Resources

ZestyAI Severe Convective Storm Suite Approved in Illinois

ZestyAI’s Z-HAIL™, Z-WIND™ and Z-STORM™ Now State-Approved for AI-Powered Property Risk Assessment

Today, ZestyAI, the leading provider of climate and property risk analytics solutions powered by Artificial Intelligence (AI), is announcing it has received approval from the Illinois Department of Insurance for its complete suite of Severe Convective Storm products.

Illinois' high population, combined with its Midwestern location and flat terrain, make it one of the most challenging states to manage wind and hail risk for Property & Casualty insurers. This is the second state approval ZestyAI has received for its Severe Convective Storm products, securing approval from the Colorado Division of Insurance earlier this year.

ZestyAI’s suite of storm products are AI-powered climate risk models that predict the frequency and severity of severe storm claims for every property in the US. The products examine the interaction of climatology, geography, and the unique characteristics of every structure and roof, analyzed in 3D, including accumulated damage from historical storms.

With ZestyAI models, carriers are able to move from territory-based rate segmentation to property-by-property to better align pricing to risk. They also benefit from enhanced underwriting, improved loss cost control measures, and portfolio optimization. Carriers can also leverage this approval to adopt ZestyAI’s Roof Quality product, which was comprehensively reviewed and approved by the Department as part of this filing.

ZestyAI’s models are built and validated on real claims data and generate the highest lift in the insurance industry. Additionally, the models are highly transparent, providing the top three factors contributing to each risk score. The models also allow an insurance carrier to modify the risk inputs on demand.

"Having our risk analytics models approved by regulators gives our customers a competitive edge," said Bryan Rehor, Director of Regulatory Affairs at ZestyAI. "Subsequent filings will be streamlined, with faster approval timelines, translating to significant time and resource savings for carriers. Additionally, these approvals lead to increased availability of high-quality insurance for property owners."

ZestyAI has long recognized the importance of regulatory approvals in the ethical and transparent implementation of AI in insurance. It is committed to understanding and complying with regulatory policy while also influencing how the industry navigates the ethical use of AI in insurance.

As leaders in securing approvals for AI-powered risk models, ZestyAI collaborates closely with numerous regulatory bodies, consistently achieving successful outcomes. ZestyAI actively shapes regulations through various strategies, including regular model audits, bias testing, scientific data selection, and continuous engagement with regulators. This proactive approach makes ZestyAI the go-to risk analytics partner for leading insurance carriers across the nation.

More information on the insurance industry’s dynamic regulatory environment, and AI regulatory compliance can be found in ZestyAI’s interactive guide: When Innovation & Regulation Meet.

.png)

ZestyAI Unveils Driveway Condition

New Driveway Condition feature enhances property risk assessment

For insurance carriers, ensuring the safety and stability of a property is paramount. A well-maintained home translates to a lower risk of costly repairs and replacements down the road. Understanding a property’s condition allows insurers to confidently estimate the likelihood of future claims and set appropriate premiums.

Physical inspections have traditionally been the gold standard for property risk assessment. However, these inspections come with a hefty price tag, require significant time investment, and are a burden on policyholders. In reality, less than 15% of an insurer's portfolio typically receives this high-touch, in-depth evaluation each year.

In the past, carriers relied on agent-provided photos to supplement these inspections, offering a glimpse into a property's overall condition. While helpful, these snapshots were limited in scope. The rise of aerial imagery provided a broader perspective, enabling insurers to assess aspects like roof condition and debris accumulation at scale.

At ZestyAI, we're on a mission to revolutionize property risk assessment by harnessing the power of data. We continuously develop innovative solutions to extract valuable insights, such as detecting changes from building permits and evaluating secondary structures. And today, we are excited to unveil our latest groundbreaking feature: Driveway Condition.

Introducing Driveway Condition

Driveway Condition is a new feature designed to evaluate the state of a property's driveway, a crucial area for property insurance underwriters.

Driveways in poor condition can pose a significant slip-and-fall liability hazard. Beyond that, a neglected driveway can be a red flag for overall property maintenance, indicating a higher risk of other potential issues. For insurers, Driveway Condition offers a valuable proxy for assessing various risk factors.

