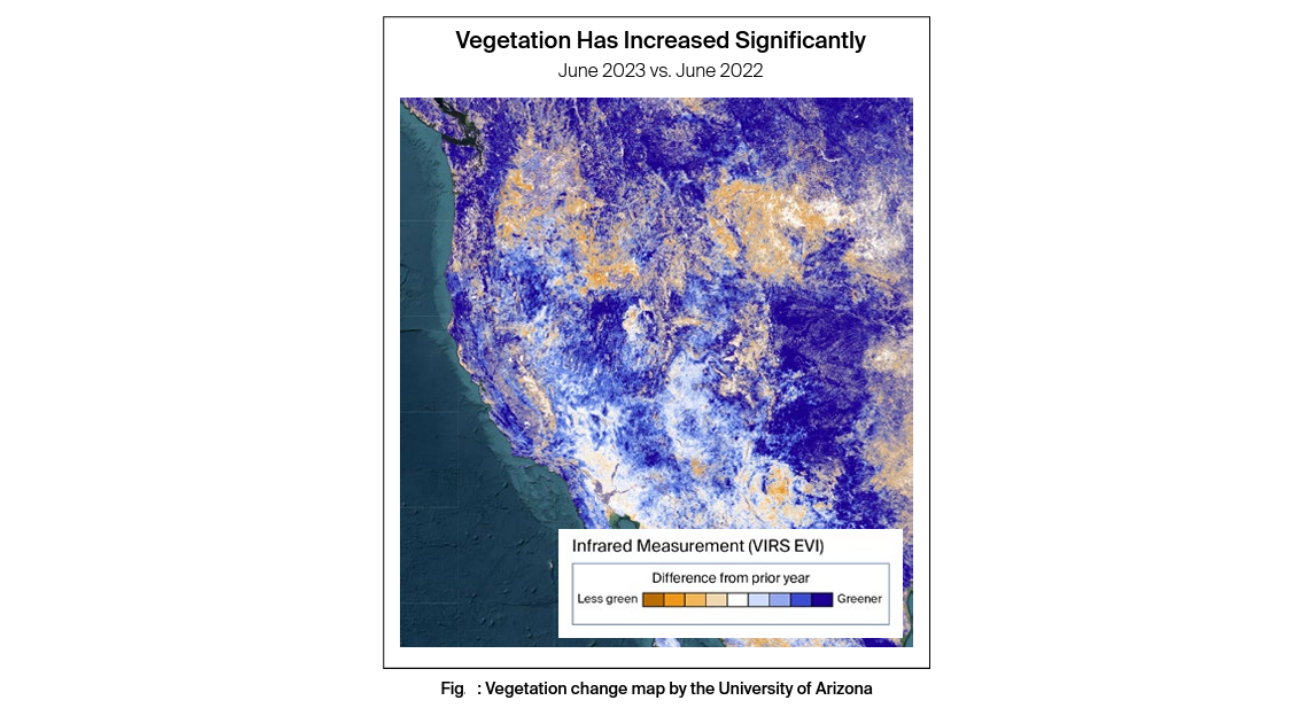

Extreme snow and rainfall across the West in 2023 have led to wetter-than-normal conditions that have acutely reduced the risk of wildfire. However, wetter conditions lead to vegetation growth, so despite 2023 presenting lower wildfire risk, the resulting vegetation accumulation, combined with persistent drought conditions in future years, will likely result in extremely high losses in the coming years. In fact, heavy rainfall has preceded many of the most severe wildfire years ever recorded in California.

Heavy rainfall has preceded many of the most severe wildfire years ever recorded in California.

Preparing for Future Wildfire Seasons

With high wildfire activity on the horizon, what steps can insurance companies take now to prepare for future wildfire seasons?

Here are three essential strategies:

1. Leverage Data for Better Understanding

Research by ZestyAI reveals that wildfires ravage 87% more land during drought years compared to non-drought years. With the western US still experiencing a megadrought that is the worst in over a millennium, it’s critical to understand the data and risks involved.

Not all homes face high risk. For the remainder, detailed property risk insights can highlight areas requiring risk mitigation. Integrate property-specific wildfire risk data into the underwriting and renewal process. This year is also an excellent opportunity to review a complete portfolio using an AI-powered wildfire risk assessment tool like Z-FIRE.

2. Educate and Empower Property Owners Through Transparency

Technology, particularly satellite/aerial imagery and artificial intelligence, can shed light on wildfire risks. Insurers can use this technology to assess the risk reduction measures that policyholders have implemented and understand how a property might withstand a wildfire.

This information is invaluable for educating homeowners and insurance agents. By knowing the specific actions that can be taken to reduce risk, such as clearing brush or using fire-resistant materials, both insurers and homeowners can be better prepared for wildfires.

3. Choose a Technology Partner Wisely

ZestyAI's Z-FIRE has set a benchmark by integrating loss data from over 1,500 wildfires and employing cutting-edge technology to derive insights on each property. By combining aerial and satellite imagery with machine learning and cloud computing, ZestyAI created Z-FIRE, a highly detailed wildfire risk assessment model.

