Reports & Research

Explore proprietary research packed with data, insights, and real-world findings to help carriers make smarter decisions.

The 2021 Wildfire Season has Devastating Potential

A Data-Driven Conversation about the US West’s Megadrought

Current climate conditions in the West reveal that 2021 may have a higher than normal risk for wildfire losses. While much of this report focuses on California, historically the worst victim of wildfire in the US, the entire western US is of concern in 2021. In particular, the expansion of deep drought into Colorado is of major concern.

Drought is a leading factor in seasonal wildfire risk. With drought extending through every western state this spring, insurers should consider looking deeply into how they are addressing this growing peril. According to AON, last year’s wildfires in the US West cost insurers over $8 billion.

We've released a complete detailing the devastating potential for 2021's wildfire season. The full report is available here.

Nearly Doubling a Property’s Wildfire Survival Rate: New Study from ZestyAI in Collaboration with IBHS Shows Impact of Key Mitigation Action

Research across more than 71,000 properties involved in wildfires draws significant links between fuel management and property survival.

Oakland,Calif., April 8, 2021: ZestyAI, a leader in climate risk analytics powered by Artificial Intelligence (AI), and the Insurance Institute for Business & Home Safety (IBHS) today released new research on how fuel management impacts destruction rates from wildfires. They found property owners who clear vegetation from the perimeter of their home or building can nearly double their structure's likelihood of surviving a wildfire.

ZestyAI, in conjunction with, IBHS studied more than 71,000 properties involved in wildfires between 2016 and 2019 to assess the relationship between vegetation, buildings, and property vulnerability. To do this, ZestyAI leveraged a combination of computer vision and AI to analyze high resolution satellite and aerial imagery of the properties that fell within the wildfire perimeter, which allowed them to determine what effects a property's physical environment had on its likelihood of survival. They found buildings with a high amount of vegetation within 5 feet of the structure were destroyed in a wildfire 78 percent of the time -- a rate nearly twice as high as those with small amounts of perimeter vegetation. This pattern held true as ZestyAI analyzed the other defensible zones, ranging from 30 to 100 feet around the property.

"It's common sense that increased vegetation increases wildfire risk, but this study shows just how powerful individual action can be in safeguarding structures. Mitigation actions that can cut risk nearly in half are statistically meaningful to anyone with a stake in this peril," said Attila Toth, CEO of ZestyAI. "These findings also underscore how wildfire research at IBHS and artificial intelligence at ZestyAI translates to real-world impact at the intersection of homeowners, community leaders, regulators, and insurance carriers. This type of collective action will help protect our communities from the devastating impact of wildfire, which unfortunately has continued to increase over the last decade."

The study also supported and confirmed takeaways from IBHS's Suburban Wildfire Adaptation Roadmaps released last year, which go beyond the home ignition zone to detail additional actions needed across eight aspects of a home to address a home's wildfire vulnerability. ZestyAI's new research found that having other structures in close proximity to a property increases its wildfire risk, particularly for properties in areas with moderate to high vegetation coverage. Buildings in these areas that had another structure within 30 to 100 feet from the property were destroyed in a wildfire 60 percent of the time, compared to a 31 percent destruction rate for homes without another structure in close proximity.

"This research further demonstrates to homeowners, community leaders, and policy makers just how impactful taking the mitigation actions laid out in the Suburban Wildfire Adaptation Roadmaps can be in protecting homes from wildfire ignition," said Roy E. Wright, President & Chief Executive Officer at IBHS. "Quantifying the effect of mitigating fuel density risk, one of the critical actions identified in the Roadmaps, is a first piece in the larger puzzle of what groups of mitigation actions most improve the chance of home survival and by what level."

ZestyAI is uniquely equipped to support this type of research because of the proprietary wildfire property loss database it developed for Z-FIRE™, its AI model that generates property-specific predictive risk scores. Z-FIRE™ has been trained on more than 1,200 wildfire events across several decades and accounts for the property-level factors that contribute to wildfire risk, including defensible space, building material, and roof pitch, which legacy models fail to consider.

Wright added, "While it is not possible to eliminate wildfire risk we are not powerless against it. We must take a pragmatic approach to mitigate risk at all levels and ultimately reduce property damage through data and science. Through collaborations with modelling organizations like ZestyAI, advanced technology like computer vision and AI help us better understand the impact of these actions at a larger scale. It is encouraging to see emerging progress in just the first months of 2021."

