Reports & Research

Explore proprietary research packed with data, insights, and real-world findings to help carriers make smarter decisions.

The 2021 Wildfire Season has Devastating Potential

A Data-Driven Conversation about the US West’s Megadrought

Current climate conditions in the West reveal that 2021 may have a higher than normal risk for wildfire losses. While much of this report focuses on California, historically the worst victim of wildfire in the US, the entire western US is of concern in 2021. In particular, the expansion of deep drought into Colorado is of major concern.

Drought is a leading factor in seasonal wildfire risk. With drought extending through every western state this spring, insurers should consider looking deeply into how they are addressing this growing peril. According to AON, last year’s wildfires in the US West cost insurers over $8 billion.

We've released a complete detailing the devastating potential for 2021's wildfire season. The full report is available here.

Nearly Doubling a Property’s Wildfire Survival Rate: New Study from ZestyAI in Collaboration with IBHS Shows Impact of Key Mitigation Action

Research across more than 71,000 properties involved in wildfires draws significant links between fuel management and property survival.

Oakland,Calif., April 8, 2021: ZestyAI, a leader in climate risk analytics powered by Artificial Intelligence (AI), and the Insurance Institute for Business & Home Safety (IBHS) today released new research on how fuel management impacts destruction rates from wildfires. They found property owners who clear vegetation from the perimeter of their home or building can nearly double their structure's likelihood of surviving a wildfire.

ZestyAI, in conjunction with, IBHS studied more than 71,000 properties involved in wildfires between 2016 and 2019 to assess the relationship between vegetation, buildings, and property vulnerability. To do this, ZestyAI leveraged a combination of computer vision and AI to analyze high resolution satellite and aerial imagery of the properties that fell within the wildfire perimeter, which allowed them to determine what effects a property's physical environment had on its likelihood of survival. They found buildings with a high amount of vegetation within 5 feet of the structure were destroyed in a wildfire 78 percent of the time -- a rate nearly twice as high as those with small amounts of perimeter vegetation. This pattern held true as ZestyAI analyzed the other defensible zones, ranging from 30 to 100 feet around the property.

"It's common sense that increased vegetation increases wildfire risk, but this study shows just how powerful individual action can be in safeguarding structures. Mitigation actions that can cut risk nearly in half are statistically meaningful to anyone with a stake in this peril," said Attila Toth, CEO of ZestyAI. "These findings also underscore how wildfire research at IBHS and artificial intelligence at ZestyAI translates to real-world impact at the intersection of homeowners, community leaders, regulators, and insurance carriers. This type of collective action will help protect our communities from the devastating impact of wildfire, which unfortunately has continued to increase over the last decade."

The study also supported and confirmed takeaways from IBHS's Suburban Wildfire Adaptation Roadmaps released last year, which go beyond the home ignition zone to detail additional actions needed across eight aspects of a home to address a home's wildfire vulnerability. ZestyAI's new research found that having other structures in close proximity to a property increases its wildfire risk, particularly for properties in areas with moderate to high vegetation coverage. Buildings in these areas that had another structure within 30 to 100 feet from the property were destroyed in a wildfire 60 percent of the time, compared to a 31 percent destruction rate for homes without another structure in close proximity.

"This research further demonstrates to homeowners, community leaders, and policy makers just how impactful taking the mitigation actions laid out in the Suburban Wildfire Adaptation Roadmaps can be in protecting homes from wildfire ignition," said Roy E. Wright, President & Chief Executive Officer at IBHS. "Quantifying the effect of mitigating fuel density risk, one of the critical actions identified in the Roadmaps, is a first piece in the larger puzzle of what groups of mitigation actions most improve the chance of home survival and by what level."

ZestyAI is uniquely equipped to support this type of research because of the proprietary wildfire property loss database it developed for Z-FIRE™, its AI model that generates property-specific predictive risk scores. Z-FIRE™ has been trained on more than 1,200 wildfire events across several decades and accounts for the property-level factors that contribute to wildfire risk, including defensible space, building material, and roof pitch, which legacy models fail to consider.

Wright added, "While it is not possible to eliminate wildfire risk we are not powerless against it. We must take a pragmatic approach to mitigate risk at all levels and ultimately reduce property damage through data and science. Through collaborations with modelling organizations like ZestyAI, advanced technology like computer vision and AI help us better understand the impact of these actions at a larger scale. It is encouraging to see emerging progress in just the first months of 2021."

For additional insights you can read the full research paper, ‘Wildfire Fuel Management and Risk Mitigation - Where to Start?' here. For more information on ZestyAI please visit www.zesty.ai, and for more information on IBHS please visit www.ibhs.org.