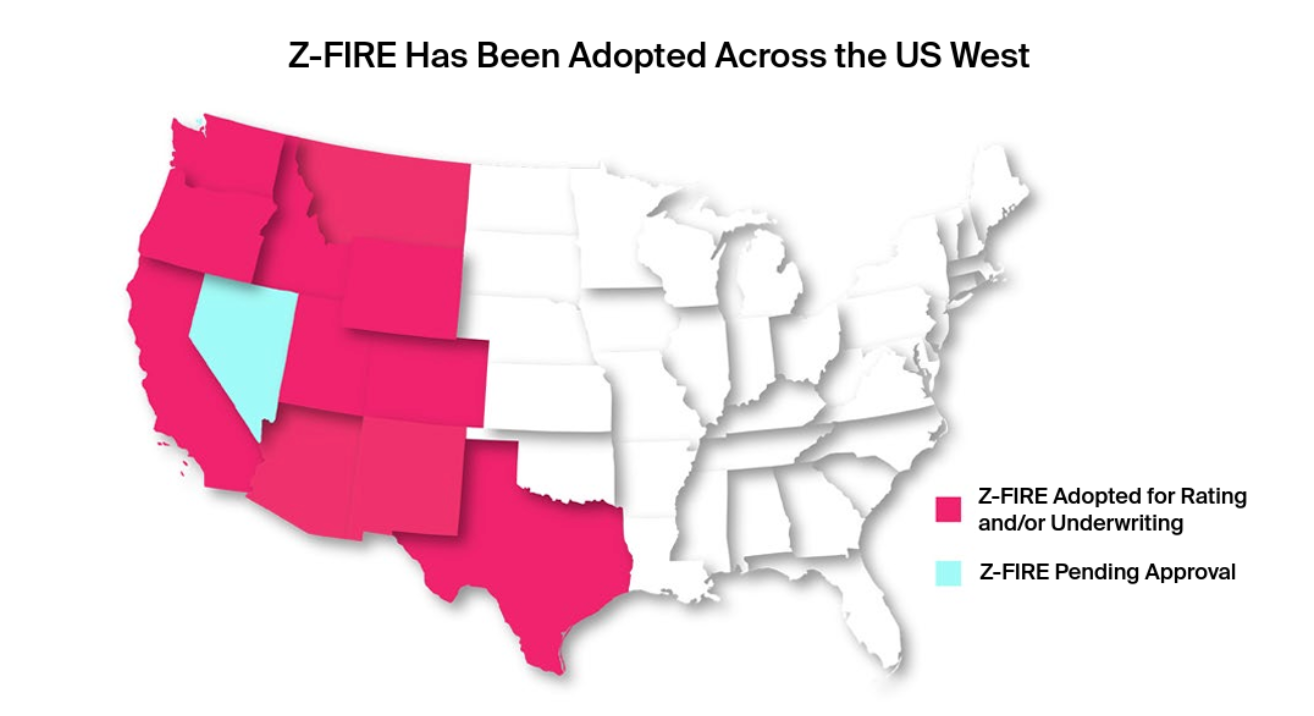

Z-FIRE has been adopted by leading insurance carriers in every single western US state.

In 2022, Z-FIRE demonstrated remarkable performance. Its integration of data through machine learning and computer vision models has established Z-FIRE as a potent tool in wildfire risk assessment for both underwriting and rating.

Make Informed Decisions with Z-FIRE

Using Z-FIRE, insurance carriers, MGAs, and reinsurers can get access to actionable insights developed from detailed property-level risk factors. While wildfire losses may be inevitable, understanding in detail how individual properties contribute to average and tail risks is a large step forward.

The specific time and location of a wildfire is nearly impossible to predict. However, Z-FIRE can give carriers an assessment of the preconditions for that fire, and describe in detail the factors which contribute to it. Knowing, not guessing, which properties fall into a high-risk category is more important now than ever. We look forward to helping our customers through this fire season and many to come.

Z-FIRE Stands Alone in Compliance

Z-FIRE has been developed in partnership with top carriers and has been included in successful filings in California and many other western states. As regulators continue to push for additional transparency and accuracy in how insurers treat wildfire risk, AI-powered solutions provide a clear advantage because of their interpretability and sensitivity to changing conditions.

In 2023, California began requiring insurers to provide discounts based on mitigation measures, and in 2024 Oregon is poised to establish similar requirements on communications to homeowners. All of these changes create a burden on insurers, but those who can adapt to the new regulatory environment by leveraging knowledgeable partners like ZestyAI will have an advantage over competitors. AI is part of the solution, helping address climate risk and maintaining the insurability of properties across the US.

Download ZestyAI's 2023 Wildfire Season Overview

_(1440_%25C3%2597_800_px)_(2).png)

2023 Wildfire Season Overview: The Calm Before the Storm

ZestyAI has released its annual Wildfire Season Overview for 2023. This comprehensive report provides insights to assist insurers in effectively managing wildfire risk.

ZestyAI has released its annual Wildfire Season Overview for 2023. This comprehensive report combines insights from recent wildfire events, prevailing drought conditions, and cutting-edge advancements in artificial intelligence to assist insurers in effectively managing wildfire risk.

Download ZestyAI's 2023 Wildfire Season Overview

Here are some key findings from the report:

A Chance To Prepare While Wildfire Fuels Accumulate

Despite a brief respite from recent wildfire devastation, the current threat remains high. Over the past decade, wildfire risk has notably increased, particularly in California. However, the occurrence of extreme snow and rainfall in the West during 2023 has temporarily reduced the risk due to wetter conditions.