For additional insights you can read the full research paper, ‘Wildfire Fuel Management and Risk Mitigation - Where to Start?' here. For more information on ZestyAI please visit www.zesty.ai, and for more information on IBHS please visit www.ibhs.org.

About ZestyAI (www.zesty.ai): Increasingly frequent natural disasters, such as wildfires, floods and hurricanes devastated communities and drove $2.2 Trillion in economic losses over the past decade. ZestyAI uses 200Bn data points, including aerial imagery, and artificial intelligence to assess the impact of climate change one building at a time. ZestyAI has partnered with leading insurance companies and property owners helping them protect homes, businesses and support thriving communities. ZestyAI was named Top 100 Most Innovative AI Company in the world by CB Insights in 2020, and Gartner Cool Vendor in Insurance by Gartner Research in 2019. For more information visit: https://www.zesty.ai/

About the Insurance Institute for Business & Home Safety (IBHS)

The IBHS mission is to conduct objective, scientific research to identify and promote effective actions that strengthen homes, businesses and communities against natural disasters and other causes of loss. Learn more about IBHS at DisasterSafety.org.

ZestyAI Research: Up to $9.8Bn in Losses Already Caused by Wildfires in 2020

As of September 18th, between $5.9Bn and $9.8Bn in losses have occurred this year alone.

The Zest

ZestyAI has been keeping a close eye on the wildfires burning in the Western United States. Whether by evacuation or smoke, most of our employees have felt the impact firsthand.

Utilizing our vast wildfire data and artificial intelligence resources, we have estimated that as of September 18th, between $5.9Bn and $9.8Bn in losses have occurred this year alone.

What has made 2020 unique?

Two key aspects have made the 2020 Wildfire Season exceptional: the number of acres burned and the timing of the fires.

2018, which previously held the California record for acres burned at 1,975,086 has been eclipsed with months left in the seasons. More than 3.3 million acres have already been charred by wildfire this year in California alone, and more than 5 million in the Western US.

Fire season tends to start in September and peak in November. In August, a large scale lightning event occurred, triggering many of the California wildfires. Oregon, which typically has a shorter wildfire season has also seen early and widespread wildfires.

Analysis Methodology

Using ZestyAI’s comprehensive historical wildfire loss data, up-to-date wildfire perimeter locations for the 2020 season, residential and commercial property information, and fueled by ZestyAI’s AI-driven wildfire damage risk scores, the expected destruction and cost of the 2020 wildfire season so far was calculated for California, Oregon, and Washington.

To estimate the destruction and damages, ZestyAI identified every structure involved in the 2020 wildfire perimeters and their associated wildfire vulnerabilities. Using the historical relationship between the risk profile of the structure, asset value, and economic loss, ZestyAI was able to estimate the full economic loss of those events (including non-insured assets such as uninsured property, and non-insured economic cost). Actual information from CalFire on CZU and LNU incident was used to validate the methodology.

From our extensive historical loss data, a relationship between structural damage expected and the cost of wildfire events was developed based on local property and loss information and expanded to include additional considerations such as smoke damage, displacement costs, and construction.