About ZestyAI (www.zesty.ai): Increasingly frequent natural disasters, such as wildfires, floods and hurricanes devastated communities and drove $2.2 Trillion in economic losses over the past decade. ZestyAI uses 200Bn data points, including aerial imagery, and artificial intelligence to assess the impact of climate change one building at a time. ZestyAI has partnered with leading insurance companies and property owners helping them protect homes, businesses and support thriving communities. ZestyAI was named Top 100 Most Innovative AI Company in the world by CB Insights in 2020, and Gartner Cool Vendor in Insurance by Gartner Research in 2019. For more information visit: https://www.zesty.ai/

About the Insurance Institute for Business & Home Safety (IBHS)

The IBHS mission is to conduct objective, scientific research to identify and promote effective actions that strengthen homes, businesses and communities against natural disasters and other causes of loss. Learn more about IBHS at DisasterSafety.org.

ZestyAI Research: Up to $9.8Bn in Losses Already Caused by Wildfires in 2020

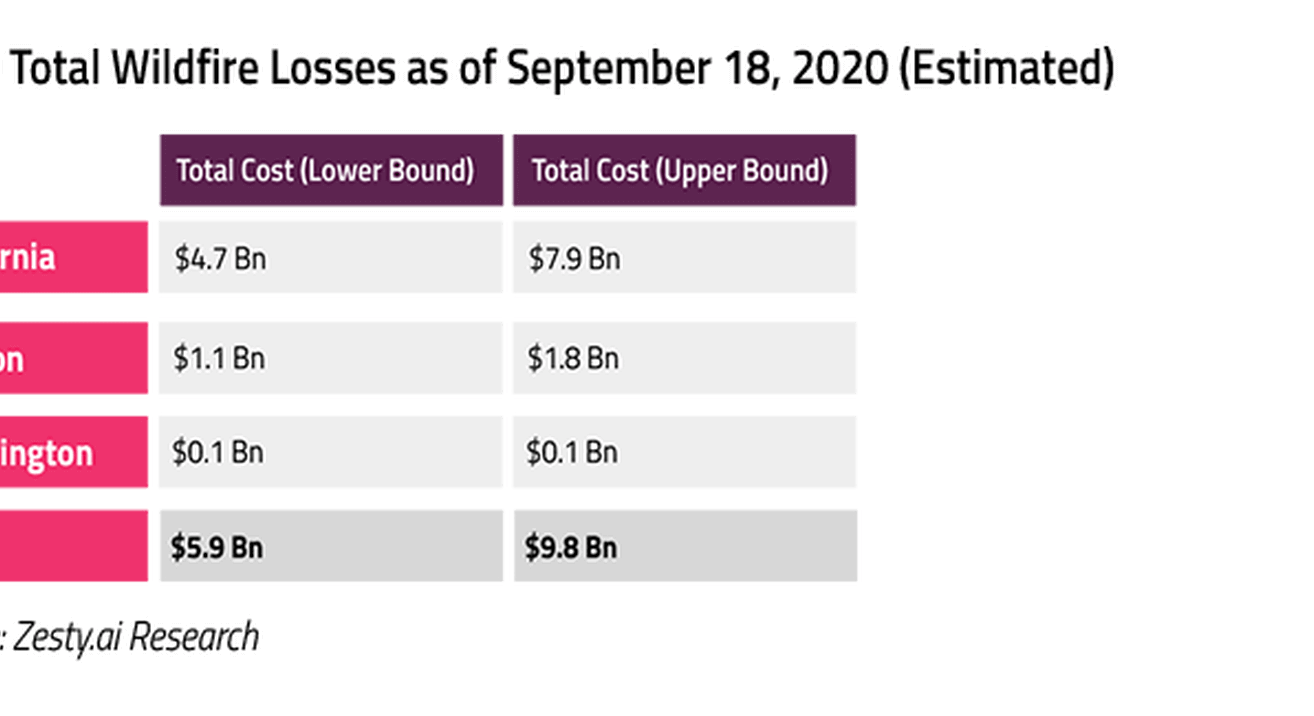

As of September 18th, between $5.9Bn and $9.8Bn in losses have occurred this year alone.

The Zest

ZestyAI has been keeping a close eye on the wildfires burning in the Western United States. Whether by evacuation or smoke, most of our employees have felt the impact firsthand.

Utilizing our vast wildfire data and artificial intelligence resources, we have estimated that as of September 18th, between $5.9Bn and $9.8Bn in losses have occurred this year alone.

What has made 2020 unique?

Two key aspects have made the 2020 Wildfire Season exceptional: the number of acres burned and the timing of the fires.

2018, which previously held the California record for acres burned at 1,975,086 has been eclipsed with months left in the seasons. More than 3.3 million acres have already been charred by wildfire this year in California alone, and more than 5 million in the Western US.