It's important to note that vegetation accumulation and ongoing droughts will likely lead to substantial losses in the coming years. California remains highly susceptible to losses and significant vegetation growth. This temporary relief in 2023 creates an ideal opportunity for insurers to review the risk technologies they have in place and embrace innovative solutions to prevent future losses.

No Role for Drought in Underwriting

Drought is indicative of fire intensity, but not losses. Although drought is an important factor in seasonal wildfire risk, the presence of drought shouldn't drive underwriting. Instead, insurers should look at property-specific solutions that consider wildfire risk over the lifetime of a policy.

Research has shown that this year's heavy rainfall may be a leading indicator for severe wildfire years to come. A comprehensive understanding of buildings, vegetation, and mitigation methods at the property level is necessary to effectively manage future wildfire risk.

A comprehensive understanding of buildings, vegetation, and mitigation methods at the property level is necessary to effectively manage future wildfire risk.

Using Advanced Models to Adapt to Changing Risks & Regulations

AI-powered risk models play a key role in mitigation. Insurers who write business in wildfire states have found increasing value in AI-powered wildfire risk models as they offer actionable risk insights, adapt quickly to changing climate risks, and comply with all regulations.

Over the last year, several western states have begun to implement new regulations for insurers in response to the changing risk environment. Discounts and transparency for mitigation efforts and property-specific decisions may become an industry standard as they have in California and Oregon.

What This Means for Insurers

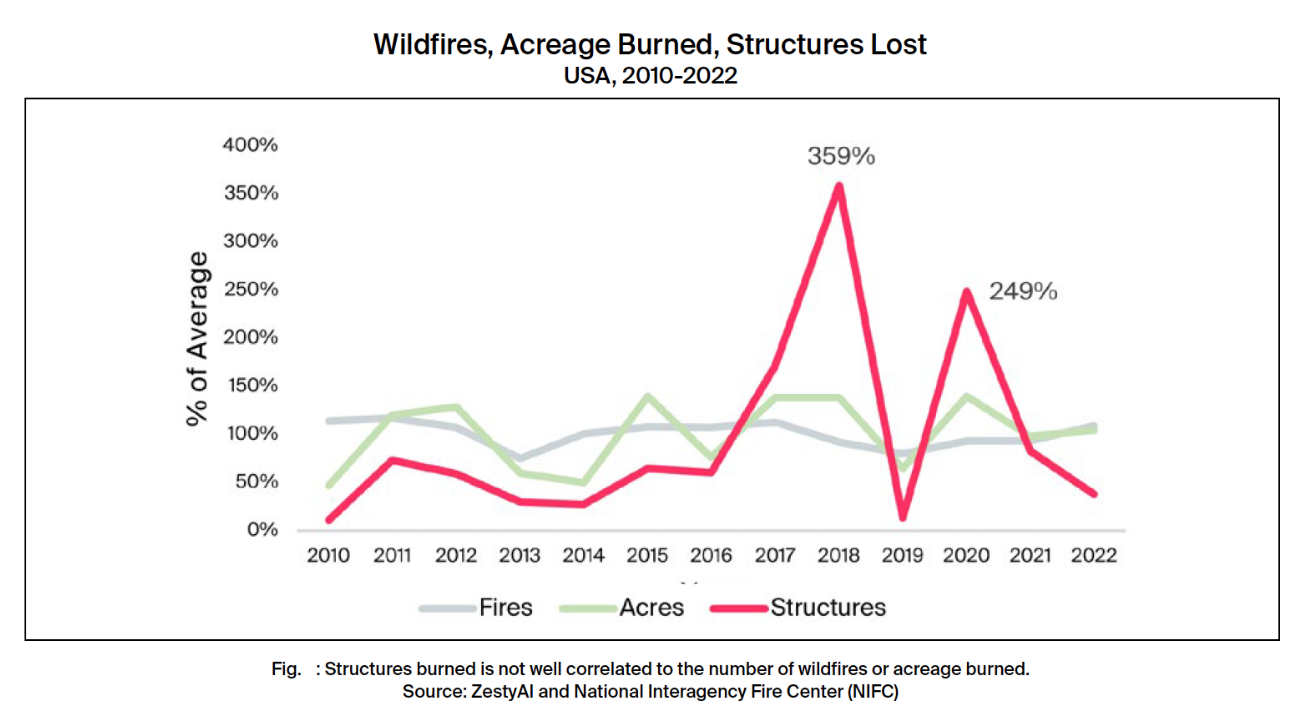

In evaluating wildfire risk, many analyses tend to focus on the number of fires and the size of the area they burn. However, what really matters to insurance companies and property owners is the loss of structures and what can be done to mitigate those losses.

For example, those providing insurance in California might be surprised to learn that despite smaller losses in 2022 compared to 2021, the total national count of acres burned and fires ignited in 2022 actually exceeded that of 2021. This mismatch between yearly wildfire activity and the number of structures lost suggests that wildfire losses are not simply dictated by wildfire activity.

The most significant factor is not how many fires start, or how far they spread, but the potential resilience of every structure and what the communities and homeowners have done to prepare for wildfire exposure. Research from ZestyAI and IBHS shows that for a more precise understanding of potential losses, insurers need to zoom in on individual properties. They should consider a structure’s location, building materials, surrounding vegetation, and efforts taken by the surrounding community to prepare for wildfires.