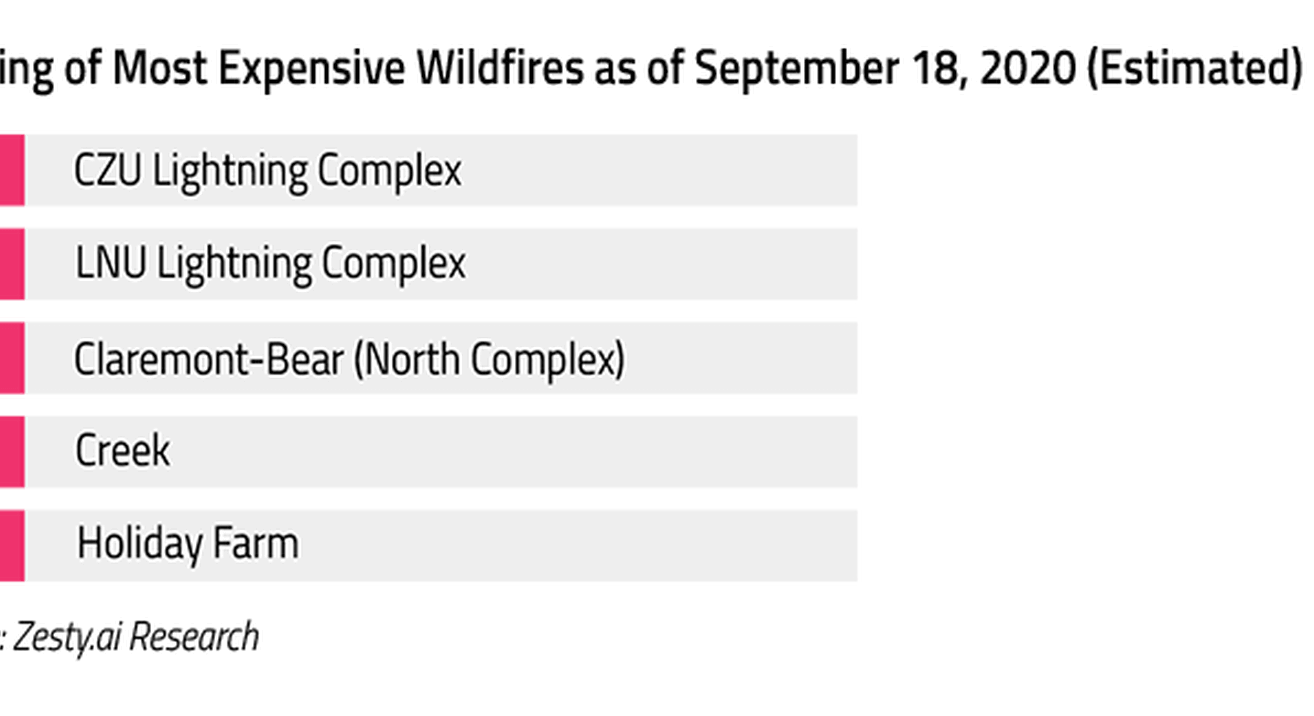

The 5 Most Destructive Fires So Far

Our estimates place the Claremont-Bear (North Complex) at the top of the list of most destructive in terms of number of properties lost. Four of these five wildfires occurred in California with the Alameda Drive fire occurring in Oregon.

The 5 Most Expensive Fires So Far

While the Claremont-Bear (North Complex) fire is estimated to have destroyed the most properties, the CZU Lightning Complex fire is currently estimated to be the most costly at up to $2.6B. That makes it responsible for ~27% of all total economic losses from fires in the 2020 season so far.