Fire season tends to start in September and peak in November. In August, a large scale lightning event occurred, triggering many of the California wildfires. Oregon, which typically has a shorter wildfire season has also seen early and widespread wildfires.

Analysis Methodology

Using ZestyAI’s comprehensive historical wildfire loss data, up-to-date wildfire perimeter locations for the 2020 season, residential and commercial property information, and fueled by ZestyAI’s AI-driven wildfire damage risk scores, the expected destruction and cost of the 2020 wildfire season so far was calculated for California, Oregon, and Washington.

To estimate the destruction and damages, ZestyAI identified every structure involved in the 2020 wildfire perimeters and their associated wildfire vulnerabilities. Using the historical relationship between the risk profile of the structure, asset value, and economic loss, ZestyAI was able to estimate the full economic loss of those events (including non-insured assets such as uninsured property, and non-insured economic cost). Actual information from CalFire on CZU and LNU incident was used to validate the methodology.

From our extensive historical loss data, a relationship between structural damage expected and the cost of wildfire events was developed based on local property and loss information and expanded to include additional considerations such as smoke damage, displacement costs, and construction.

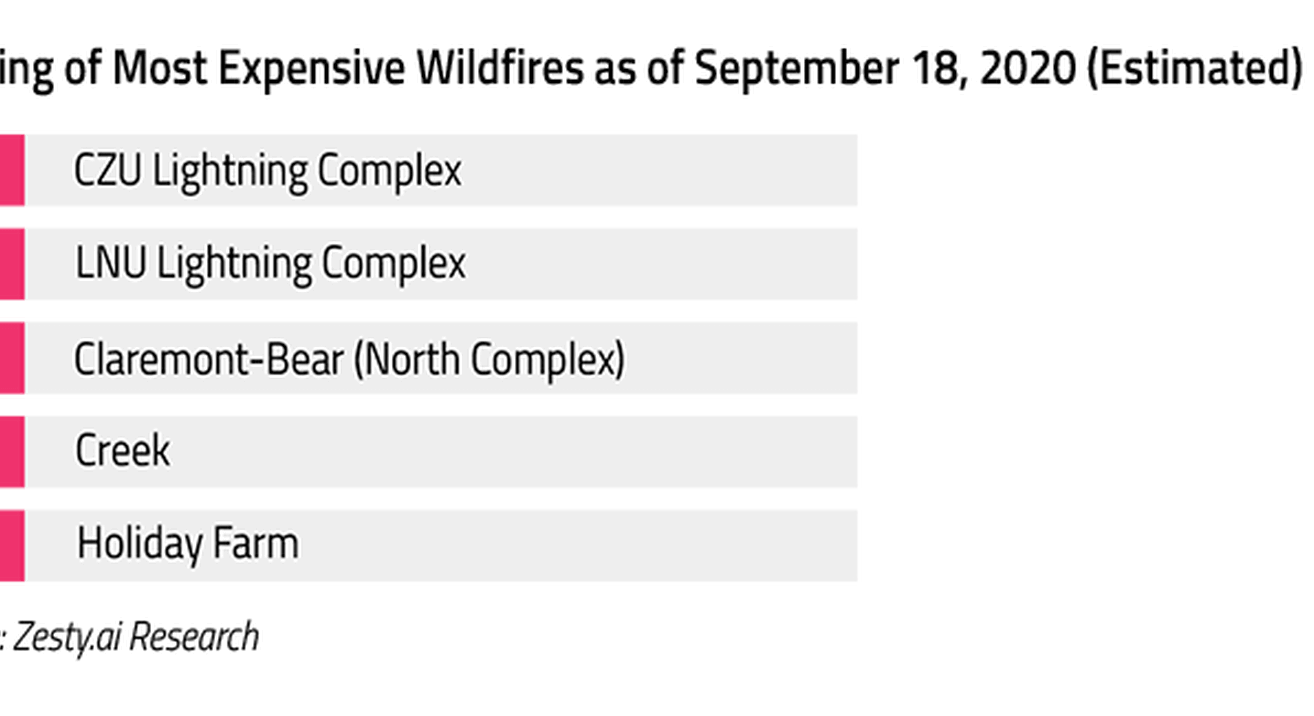

The 5 Most Destructive Fires So Far

Our estimates place the Claremont-Bear (North Complex) at the top of the list of most destructive in terms of number of properties lost. Four of these five wildfires occurred in California with the Alameda Drive fire occurring in Oregon.