Modern wildfire risk tools like ZestyAI's Z-FIRE do just that. They analyze individual property features and measure the impact of those features on the probability of loss. They also factor in nearby vegetation, community preparations, local infrastructure, and the lay of the land. This property-centric approach doesn’t try to predict exactly what a wildfire will do. Instead, it gives valuable information on how and why properties might be damaged by wildfires.

These models don't just offer a simple risk score, but also help explain what makes a particular property vulnerable and what steps can be taken to protect it.

Find out more, including how Z-FIRE performed in 2022, in this year’s Wildfire Season Overview.

Download ZestyAI's 2023 Wildfire Season Overview

.png)

As Hail Damage Continues Across the U.S., New Research From ZestyAI and IBHS Works to Make Hail Losses More Predictable

Research considers valuable data on smaller hailstone impacts, which are likely responsible for 99 percent of the impacts on a roof from a hailstorm.

San Francisco, CA, April 19, 2023 – Today ZestyAI, the leading provider of climate and property risk analytics solutions powered by artificial intelligence (AI), and the Insurance Institute for Business & Home Safety (IBHS) released new research examining catastrophic losses from severe convective storms, particularly hail. The study focuses on hail-driven losses in property and casualty insurance.

Hail losses are a persistent problem for property insurers’ risk management efforts. Historically, carriers have focused on intense events to predict hail risk, with supporting data confined to storms with hailstones larger than one or two inches. The study Small Hail, Big Problems, New Approach shows high concentrations of small hail are more important than previously thought, pointing to an opportunity to broaden data sets to account for the cumulative effect all hailstorms have on a roof’s susceptibility to damage over time, leading to a claim.

This new research shows all hail needs to be accounted for when modeling and ultimately understanding losses. Using data from all hail events, not just those with hail that meet the severe criteria of one inch or greater, allows carriers to consider valuable data on smaller hailstone impacts. Additionally, insurers can integrate climate and materials science to better understand hail frequency and severity. Research suggests using this new approach could perform as much as 58 times more accurately than looking at events with large and very large maximum hail sizes alone, allowing carriers to more effectively assess hail risk, achieve more profitable underwriting and open up ratings to previously avoided areas.

“As we’ve learned more about hailstorms, we've discovered storms that produce large concentrations of small hail are more common than we thought, and despite causing less individual damage than a single large hailstone, small hail, especially in high concentrations, is likely a meaningful contributor to the loss we see each year from hail,” said Dr. Ian Giammanco, managing director of standards and data analytics at IBHS. “Experiments also show large concentrations of smaller hailstones cause degradation to the asphalt shingles, specifically dislodging large amounts of granules. Once enough granules are lost, the underlying asphalt material can become more susceptible to aging and weathering. Repeated exposure to these types of hailstorms can shorten the life of an asphalt shingle roof and increase the damage caused by large hailstones in the next storm.”

“Hail losses are a persistent problem for property insurers’ risk management efforts,” said Attila Toth, founder and CEO of ZestyAI. “Three of the nation’s five largest publicly-traded P&C carriers mentioned hail as a key concern in 2022 financial reports. Greater losses have brought attention to hail risk, and the insurance industry needs better approaches to solve this problem.”

“Three of the nation’s five largest publicly-traded P&C carriers mentioned hail as a key concern in 2022 financial reports. Greater losses have brought attention to hail risk, and the insurance industry needs better approaches to solve this problem.”

Hail risk can be especially costly to insurers because, unlike other catastrophic perils like hurricanes and wildfires, it can be difficult to identify the storm that caused a hail claim. As a result, insurance carriers could be forced to raise overall premiums or introduce high deductibles to compensate for the added costs.

As climate and materials science have developed, more data has become available providing improved hail risk evaluation options that can lead to better decisions at earlier stages of the policy life cycle. Other benefits could include more profitable underwriting, a greater ability to rate previously-avoided areas and significantly reduced loss ratios.

For the complete ZestyAI and IBHS research paper visit this page.

About ZestyAI

ZestyAI offers insurers and real estate companies access to precise intelligence about every property in North America. The company uses AI, including computer vision, to build a digital twin for every building across the country, encompassing 200 billion property insights accounting for all details that could impact a property’s value and associated risks, including the potential impact of natural disasters. Visit zesty.ai for more information.

About the Insurance Institute for Business & Home Safety (IBHS)

The IBHS mission is to conduct objective, scientific research to identify and promote effective actions that strengthen homes, businesses and communities against natural disasters and other causes of loss. Learn more about IBHS at ibhs.org.

###

For more information, contact:

Linsey Flannery

Director of Communications, ZestyAI

416-939-9773

Mary Anne Byrd

Communications Director, IBHS

803-669-4216

90-Second Fact Sheet: The Reinsurance Market in 2023

Reinsurance rates are spiking to an all-time high. Fitch estimated a 20-60% rate increase for cedants in the overall property reinsurance market at the January 1st renewals.1 Terms and conditions are also tightening - many reinsurers are limiting their cedants to much higher attachment points2, or exiting CAT-exposed lines altogether

The main drivers for uptick in reinsurance rates

Our research has found three drivers underpinning the trend:

1. Devastating CAT losses, particularly from secondary perils

59% of all CAT losses come from secondary perils3, and those losses have caused major shifts in the reinsurance landscape. Howden estimates that global property CAT reinsurance rates were up 37% at the January renewals4.