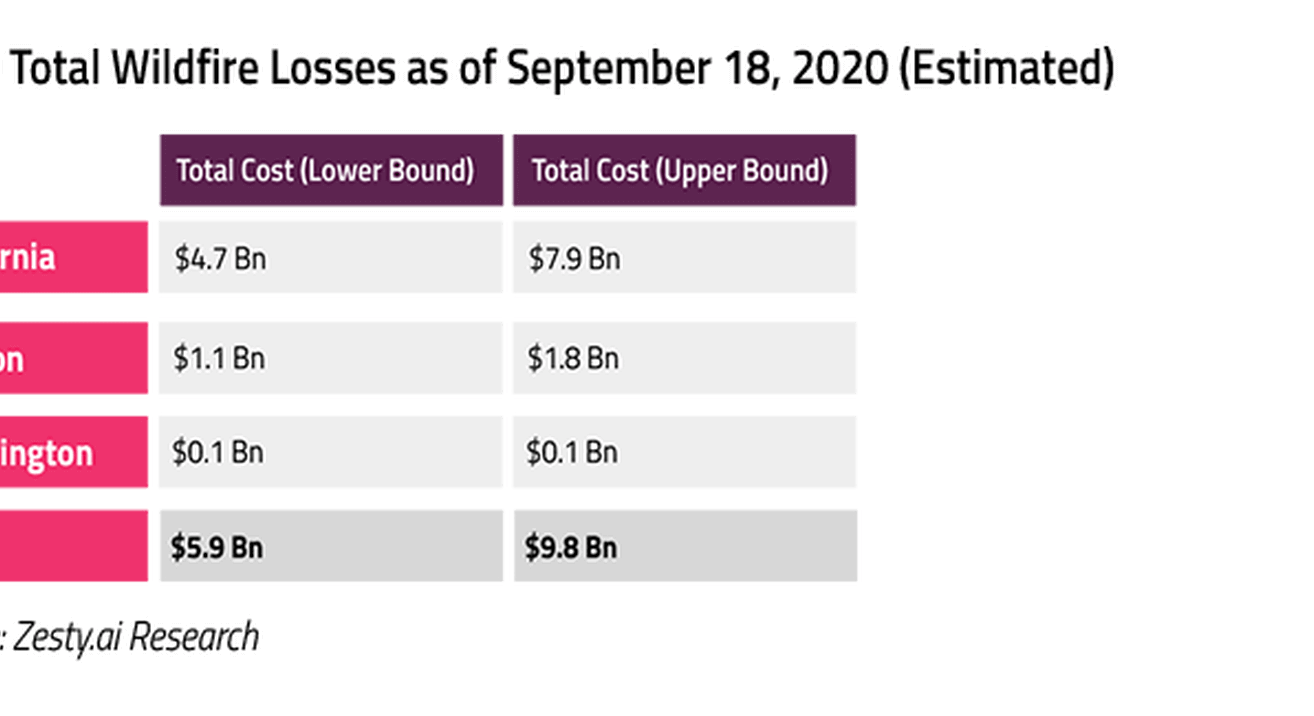

Putting Numbers on Destruction

By ZestyAI estimates, between $5.9Bn and $9.8Bn of economic losses have occurred in California, Oregon, and Washington so far this year. California, which also leads in acres burned (5M+) makes up the lion’s share at up to $7.9B.

It’s important to state that the fire season is not yet over. In much of the Western US, it could be just beginning. With a number of fires still active and the potential for more to start, these numbers are almost certain to rise between now and the end of the year.

Looking Forward

Multiple estimates place the 2018 wildfire season at around $15Bn in total losses. While exceptional in terms of total acres burned, the 2020 wildfire season has not yet reached that level of economic loss. Without any doubt, this will be one of the costliest years on record, and with months left in the season, the potential exists for this year to surpass 2018 if it continues at its current pace.

ZestyAI will continue to monitor this fire season. As in years past, new data continues to refine our models and analyses. Insurance professionals and media who would like more information about this analysis or about how artificial intelligence can help insurers protect themselves and their customers from wildfire should contact us.

Case Study: Adapting to Escalating Severe Convective Storm Risk

Insights from a 5-year retrospective on ZestyAI’s models in action

The Rising Threat of Severe Convective Storms

The past few decades have seen a dramatic rise in the frequency and intensity of severe convective storms, resulting in significant financial repercussions for the insurance industry. In the last year alone, insured losses from severe convective storms reached an astounding $60 billion, marking an average annual growth rate of over 11% over the past twenty years. This alarming trend means a new approach is needed to manage and mitigate the escalating risks associated with severe weather events.

In the last year alone, insured losses from severe convective storms reached an astounding $60B, marking an average annual growth rate of over 11% over the past twenty years.

The traditional methods of risk assessment and management are no longer sufficient to cope with the increasing unpredictability and severity of these weather events. As the risk evolves, so must the solutions. Changing risks call for innovative solutions that leverage advanced technology and data analytics to enhance the accuracy and effectiveness of risk modeling.

A New Approach

ZestyAI’s Z-HAIL and Z-WIND models are specifically designed to address the challenges posed by severe convective storms. In a new retroactive case study, we explore the performance of these models on a carrier’s book of business over the prior five years, highlighting their effectiveness in delivering comprehensive coverage and precise risk segmentation.

Key findings from the case study include:

Comprehensive Coverage with High Accuracy

One of the standout results from the case study is the exceptional hit rate of 99.7% achieved by Z-HAIL and Z-WIND. This shows the models were able to accurately identify and assess the risk of severe convective storms for nearly all the properties in the carrier's portfolio.