The 5 Most Expensive Fires So Far

While the Claremont-Bear (North Complex) fire is estimated to have destroyed the most properties, the CZU Lightning Complex fire is currently estimated to be the most costly at up to $2.6B. That makes it responsible for ~27% of all total economic losses from fires in the 2020 season so far.

Putting Numbers on Destruction

By ZestyAI estimates, between $5.9Bn and $9.8Bn of economic losses have occurred in California, Oregon, and Washington so far this year. California, which also leads in acres burned (5M+) makes up the lion’s share at up to $7.9B.

It’s important to state that the fire season is not yet over. In much of the Western US, it could be just beginning. With a number of fires still active and the potential for more to start, these numbers are almost certain to rise between now and the end of the year.

Looking Forward

Multiple estimates place the 2018 wildfire season at around $15Bn in total losses. While exceptional in terms of total acres burned, the 2020 wildfire season has not yet reached that level of economic loss. Without any doubt, this will be one of the costliest years on record, and with months left in the season, the potential exists for this year to surpass 2018 if it continues at its current pace.

ZestyAI will continue to monitor this fire season. As in years past, new data continues to refine our models and analyses. Insurance professionals and media who would like more information about this analysis or about how artificial intelligence can help insurers protect themselves and their customers from wildfire should contact us.

Deferred Maintenance Adds $317B in Exposure for Insurers

New research from ZestyAI reveals that 62% of U.S. homeowners are deferring critical home maintenance, adding up to $317 billion in potential claims exposure for insurers.

These findings come as Severe Convective Storms (SCS) caused an estimated $58 billion in insured losses in 2024, surpassing hurricane-related losses and marking the second-costliest SCS year on record.

Tornadoes, hail, and wind events now account for over 60% of all U.S. catastrophe claims, and research from the Insurance Institute for Business & Home Safety (IBHS) shows that roof damage accounts for up to 90% of residential catastrophe losses.

Key Findings from ZestyAI’s Homeowner Survey

According to ZestyAI’s nationally representative survey, 62% of homeowners have delayed essential repairs due to budget constraints, representing nearly 59 million U.S. homes with unaddressed vulnerabilities. Forty percent said they would rely on an insurance claim to cover major repairs like roof replacement, adding up to an estimated $317 billion in potential exposure for carriers.

Alarmingly, 63% of homeowners who weren’t living in their home at the time of the last roof replacement don’t know how old their roof is, making it even harder to detect aging systems before they fail. Meanwhile, 12% admitted they would delay repairs indefinitely, further increasing their risk of property damage.

Severe Convective Storms: The Growing Catastrophe Risk

This blind spot compounds known risks: prior ZestyAI analysis has identified over 12.6 million U.S. properties at high risk for hail-related roof damage, representing $189.5 billion in potential roof replacement costs.

“Deferred maintenance has long been a known risk factor, but today the stakes are higher than ever,” said Kumar Dhuvur, Co-Founder and Chief Product Officer of ZestyAI. "With claim severity rising and storm losses compounding, insurers need more than hazard maps to navigate this landscape."

"Property-level insights allow carriers to proactively address known vulnerabilities, improve underwriting precision, and work with homeowners to reduce losses before they happen.”

ZestyAI’s findings support a growing push toward data-driven, preventative underwriting strategies, especially as carriers face rising claim severity and pressure to improve combined ratios across storm-prone states.

Why Jencap Chose ZestyAI for Wildfire Risk Modeling

In today’s property insurance market, understanding wildfire risk at the individual structure level is more critical than ever. For wholesale brokers like Jencap, the ability to deliver actionable, data-driven insights to retail agents and carriers is essential, especially as wildfire conditions evolve rapidly across the country.

That’s why JenCap turned to ZestyAI.

In the video above, Ben Beazley, EVP and Head of Property at JenCap, shares two key reasons why ZestyAI’s Z-FIRE™ model stood out:

- Structure-level precision: Z-FIRE analyzes wildfire risk at the individual property level—factoring in building materials, defensible space, vegetation, topography, and historical fire patterns to predict which homes are most vulnerable and which are more likely to withstand a fire.

- Continuously refreshed data: While the core model remains stable and DOI-approved, Z-FIRE is updated with the latest fire perimeters, confirmed loss locations, and vegetation data. This ensures it reflects the most current wildfire seasons and emerging risk patterns.

- Z-FIRE is already approved for rating and underwriting in every major wildfire-prone state. For JenCap and many others, it’s become a vital tool for evaluating wildfire exposure and supporting smarter decisions in high-risk areas.

.webp)

Z-FIRE Was Built for This: Addressing the Threat of Urban Conflagration

From dense neighborhoods to high-intensity burn zones, Z-FIRE has long accounted for the drivers of urban wildfire risk.