2. A new urgency to improve return on capital

“When the cost of capital is equal to the rate of return, something has to change.” - Aditya Dutt, CEO of Aeolus Capital Management5. The reinsurance industry has underperformed since 2017, with an average return on equity of just under 5%6. Poor underwriting performance was a key driver, with an industry average 101% combined ratio over the same period7. Reinsurers are poised to use the tightening market as a chance to improve performance, with Fitch forecasting a 4pp underwriting margin expansion for reinsurers in 20238. Unfortunately for primary insurers, Goldman Sachs predicts that the same tightening market will create significant volatility for cedants9.

3. Value erosion in reinsurer investment portfolios

Macroeconomic factors are driving significant unrealized investment losses for reinsurers, particularly on fixed income portfolios due to rising interest rates. Aon estimates that these investment portfolio losses drove a 17% decline in global reinsurance capital across the first 9 months of 2022, with some players reporting equity value losses as high as 40-50% over that period10. Reinsurers will look to shore up these losses with better underwriting performance, which likely means tougher rates for primary carriers.

How property insurers can improve their odds with AI-powered predictive climate and property risk platforms

These factors mean that primary insurers can expect challenging reinsurance negotiations at the June 1st renewal deadline, particularly on property lines. However, new AI-powered predictive climate and property risk platforms can improve the odds for property insurers in three areas:

1. Rapid improvements in risk mitigation

Implementation-free portfolio reviews can quickly drive major loss ratio improvements.

2. Turn the tables of CAT risk screening in your favor

Improving data quality can lead to more favorable stochastic model portfolio screens, particularly with insight about the roof.

3. Enter the room as a leader in cutting-edge risk practices

Showing the same commitment to new technologies as industry leaders can help cedants build a better case.

Conclusion

With the right mitigation action and a cutting edge view of portfolio risk, cedants can navigate the upcoming 6/1 renewal successfully.

Learn more about how an AI-powered predictive climate and property risk platform can help you.

------------------------------------------------------------------------

Sources

1 & 8 - Fitch, Reinsurers’ Underwriting Margins to Expand by 4pp in 2023

2 & 3 - Gallagher Re, Gallagher Re Natural Catastrophe Report 2022

4 - Howden, Howden’s renewal report at 1.1.2023: The Great Realignment

5 - AM Best, Reinsurance: Roundtable Discussion on Renewals and What 2023 May Hold

6, 7 & 10 - AON, Reinsurance Market Dynamics

9 - Reinsurance News, Hard market to increase volatility for primary insurers: Goldman Sachs

ZestyAI Announces 180-day Playbook to Navigate First-of-its-kind Wildfire Regulatory Requirements in California

Playbook Leverages Historic Regulatory Success of ZestyAI’s Wildfire Model (Z-FIRE™) to Lead Insurance Carriers Towards Regulatory Compliance in the Largest Insurance Market in the U.S.

San Francisco, CA, September 20, 2022 – ZestyAI, the leading provider of property risk analytics solutions powered by Artificial Intelligence (AI), has developed a 180-day playbook to support insurance carriers as they work to meet the Mitigation in Rating Plans and Wildfire Risk Models regulation expected to be adopted by the California Department of Insurance (CDI) before year-end. The playbook reflects the company’s unique ability as the only comprehensive solution in the marketplace to help insurers meet or exceed every single requirement in the new regulation — meeting 100 percent compliance inside the tight 180-day window.

On September 7, 2022, Insurance Commissioner Ricardo Lara announced he had submitted the department’s insurance rating regulation recognizing wildfire and safety mitigation efforts made by homeowners and businesses, to the California Office of Administrative Law for final approval. This first-of-its-kind regulation will require all insurers in California to refile their existing rating plans on an aggressive 180-day timeline.

“Eight of the ten most destructive wildfires in California’s history have occurred in the last five years,” said Attila Toth, Founder and CEO of ZestyAI. “While the new wildfire regulations will have a significant impact on California’s insurance industry, adapting to this peril is key to having a sustainable insurance ecosystem in California. As the leader in property-specific wildfire risk assessment, we have offered input at each step of this process. We are here to support admitted carriers with a turnkey solution complying with every single requirement as they navigate this process and work to meet the new regulations.”

The new wildfire safety regulation requires insurance companies to consider the structure of a home, its surroundings, and community-level mitigation. Insurers with concerns about the regulation can reach out to ZestyAI to get a complete explanation of how the regulations will impact them. This includes access to the 180-day playbook, which breaks down the regulatory compliance process into an orderly roadmap that addresses all three major challenges that insurers will face:

- Operational — The process of rapidly integrating new data sources, educating the public on how wildfire mitigation affects insurance policies, and a framework for a compliant appeals process.

- Rating — How to weight property-specific characteristics, including those with and without historical loss data, in rating plans as well as guidance on mitigation credits.

- Filing — Carriers who use a rating plan reliant on traditional wildfire models without property-specific information will need to overhaul their rating framework. Relying on multiple approved rate filings, ZestyAI has developed a comprehensive filing toolkit that can support carriers at every facet of the filing process.

ZestyAI’s Z-FIRE™ model has quickly become the leader in property-specific wildfire risk assessment. Using AI algorithms trained on more than 1,500 wildfire events across 20 years of historical loss data, Z-FIRE™ provides a level of detail that is of essential value to both the insurer and the homeowner.