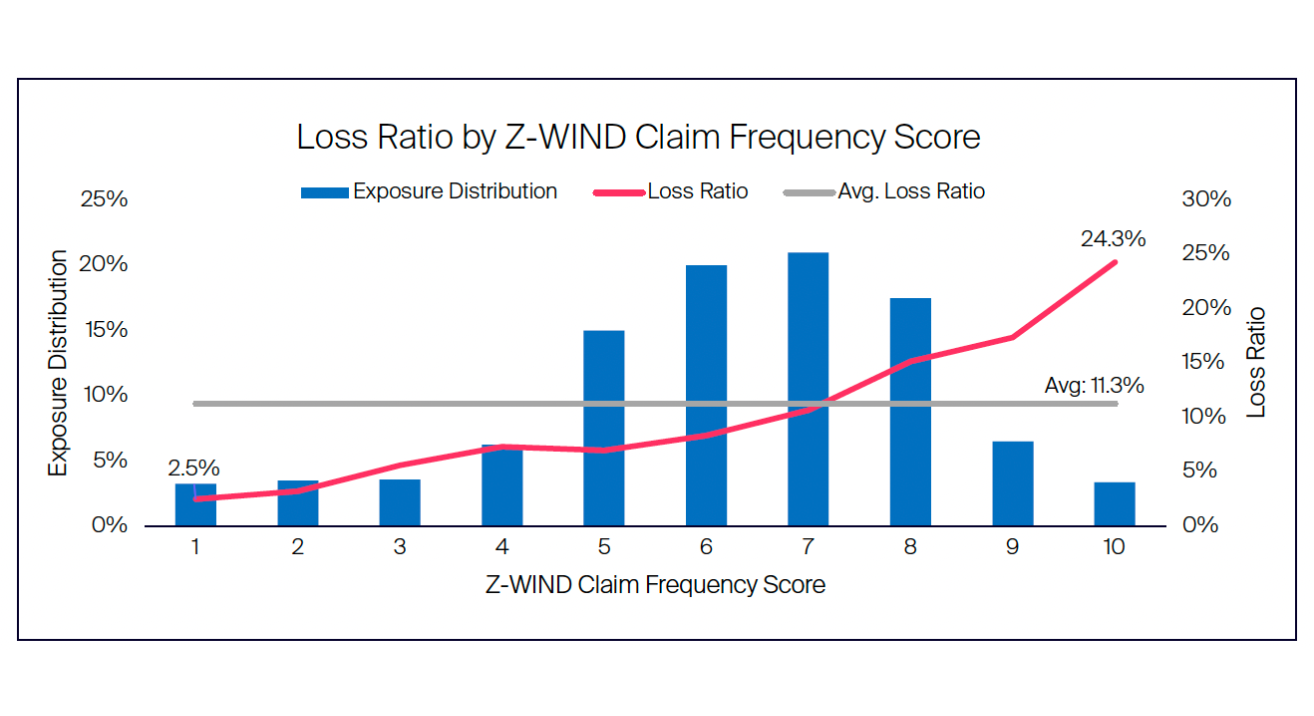

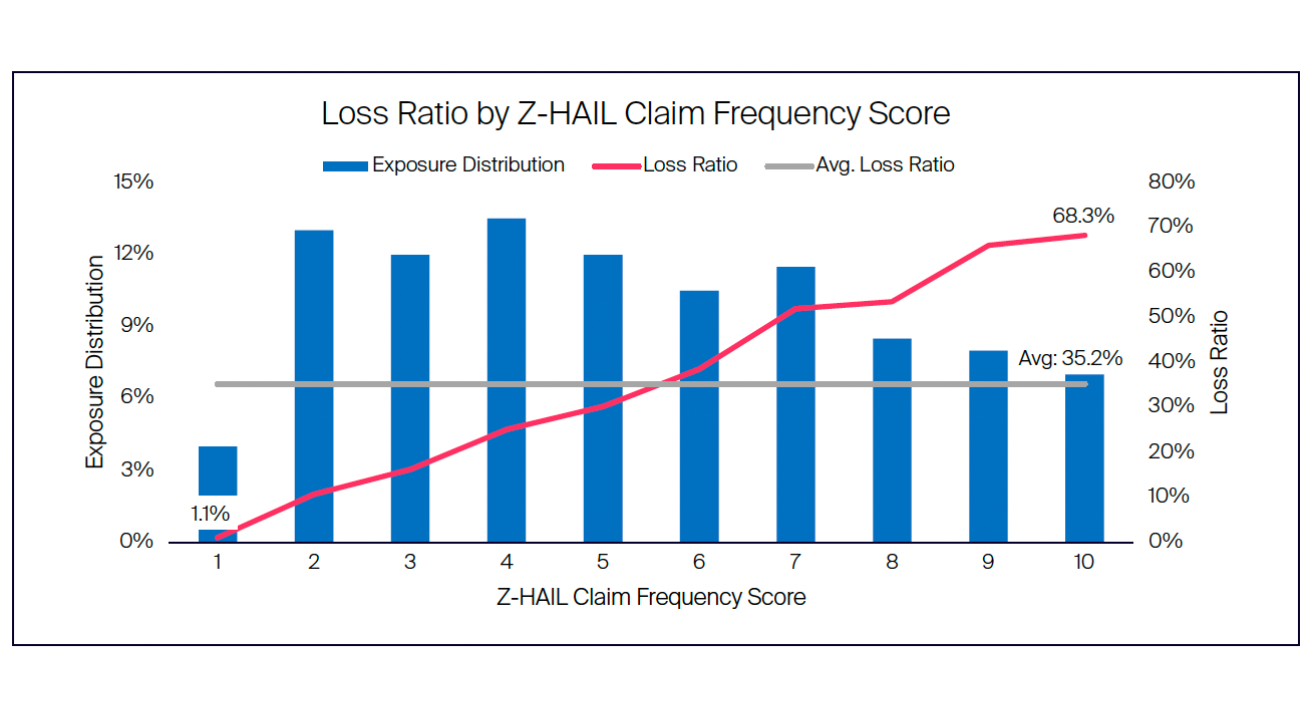

Strong Risk Segmentation

The models demonstrated remarkable capability in risk segmentation, with Z-HAIL generating a lift of 62X and Z-WIND achieving a lift of 9.7X. This means that the models were able to effectively differentiate between high-risk and low-risk properties, even within small geographic areas such as a single zip code. Accurate risk segmentation allows insurers to tailor their policies and pricing strategies more precisely, leading to better management of their risk exposure.