Our Driveway Condition model is a robust system that analyzes various factors to categorize a property's driveway as good or poor.

- Good: This classification denotes a well-maintained driveway with professional construction and minimal aesthetic issues.

- Poor: This classification identifies driveways exhibiting significant wear and tear or structural damage. Poor construction practices may be evident, including unclear delineation from surrounding areas, uneven terrain, and potentially hazardous pathways. Additionally, the presence of large cracks and uneven surfaces create a tripping hazard.

Our analysis indicates that a large majority of properties exhibit well-maintained driveways, falling within the "good" classification. Conversely, properties with significant deterioration ("poor" classification) represent less than 10% of the total. The Driveway Condition model demonstrates exceptional coverage, achieving a hit rate exceeding 95% across the contiguous United States and Hawaii.

Benefits of Driveway Condition for Insurance Carriers

- Enhanced Risk Assessment: Driveway Condition serves as a reliable indicator of overall property care and maintenance. It can potentially impact underwriting decisions across various loss types.

- Streamlined Underwriting: The three-tier rating system empowers insurers to streamline the underwriting process. Properties categorized as "good" can potentially be fast-tracked through approval, while "fair" or "poor" classifications can trigger further evaluation, such as a manual review or an inspection. Driveway Condition can also be used in conjunction with other criteria to create a more comprehensive risk profile.

- Reduce Liability: Identifying properties with potentially hazardous driveways allows insurers to proactively address potential liability risks and work with homeowners to make needed repairs

Driveway Condition: A Powerful Tool for Smarter Risk Management

In today's data-driven world, insurers require comprehensive tools to assess property risk accurately. ZestyAI's Driveway Condition is a powerful addition to the underwriting toolkit. By leveraging this innovative feature, insurers can gain a deeper understanding of a property's condition, optimize their underwriting processes, and ultimately make informed risk management decisions.

Driveway Condition is included as part of our Location Insights product, delivering highly accurate property intelligence on parcels and structures for all properties in the contiguous US and Hawaii – instantly, and without the need for on-site inspections. Location Insights identifies various high-risk features, such as roof quality, swimming pools, trampolines, lot debris, and overhanging vegetation. This comprehensive data facilitates accurate underwriting, fostering transparency for customers and reinsurers, and is available on-demand in our web app, Z-VIEW, as a batch for projects such as re-underwriting in Z-PORTFOLIO, and via our API.

Partner with ZestyAI for a More Efficient Future

At ZestyAI, we are committed to providing cutting-edge solutions that empower insurers to streamline operations and make smarter decisions. Contact us today to learn more about how Driveway Condition and our other industry-leading features can transform your property risk assessment strategies.

Wildfire Season Update: July Blazes Highlight Risk and Mitigation Strategies

Z-FIRE analysis reveals vulnerability in wildfire zones – 100% of properties were at "Very High" risk

The current wildfire season underscores the importance of proactive risk management. With hot, dry conditions prevailing across the western US, July has seen numerous wildfires erupt, echoing our earlier predictions in our research, "Wildfire Season Overview: Not Just a California Problem."

The Current Wildfire Situation

Fortunately, most current incidents have been in remote areas that have a lower risk of loss of life and property. So far, it appears these fires have not been nearly as deadly as the South Fork Fire near Ruidoso, New Mexico, in June.