Not every wildfire spreads through forests. Some move house to house, block to block, driven by wind, heat, and proximity. As these events become more common, insurers are asking sharper questions about how to assess risk in densely built environments.

Z-FIRE was designed to account for the real-world conditions that enable this type of fire behavior, capturing the structural, spatial, and environmental factors like building density, defensible space, mitigation strategy, climatology, and slope that contribute to urban conflagration.

What Is Urban Conflagration?

Urban conflagration refers to a fire that spreads rapidly through a densely built environment, jumping from structure to structure rather than moving solely through vegetation. Unlike traditional wildfires that primarily burn forests or grasslands, these events are driven by building materials and the adoption of fire mitigation practices, the spacing between structures, and proximity to areas that are known to be challenging for firefighters.

Wind and terrain—particularly steep slopes—often accelerate the spread, pushing fire fronts into residential areas and compounding the risk of widespread destruction. For insurers, urban conflagrations represent a uniquely challenging peril, where fire behavior is shaped as much by the built environment as by natural fuels. Without a model built to capture these dynamics, they’re nearly impossible to assess accurately.

We’ve seen what happens when wind-driven embers reach tightly packed communities. In fires like Marshall, Lahaina, and the recent Palisades and Eaton Fires, wildfires didn’t stop at the wildland-urban interface—they became full-scale urban conflagrations.

These events are stark reminders that wildfire risk doesn’t end at the edge of the forest and that densely populated areas can produce concentrated, catastrophic losses.

For insurers, these events raise a critical question: Where are the next high-concentration loss scenarios hiding in the portfolio?

When urban conflagration strikes, damage rates spike, and PML exposure can increase exponentially. Identifying the neighborhoods where construction patterns, terrain, and fuel conditions create the potential for that kind of fire behavior is no longer optional; it’s essential.

At ZestyAI, we’ve been asking, and answering, these questions for years. The Z-FIRE model was designed to do exactly that.

Built to Reflect Real-World Urban Risk

From its inception, Z-FIRE has accounted for the drivers of urban conflagration. Its two-level architecture combines neighborhood-level dynamics with property-specific characteristics, offering a detailed and scalable view of wildfire risk—even in densely built environments.

Level 1 (L1): Neighborhood Risk Score

L1 predicts the likelihood that a property will fall within a wildfire perimeter. It does this by analyzing climatology, historical wildfire behavior, terrain, fuel type, and wildfire suppression ratings to understand where fires are likely to start, spread, and grow.

Two variables are particularly important for identifying urban conflagration risk:

- Fuel Type, which accounts for both vegetative fuels and the built environment. In densely developed areas, clusters of structures can serve as fuel, particularly when combined with slope, dry conditions, or limited defensible space.

- Wildfire Suppression Rating (WSR), which indicates areas where fire suppression is likely to fail due to access, water availability, or firefighting capacity. Rather than relying on WSR alone, Z-FIRE factors in proximity to high and very high WSR zones, enabling it to capture risk spillover into nearby neighborhoods.

What sets Z-FIRE apart is how these variables interact. The model doesn’t assess them in isolation—it evaluates how multiple risk factors compound one another. This layered, interaction-driven approach allows Z-FIRE to surface hidden vulnerabilities that simpler, one-dimensional models often miss and accurately identify regions with high conflagration risk.

- L1 evaluates wildfire risk based on local terrain, fuel types, and building density. Critically, Z-FIRE incorporates two critical variables that are key indicators of conflagration risk. Both “fuel type” and proximity to areas with a High or Very High wildfire suppression rating.

- Fuel Type accounts for both vegetation and for developed land characteristics. While vegetative fuel and its management are key for wildfire, building density can become a large contributor to conflagration risk if combined with the other high-risk factors. It is important to remember that Z-FIRE allows for unlimited variable interaction; a high-density neighborhood can be at high risk of other factors, contributing to conflagration risk.

- Wildfire Suppression Rating (WSR) reflects the risk that a high-intensity fire may become impossible to manage by firefighters. Because those areas tend to be located in the WUI, Z-FIRE does not only rely on the WSR score, but also uses the distance proximity to high or very high WSR.