The model was the first AI model ever approved as part of a rate filing by the CDI and the second wildfire risk model. It has been widely adopted across the Western U.S., where its use has been approved for both underwriting and rating. During 2021's APCIA Western Region Conference, CDI representatives expressed that the agency’s familiarity with Z-FIRE™ means in future filings the focus will be limited to the carrier's specific use of the model, not the details of the model itself, potentially greatly expediting the reviews of carriers using the Z-FIRE™ model.

ZestyAI’s Z-FIRE™ considers features such as topography and historical climate data in combination with factors extracted from high-resolution imagery of the property itself and its surroundings, including homeowner and community mitigation efforts, to provide both neighborhood and property-specific risk scores.

A significant advantage to insurance carriers is that they can use these data elements to communicate with homeowners on what specific actions can be taken to lower their property’s risk, such as upgrading building materials and cutting down surrounding dry brush or overhanging vegetation. The impact of mitigation efforts can be significant. A joint study by the Insurance Institute for Business & Home Safety (IBHS) and ZestyAI, which studied over 71,100 wildfire-exposed properties, found that property owners who clear vegetation from the perimeter of their home or building can nearly double their structure's likelihood of surviving a wildfire.

About ZestyAI

ZestyAI offers insurers and real estate companies access to precise intelligence about every property in the United States. The company uses AI, including computer vision, to build a digital twin for every building across the country, encompassing 200 billion property insights accounting for all details that could impact a property’s value and associated risks, including the potential impact of natural disasters. Visit zesty.ai for more information.

ZestyAI Publishes Data-Driven Look at 2022 Wildfire Season

2022 Wildfire Season Overview looks back at 2021 and ahead to what may be a long year of wildfires in 2022.

Today, ZestyAI released its 2022 Wildfire Season Overview. Each year, ZestyAI prepares a comprehensive overview to help guide insurers based on recent wildfire events, persistent drought conditions, and advancements in artificial intelligence for managing wildfire risk.

If it seems like wildfires are burning at all times of the year, it's not just you. Very destructive events, like last December's Marshall Fire, are occurring in months not typically associated with high wildfire danger. Those who study wildfires, including ZestyAI, have begun to start thinking in wildfire "years" instead of wildfire "seasons'. Strong wildfire years, with 10+ million acres burned, have quickly become the new normal. The last 10 years have been the worst on record for property and casualty (P&C) insurers when it comes to wildfire. 8 of the top 20 fires in California history, and more than half of the acreage burned by them, occurred in just the years 2020 and 2021.

What can insurers do to prepare themselves for persistent wildfires?

- Understand the Data: Instead of sticking with decades-old approaches, assess wildfire risk at the property level.

- Continue to Bring Transparency and Education to Homeowners: Insights from AI-based wildfire risk models may be passed on to homeowners and agents, enabling a much better understanding of wildfire risk.

- Find the Right Technology Partner: Aerial and satellite imagery, machine learning, and infinitely scalable cloud computing resources were combined to build the most granular wildfire risk assessment model (Z-FIRE™). Using Z-FIRE™, ZestyAI can accurately estimate an individual property’s wildfire risk, plus highlight the key property-level factors that contribute to that risk.

Click here to download ZestyAI's 2022 Wildfire Season Overview.

ZestyAI offers insurers and real estate companies access to precise intelligence about every property in North America. The company uses AI, including computer vision, to build a digital twin for every building in North America, encompassing 200B property insights accounting for all details that could impact a property’s value and associated risks, including the potential impact of natural disasters. Visit https://zesty.ai for more information.

Why Non-Weather Water Losses Are Quietly Eroding Profitability

New research reveals how insurers can rethink their strategy for the 4th costliest peril in homeowners insurance

The Silent Peril Reshaping Homeowners Insurance

Non-weather water damage rarely makes headlines, but it’s quietly eroding profitability across the country.

It is now the fourth costliest peril in homeowners insurance, and claim severity has increased 80% in the last decade—a trend that’s accelerating even as frequency remains relatively flat.

Traditional risk models struggle to capture the early warning signs behind these losses, leading to mispriced policies, undetected exposure, and rising volatility for carriers.

Want the full analysis? Download the complete “Winning the Fight Against Non-Weather Water Losses” guide.

Why Loss Severity Keeps Rising

Aging homes and overlooked system failures

Many of the most expensive losses stem from aging plumbing, deteriorating materials, and slow-burn failures that often go undetected until damage is significant.

Frequency is flat—severity is not

Loss patterns suggest that while the number of events hasn’t surged, the financial impact of each event has—a signal that traditional models are not capturing the right property-level predictors.

The Property Features Most Predictive of Water Losses

The overlooked attributes that traditional models miss

Standard territory- or age-based assessments often ignore the property-specific details that meaningfully influence water loss risk, including:

- supply line material and age

- plumbing configuration

- occupancy patterns

- system maintenance and upgrades

- moisture exposure and prior loss indicators

These factors vary widely between neighboring homes—yet most models treat them as identical.

Where Traditional Underwriting Falls Short

ZIP-code and age-based proxies mask true risk

Legacy approaches rely heavily on broad territory-level assumptions that overlook structural vulnerabilities and system conditions.

Limited visibility creates mispriced policies

Without property-level insight, high-risk homes are often underpriced while lower-risk homes subsidize them—driving loss ratio volatility over time.