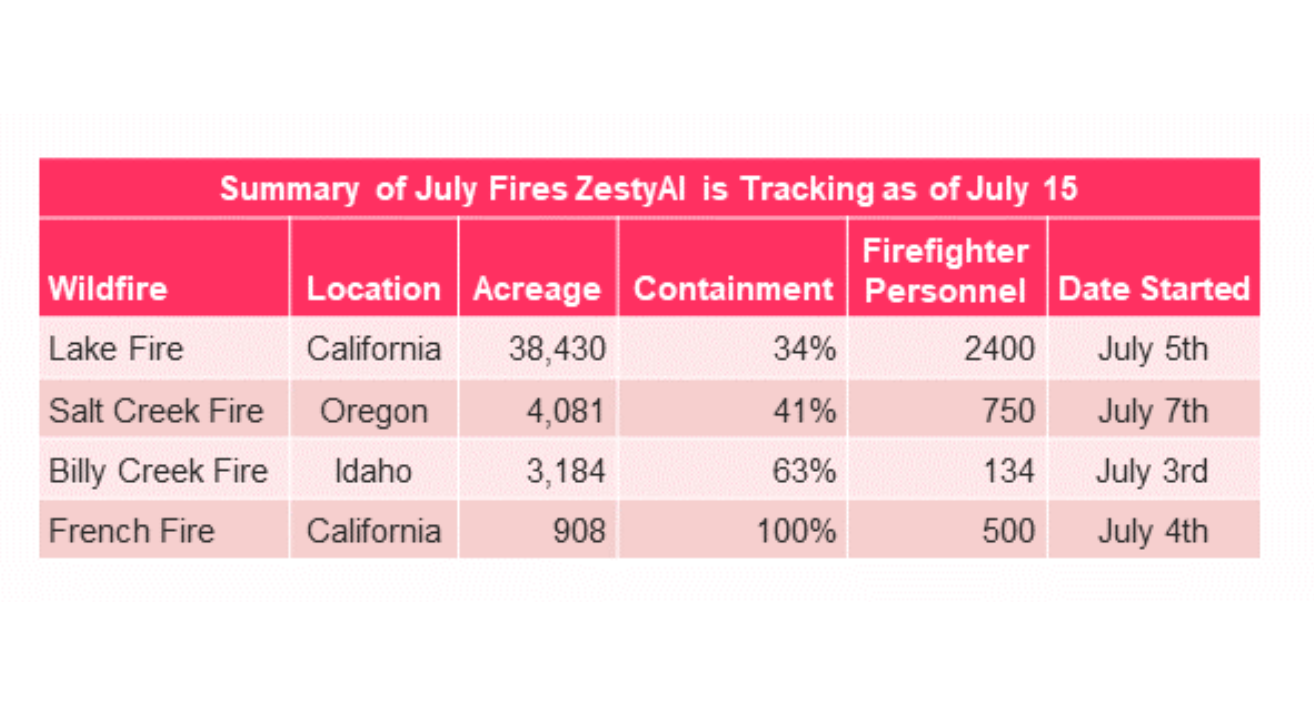

However, the destruction has still been sizeable. California’s largest wildfire so far this year, the Lake Fire near Santa Barbara, started on July 5th and has consumed an estimated 38,000 acres. It remains at only 34% contained, according to Cal Fire. The French Fire in Mariposa County, California, which ignited July 4th, shut down a major thoroughfare into Yosemite National Park, which has since been reopened. The fire has burned about 900 acres of grass, oak woodland, and brush; it left 4 people injured and destroyed 11 structures.

As we predicted, it’s not just a California problem. More than 750 firefighters are working to contain the Salt Creek Fire in Southwest Oregon, which ignited July 7th currently stands at over 4,000 acres consumed. It is 41% contained. And on the Washington/Idaho border, the Billy Creek Fire has reached 74% containment, having burned over 3,000 acres. Fortunately, most structures are a mile or more outside of the perimeter.

Predicting Wildfire Risk With Accuracy

ZestyAI's Z-FIRE wildfire model leverages AI and historical wildfire data to predict neighborhood and property-level wildfire risk across the US. This comprehensive model helps insurance companies understand loss risk and collaborate with policyholders on mitigation strategies.

There are three components of Z-FIRE:

- Level 1 Score (L1): Predicts the likelihood of a property being located within a wildfire perimeter over the next year.

- Level 2 Score (L2): The conditional probability of a property being destroyed if within a wildfire perimeter.

- Risk Factor Analysis: Provides insights into factors influencing L1 and L2 scores.