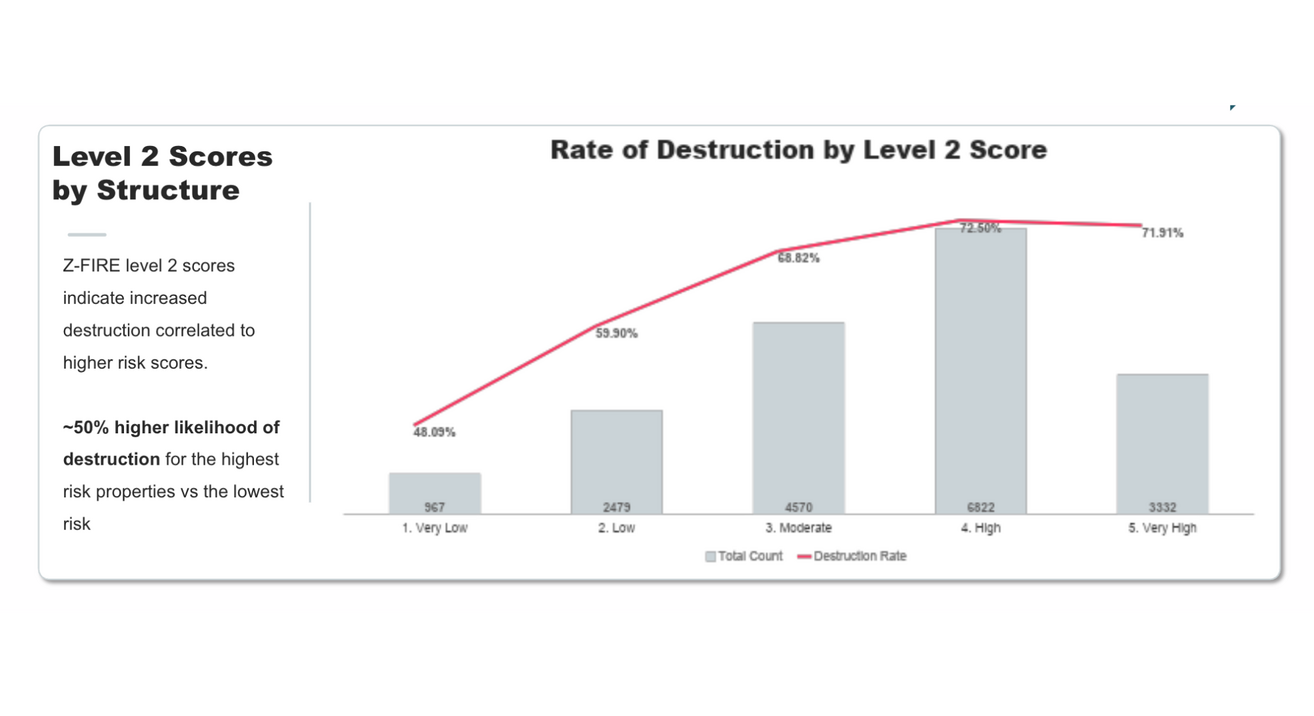

Level 2 (L2): Property-Specific Risk Score

At the structure level, L2 evaluates both nearby vegetation and building fuel density, a key driver of structure-to-structure ignition. This metric, validated by the Insurance Institute for Business & Home Safety (IBHS), helps Z-FIRE model how a single ignition can escalate within tightly packed neighborhoods, even in the absence of natural fuels.

Z-FIRE was trained on real-world events with clear urban conflagration patterns. In the 2017 Tubbs Fire, for example, flames spread deep into Santa Rosa, destroying dense subdivisions like Coffee Park. Similarly, recent fires such as Palisades and Eaton moved rapidly through built-up areas, where tightly spaced structures provided a continuous path of fuel.

Case in Point: Palisades and Eaton, CA

In the recent Palisades and Eaton Fires, Z-FIRE’s predictive accuracy was once again put to the test. Our analysis showed that over 91% of the affected area was already classified by Z-FIRE as high or very high risk based on Level 1 (L1) neighborhood scores.

Notably, none of the impacted areas were categorized as “Very Low Risk,” a strong validation that Z-FIRE captured the inherent vulnerability of these communities well before ignition.

Looking at Level 2 (L2) property-specific scores, the correlation between predicted risk and actual destruction became even clearer.

Structures with the highest Z-FIRE risk scores were 50% more likely to be destroyed compared to those with the lowest scores in the same fire footprint.

These destruction rates align with the model’s fundamental architecture: properties with denser surrounding structures, minimal defensible space, and combustible fuels nearby face a dramatically higher likelihood of loss during a wildfire.

The model identified risk in this community not simply based on topography or vegetation, but because of its underlying urban structure, including building materials, spacing between homes, and neighborhood density. These are the very factors that drive vulnerability to conflagration.

Z-FIRE was designed to capture these dynamics, reinforcing its value as a forward-looking tool for rating, underwriting, and mitigation planning.

A Model Informed by What’s Happening on the Ground

Wildfire conditions are constantly changing, and Z-FIRE stays current by continuously incorporating the latest ground-truth data, including updated fire perimeters, confirmed loss locations, and vegetation conditions.