Get deeper insights on the drivers of water loss severity in our full guide → “Winning the Fight Against Non-Weather Water Losses”

How AI and Property-Level Data Are Changing the Landscape

AI models trained on real-world claims data can identify early signals of potential water loss by analyzing the interaction between:

- plumbing systems

- property attributes

- historical patterns

- material degradation

- repair history

This enables carriers to segment risk accurately, adjust pricing, and reduce preventable losses—long before small issues turn into major claims.

What Homeowners Actually Understand About Water Risk

Misconceptions around coverage and prevention

ZestyAI’s research shows that many policyholders:

- misunderstand what is and isn’t covered

- underestimate how much damage water can cause

- rarely take preventive actions unless prompted

This disconnect creates an opportunity for carriers to strengthen education, mitigation, and customer engagement.

Steps Carriers Can Take Today

Improve segmentation and rating accuracy

Property-level signals enable more precise risk tiers and more stable long-term portfolios.

Strengthen mitigation and reduce loss severity

Insights help identify which homes are at elevated risk and where targeted mitigation can reduce exposure.

Enhance underwriting workflows with explainable insights

Transparent, explainable AI helps underwriters understand the key drivers behind elevated risk—supporting both decision-making and regulatory review.

Get the Full Guide

Our new research paper, Winning the Fight Against Non-Weather Water Losses, breaks down the trends reshaping this growing peril—and the strategies carriers can use to get ahead of it.

Access the Guide

AI-Powered Severe Convective Storm Risk Models Approved in Ohio

Amid a surge in billion-dollar storm events, Ohio insurers gain access to advanced, property-specific risk models that strengthen underwriting.

ZestyAI announced that its Severe Convective Storm suite, including Z-HAIL™, Z-WIND™, and Z-STORM™, has received regulatory approval from the Ohio Department of Insurance.

With the addition of Ohio, ZestyAI’s Severe Convective Storm suite is now approved for use in 16 states, covering key high-risk markets across the Midwest, Great Plains, and South.

Ohio Faces Rapidly Rising Storm Losses

Ohio has experienced 36 billion-dollar loss storm events over the past five years alone, surpassing the total from the previous two decades, which saw just 33 events, according to NOAA’s National Centers for Environmental Information (NCEI). Severe convective storms, including hail, wind, and tornadoes, were the driver, contributing to over 57% of the state’s total weather-related damages since 1980.

Traditional Models Miss Critical Property-Level Differences

ZestyAI’s AI-driven platform predicts the likelihood and severity of claims from severe convective storms at the individual property level by analyzing the interaction of local climatology with property-specific characteristics. In contrast, most risk assessment models today rely on broader territory or ZIP code-level evaluations, overlooking critical property-level factors.

Each model is built and validated on extensive real-world claims data and delivers transparent explanations of the key drivers behind every risk score, helping carriers make more accurate underwriting and rating decisions.

Key capabilities include:

- Z-HAIL: Predicts hail damage risk and claim severity using property-specific attributes like roof complexity, historical losses, and accumulated damage, identifying which homes are most likely to file a claim, even within the same neighborhood.

- Z-WIND: Combines AI-generated 3D analysis of roof condition, complexity, and potential failure points with local climatology to deliver pivotal insights into property-specific wind vulnerability and severity.

- Z-STORM: Predicts the frequency and severity of storm damage claims, examining the interaction between climatology and the unique characteristics of every structure and roof.

Regulatory Approval Reflects a Shift Toward Precision Underwriting

“Too often, storm risk is priced using rough proxies instead of accurate property insights,” said Kumar Dhuvur, Founder and Chief Product Officer at ZestyAI.

“Regulatory approval in Ohio affirms the industry’s shift toward precision underwriting and rating—and opens the door to smarter, risk-aligned decisions and fewer preventable losses in one of the nation’s most important insurance markets.

12.6 million US properties at high risk from hail damage

ZestyAI analysis reveals $189.5 billion in potential hail losses.

ZestyAI's analysis revealed that more than 12.6 million U.S. properties are at high risk of hail-related roof damage, representing $189.5 billion in potential replacement costs.

Powered by ZestyAI’s Z-HAIL™ model, the analysis underscores the growing financial threat of severe convective storms (SCS), including hail, tornadoes, and wind events. In 2024 alone, damages from SCS were estimated at $56 billion—surpassing losses from hurricanes.

Yet many insurers still rely on traditional models designed to estimate portfolio-level exposure, not property-level risk. As hail events increase in severity and frequency, these models often miss the structural and environmental conditions that drive real losses.

Kumar Dhuvur, Co-Founder and Chief Product Officer at ZestyAI said:

“Catastrophe models have helped insurers understand where storms may strike and how losses might add up at a portfolio level. But they weren’t built to assess risk at the individual property level, and they often miss the specific conditions that drive hail damage. By analyzing the interaction between structure-specific features and local storm patterns, we can distinguish risk between neighboring properties—enabling smarter underwriting, more precise pricing, and better protection for policyholders.”

Z-HAIL evaluates hail risk using a proprietary blend of climate, aerial, and property-specific data. By applying advanced machine learning to these inputs, Z-HAIL delivers highly granular predictions that reflect both the physical characteristics of a structure and the storm activity in its immediate surroundings.