Z-FIRE Analysis of Recent Fires

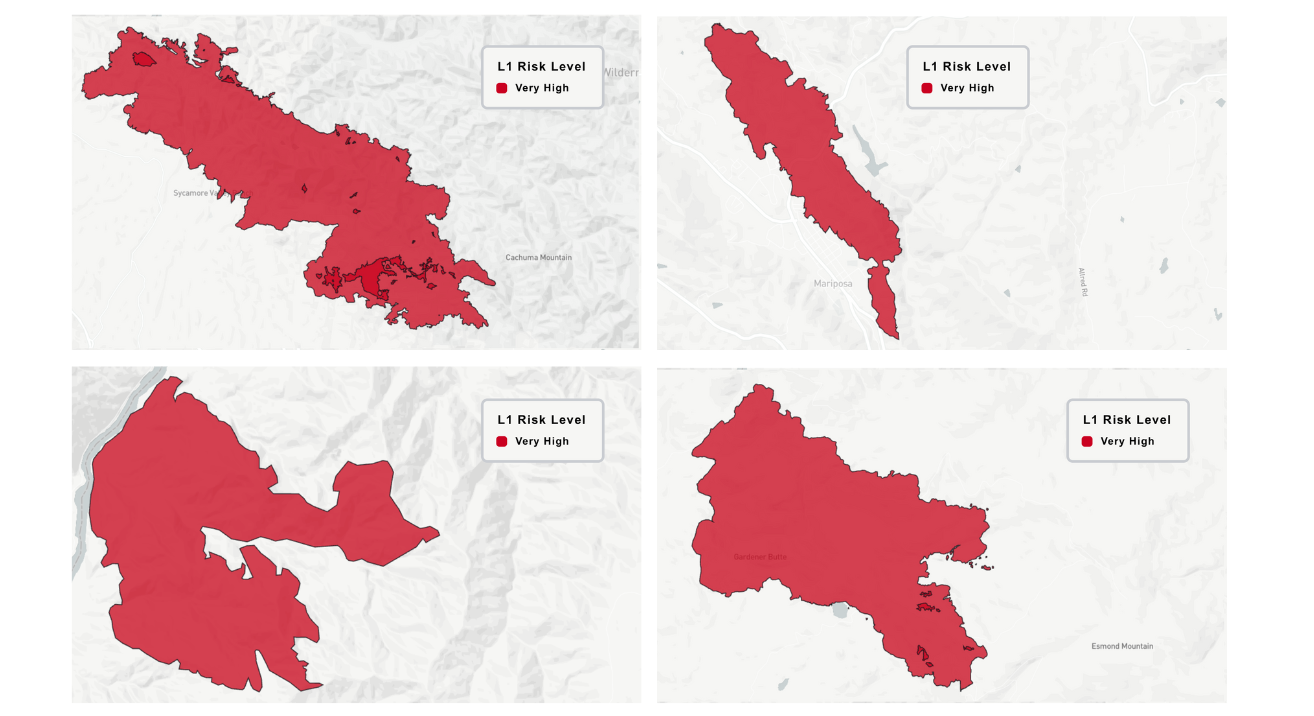

We analyzed the fire perimeters of four major July wildfires: Billy Creek (Idaho), Salt Creek (Oregon), French (California), and Lake (California). This analysis will be revisited for a complete assessment in our annual Z-FIRE performance memo.