While the core model remains stable and fully approved for rating and underwriting, this steady stream of fresh data ensures that Z-FIRE reflects the most recent fire seasons and emerging risk patterns.

The 2023 and 2024 fire seasons reinforced what we’ve long understood: fire behavior is increasingly shaped by the built environment. Z-FIRE continues to perform as expected across a wide range of scenarios, including structure-to-structure ignition in densely built areas.

These results reaffirm the model’s ability to provide timely, reliable insights to support carrier decision-making in a rapidly evolving risk landscape.

Available Now, for Those Who Need It Most

For carriers looking to better understand and underwrite wildfire risk, whether in traditional WUI zones or increasingly vulnerable urban neighborhoods, Z-FIRE offers a tested, approved, and field-proven solution.

Built on over a decade of confirmed loss data and designed to capture the drivers of urban conflagration, Z-FIRE supports smarter decisions across pricing, underwriting, mitigation, and reinsurance.

Importantly, Z-FIRE is approved for underwriting and rating by Departments of Insurance (DOIs) across all western states, with Oklahoma recently added to the list. Carriers can deploy the model today with confidence, knowing it meets regulatory standards while delivering granular, property-specific insights to support risk selection, pricing, and mitigation strategies.

If you're looking to validate wildfire risk insights on your own book of business, we invite you to put Z-FIRE to the test. Our team can run a targeted evaluation to show how the model performs across your portfolio, highlighting risk segmentation opportunities and identifying properties most vulnerable to structure-to-structure spread.

Get in touch to schedule an evaluation and see how Z-FIRE can strengthen your wildfire strategy today.

ZestyAI launches AI agent to cut research time for competitive intelligence by 95%

ZORRO Discover™ automatically converts regulatory filings into actionable market intelligence — potentially saving insurers billions in costs

ZestyAI today announced the launch of ZORRO Discover™, a generative AI agent that delivers instant insights into regulatory filings and competitive market activity.

Solving a $2.5 Billion Regulatory Research Problem

Regulatory research remains one of the costliest inefficiencies in insurance, with an estimated $2.5 billion spent annually on manual reviews. The process consumes millions of hours across fragmented workflows, as filings often stretch into the thousands of pages, slowing competitive analysis and strategic decision-making.

To solve this, ZestyAI built ZORRO Discover on a proprietary generative AI pipeline, leveraging large language models optimized for insurance-specific content, including filings, objections, responses, and regulations from all 50 states.

Using agentic AI, the platform proactively navigates and synthesizes regulatory data, delivering a fast, intuitive experience tailored to the structure and language of insurance filings.

Accelerating Research by 95%

Early adopters of ZORRO Discover have found that insurers can cut research time by an average of 95%, saving thousands of work hours and millions in costs.

“For too long, regulatory filings have buried critical intelligence under layers of complexity,” said Kumar Dhuvur, Founder and Chief Product Officer of ZestyAI. “Through years of working closely with regulators, we’ve come to deeply understand these challenges.”

“ZORRO Discover puts that intelligence at insurers’ fingertips so they can act faster, stay compliant, and make smarter decisions in an increasingly competitive market.”

How Teams Use ZORRO Discover

ZORRO Discover can be used by compliance, actuarial, product, and strategy teams to accelerate competitive research and reduce regulatory risk. By replacing manual reviews with a consistent, repeatable process, the platform helps teams improve research accuracy, focus on high-impact work, and stay ahead of regulatory changes.

Key Capabilities

- Plain-language search: Analyze and compare filings across carriers, states, and time periods using intuitive queries—no deep regulatory or technical expertise required.

- Zero in on critical details instantly: Transform complex filings into executive-level insights for faster, more informed decision-making.

- Spot market opportunities early: Track shifts in rates, rules, forms, and guidelines to anticipate industry trends and act proactively.

- Run side-by-side comparisons: Evaluate pricing strategies, regulatory objections, or model usage over time and across competitors. Example: Compare windstorm mitigation discounts across three major carriers in Florida.

Expanding to Additional Lines of Business

ZORRO Discover launches with a focus on homeowners insurance and is rapidly expanding to support regulatory and competitive intelligence across auto, commercial, and additional lines of business.

Request early access to ZORRO Discover here.

Arizona Approves ZestyAI’s AI-Driven Storm Models Amid Escalating Storm Losses

Regulators greenlight property-level hail and wind insights to support risk-aligned underwriting and rating

The Arizona Department of Insurance and Financial Institutions has approved the use of ZestyAI’s Severe Convective Storm suite, including Z-HAIL™, Z-WIND™, and Z-STORM™, giving insurers access to property-level risk insights.