Key findings from the analysis:

- 12.6 million U.S. structures flagged as high risk for hail-related roof damage

- $189.5 billion in total potential roof replacement exposure

Top five states by dollar exposure:

- Texas ($68B)

- Colorado ($16.7B)

- Illinois ($10.8B)

- North Carolina ($10.4B)

- Missouri ($9.5B)

States with the lowest dollar exposure:

- Maine ($4.7M)

- Idaho ($12.8M)

- New Hampshire ($18.5M)

- Nevada ($49.3M)

- Vermont ($64.7M)

In recent case studies, Z-HAIL has demonstrated the ability to pinpoint which properties are most susceptible to hail damage—even within the same neighborhood and exposed to the same storm. In one example from Allen, Texas, following a storm with 2.5-inch hailstones, Z-HAIL segmented risk across 483 policies, identifying no losses among properties rated “Very Low” by the model. This level of intra-territory precision gives insurers the ability to refine risk selection with confidence—even in the most hail-prone regions of the country.

-1.png)

Unlocking Insurance Access for Half a Million Homes and Business Owners

ZestyAI's property-level risk models are helping insurers expand sustainable coverage in wildfire- and storm-prone regions.

ZestyAI helped carriers and insurers of last resort extend coverage to over 511,000 properties previously deemed uninsurable in 2024. This year, ZestyAI aims to double its impact, helping to bring coverage options to over a million families and businesses, ensuring that those in catastrophe-prone regions have access to sustainable, risk-aligned insurance.

A 2024 Deloitte survey found that nearly a quarter of homeowners in high-risk states are struggling to find coverage, while over half cite affordability as a growing concern—underscoring the industry’s need for granular insights that support underwriting and pricing decisions aligned with true property-level risk.

“For too long, insurers have had to make high-stakes decisions with incomplete information,” said Attila Toth, Founder and CEO of ZestyAI. “Advanced AI models are changing that. With granular, property-specific risk insights, insurers can close protection gaps and build a more resilient market.”

Traditional risk assessment methods rely on territory- or ZIP code-level evaluations, overlooking the property-level characteristics that drive risk. This approach leads to adverse selection, inaccurate pricing, and widespread market withdrawal.

ZestyAI replaces this approach with transparent, AI-powered models that integrate climatology, geospatial data, historical losses and structural attributes to deliver precise views of wildfire, hail, and wind risk, among other perils.

The results:

- Clear mitigation guidance to help policyholders take action.

- Risk-aligned premiums that support responsible market expansion.

- Improved underwriting precision through AI-driven risk scores and near-complete U.S. coverage.

- Optimized loss cost controls via more effective deductible, Actual Cash Value (ACV), and coverage strategies.

- A supportive experience for carriers, families, and businesses—enabling faster decisions, better communication, and greater confidence in coverage options.

- Streamlined inspections that lower expenses and improve efficiency.

ZestyAI collaborates closely with regulators to ensure transparency, validation, and model oversight. Its wildfire model, Z-FIRE, is approved across all Western states, while its severe convective storm models have gained broad acceptance from Texas to Colorado and throughout the Midwest and Great Plains.

As regulators support the use of advanced models, they are also paving the way for smarter risk-based pricing and proactive mitigation—revitalizing insurance’s core mission: protecting the livelihood of home and business owners and their communities.

.png)

2025 Storm Risk Webinar Now Available On Demand

Stream our webinar for a preview of severe convective storm risk in 2025 and see how AI-driven insights can help you stay prepared.

Severe convective storms are becoming more frequent and costly, putting pressure on insurers to refine underwriting and risk management strategies.

On April 2, our experts covered:

- Key drivers behind increasing severe storm losses

- What La Niña means for the 2025 season

- How AI-powered risk models improve risk segmentation

- Live Q&A – Get expert answers to your toughest questions!

Missed the live event? Stream now!

EarthDaily Analytics Partners with ZestyAI for Advanced Property Risk Insights

Earth Observation data meets AI to address rising climate risks and enhance insurance decision-making.

ZestyAI has partnered with EarthDaily Analytics (EarthDaily), a global provider of Earth Observation analytics and data.

Through this partnership, ZestyAI’s advanced models—including Z-FIRE™, Z-HAIL™, Z-WIND™, and Z-STORM™—will be available through EarthDaily’s Ascend platform, delivering geospatial data, risk modeling, and post-event insights to insurers.

With the insurance industry facing escalating challenges from climate-driven catastrophes and increasing pressure to accurately price risk, ZestyAI’s models provide granular, property-level risk data. These models analyze factors like vegetation density, construction materials, and historical weather patterns to offer insights beyond traditional methods.

“At EarthDaily, we’re committed to delivering cutting-edge property insights to customers navigating today’s climate risks,” said Rachel Olney, VP of Insurance at EarthDaily.

With advanced AI models covering wildfire, hail, wind, and property data, ZestyAI is an ideal partner to support our mission.

"By including their advanced analytics in our Ascend platform, we’re excited to empower clients to take proactive steps in managing and mitigating risk with confidence."

ZestyAI’s solutions achieve nearly 100% hit rates, offering actionable insights that insurers and businesses can trust. By bolstering the data available in the Ascend platform with property-level insights, the partnership provides decision-makers with a new level of clarity to mitigate risks, improve underwriting, and allocate resources more effectively.

The collaboration exemplifies the growing importance of innovative technology in the insurance and property management sectors, especially as global climate risks continue to evolve.

See How Insights Turn Into Decisions

ZestyAI transforms data into action. Get a demo to see how the same AI powering our reports helps carriers make faster, smarter, regulator-ready decisions.