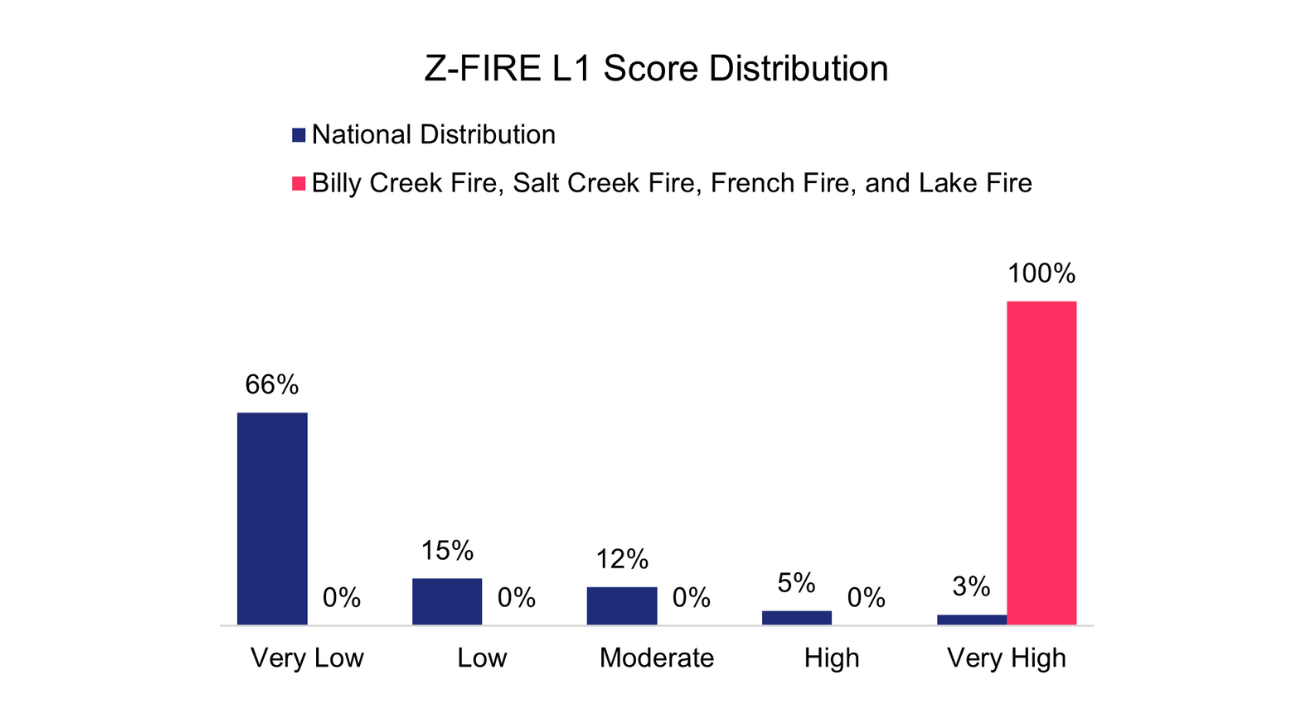

L1 Results: Very High Risk Confirmed

L1 scores identified "Very High" risk for all properties within the fire perimeters. Notably, 100% of properties within fire zones were classified as "Very High" risk, compared to just 3% nationally. This information is crucial for implementing appropriate mitigation strategies by insurance carriers and property owners.