Rising Storm Losses Across Arizona

In Arizona, the most frequent and damaging thunderstorm losses stem from strong, straight-line winds, especially downbursts. These sudden, localized wind events can exceed 100 mph and often cause significant roof and structural damage, particularly in vulnerable homes.

In 2024 alone, Arizona experienced 67 days of severe storm events, according to NOAA. These included high winds, large hail, tornadoes, and damaging downbursts, highlighting the growing volatility of the state’s monsoon season and the increasing threat to both rural and urban communities.

How ZestyAI’s Models Improve Precision

ZestyAI’s models are designed to address these risks. By analyzing how local climatology interacts with individual property features, the platform predicts both the likelihood and severity of storm-related claims, offering a more accurate alternative to traditional ZIP code or territory-based approaches, which often miss critical risk signals.

Each model is trained and validated on extensive real-world claims data and provides clear, transparent explanations of the key factors driving each score, enabling more confident underwriting and rating decisions.

Key Model Capabilities

- Z-HAIL: Predicts hail damage risk and claim severity using property-specific attributes like roof complexity, historical losses, and accumulated damage, identifying which homes are most likely to file a claim, even within the same neighborhood.

- Z-WIND: Combines AI-generated 3D analysis of roof condition, complexity, and potential failure points with local climatology to deliver pivotal insights into property-specific wind claim vulnerability and severity.

- Z-STORM: Predicts the frequency and severity of storm damage claims, including hail and wind, examining the interaction between climatology and the unique characteristics of every structure and roof.

Regulatory Confidence in AI-Driven Models

Bryan Rehor, Director of Regulatory Affairs at ZestyAI said,

“Arizona is a key market for many of our carrier partners, and one of the most rigorous regulatory environments for model review. This approval is a strong signal of confidence in our technology and our commitment to transparency, precision, and regulatory alignment.”

Arizona marks the 19th state to approve ZestyAI’s Severe Convective Storm suite—and the fourth model approved in Arizona overall, joining Z-FIRE™, ZestyAI’s AI-powered wildfire risk model already in use across the state. With elevated risk across multiple perils, Arizona’s adoption of ZestyAI’s models reflects growing regulatory confidence in AI-driven models that enable smarter underwriting, precise pricing, and stronger resilience in the face of extreme weather.

What We Learned from Scott Stephenson on Trust, Execution, and Leadership

At our 2025 offsite, we had the rare privilege of hosting Scott Stephenson, former Chairman, President, and CEO of Verisk, for a candid fireside chat with our CEO, Attila Toth.

More than a guest speaker, Scott has been a mentor to our founders and a steady source of insight and encouragement on our journey.

Over two decades, he led Verisk through extraordinary growth: doubling revenue, quadrupling market cap, and shaping one of the most respected analytics companies in the world. Named one of Forbes’ Most Admired CEOs, Scott helped define the modern insurance ecosystem.

But what stayed with our team long after the session wasn’t the accolades. It was his clarity, humility, and deep conviction that great companies aren’t defined by vision—they’re defined by execution.

Here are three takeaways that stuck with us:

Trust is a survival skill

Scott opened with the story of the 1949 Mann Gulch wildfire, where only 3 of 16 elite smokejumpers made it out alive. The team leader lit an escape fire and lay down inside it. He shouted for the others to follow, but no one did.

“They were a team on paper,” Scott said, “but they’d never trained together. They didn’t trust each other enough to act as one.”

The lesson? In high-stakes environments, technical talent means little without trust. Success depends on how quickly and cohesively a team can move together.

Thinking isn’t doing

Smart teams often confuse planning with progress. As Scott put it:

“Thinking about something, even deeply—and talking about it with others—feels like you’re doing the work. But you’re not.”

Insight without execution is just potential energy. The companies that thrive aren’t the ones with the most ideas; they’re the ones that ship, iterate, and improve with discipline.

Leadership is a mindset

Scott began his career as an engineer. Leadership wasn’t on his radar—until curiosity led him to explore it. His message: leadership isn’t a job title, and it’s not reserved for MBAs. It belongs to those who take responsibility, act with principle, and stay grounded in reality.

Why it mattered

Scott didn’t come to ZestyAI to celebrate the past. He came to challenge us. To remind us that in an industry facing rising losses, regulatory pressure, and rapid change, progress isn’t driven by buzzwords or strategy decks. It’s driven by clarity, trust, and the discipline to do the hard work.

That message hit home. As we scale ZestyAI, our ambition isn’t just to innovate; it’s to lead with purpose. To build the new standard for risk analytics. One that helps insurers price with precision, expand access to coverage, and strengthen the resilience of entire communities.

See How Insights Turn Into Decisions

ZestyAI transforms data into action. Get a demo to see how the same AI powering our reports helps carriers make faster, smarter, regulator-ready decisions.