L2 Reveals Elevated Risk to Structures

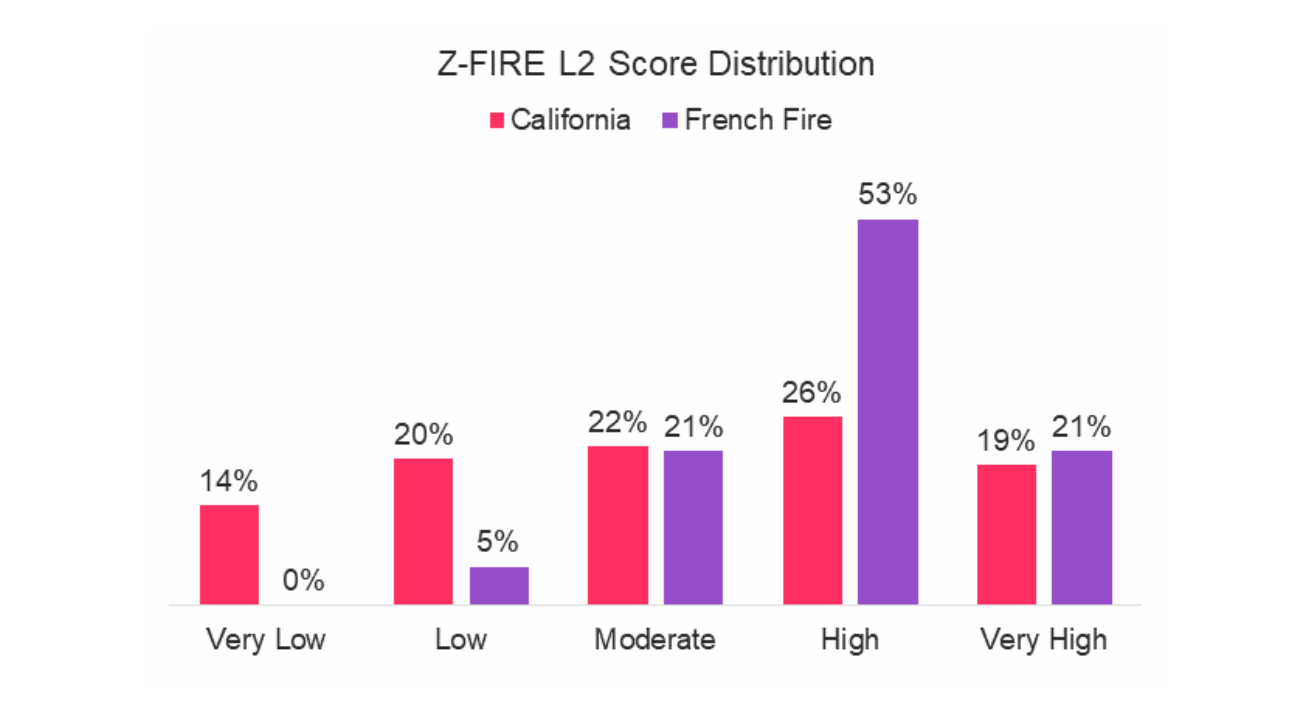

The Z-FIRE L2 score predicts the likelihood of each property being destroyed when included in a wildfire perimeter. We analyzed the properties within the French Fire perimeter for L2 risk, as this fire included the most structures at risk of being consumed (39).

We found that the properties within the French Fire perimeter were at higher risk than California at large. Approximately three-quarters of properties were classified as “High” or “Very High” risk for destruction versus less than half of properties across California. For the French Fire, about a quarter was within the “Low” or “Moderate” risk categories. Notably, no properties were considered “Very Low” risk, while 14% of all California properties are in this category.

This underscores the importance of property-specific characteristics and maintenance undertaken by property owners, like maintaining defensible space and upgrading building materials for fire resiliency. As we found in our research co-authored by the Insurance Institute for Business & Home Safety (IBHS), fuel reduction efforts, such as trimming nearby vegetation and maintaining a defensible space, can increase the likelihood of a structure surviving by 100%. While the entire French Fire area exhibited high wildfire risk, mitigation efforts undertaken by property owners can significantly reduce a structure's risk.

After the French Fire is fully contained, we’ll analyze L2 score performance in predicting which structures survived as part of our 2024 Z-FIRE performance memo.

A Stark Reminder: Mitigation is Critical

The science is clear: reducing fuel around a property significantly increases its chances of surviving a wildfire. Individual property owners and entire communities play a critical role in fire risk. To learn more, explore our full research report, "Wildfire Fuel Management and Risk Management," along with our 2024 Wildfire Season Overview.

Note: Wildfire situations are constantly evolving. The figures and analysis presented here may change as fire perimeters evolve and containment increases.

Now Available: The Insurers Guide to Roof Risk

Learn how leading insurers are mastering roof risk and maximizing lift

It’s hard to overstate how important the roof is from an insurability standpoint. The roof represents significant risks and potential opportunities, making it a critical focus area for insurers. This has become even more important in recent years as the impact of severe convective storms is often reflected in roof losses. Understanding this, ZestyAI has released new research for property insurers called The Insurers Guide to Roof Risk.

Download The Insurers Guide to Roof Risk

In an era where the severity and frequency of roof-related claims are on the rise, particularly due to the increasing impact of severe convective storms, innovative tools and strategies are essential. The Insurers Guide to Roof Risk provides actionable insights to improve risk assessment, underwriting processes, and overall business strategy.

What’s Inside the Guide?

The Insurers Guide to Roof Risk includes:

- Roof Failure Factors: Learn the underlying contributing factors behind why older roofs fail more often.

- Beyond Roof Age: Discover why roof complexity, condition, and climate are more important than roof age alone.

- Identifying Missing Risk Factors: Understand the key factors to roof risk that most traditional models miss.

- Advanced Risk Segmentation: See how using machine learning and new data sources can split risk more than 60 times better than traditional models.

- Portfolio Optimization: Access a comprehensive toolbox to optimize your portfolio and new business selection to generate exponential lift versus traditional models.

Ready to see how ZestyAI works on your book of business?

Tell us a little about your needs. We'll show you how we reduce losses and help you price with precision.