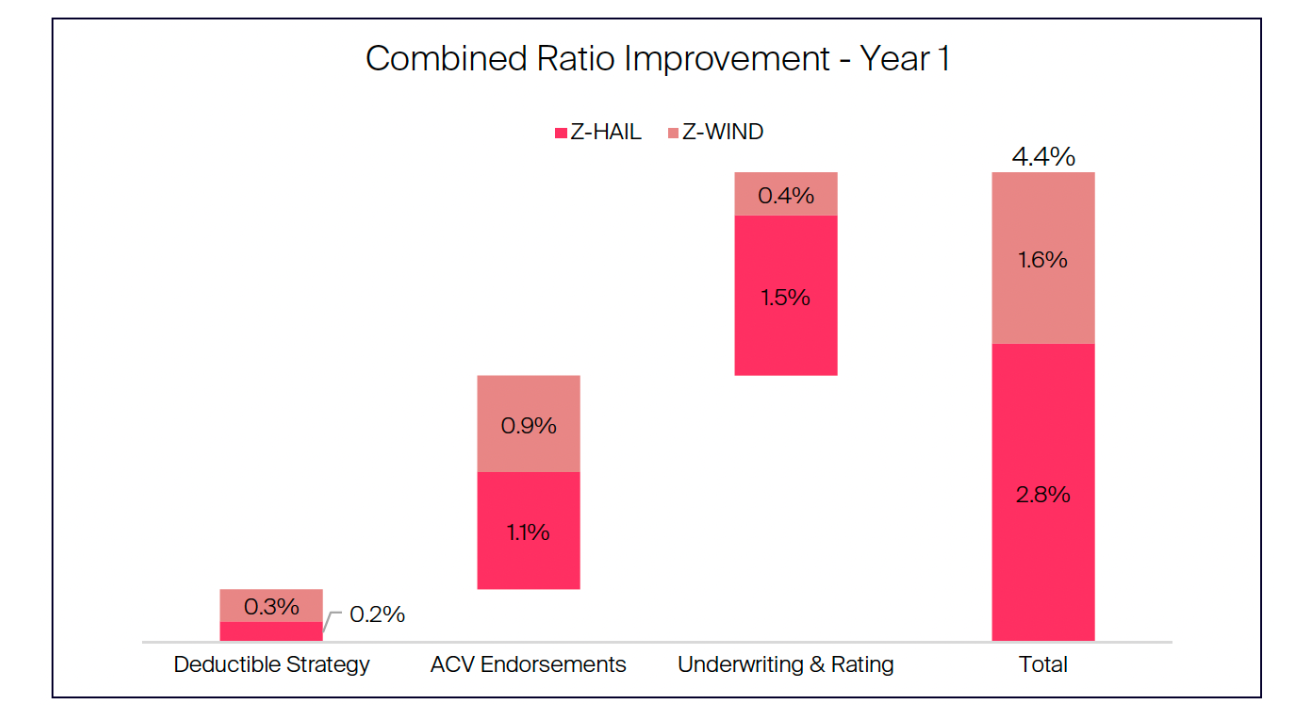

Improved Combined Ratio

Implementing Z-HAIL and Z-WIND would significantly enhance a carrier’s combined ratio, calculated to be approximately 4 points in the first year. This improvement can be attributed to the models’ ability to optimize underwriting, rating, and the application of deductibles and Actual Cash Value (ACV) endorsement strategies. By accurately assessing the risk and applying appropriate measures, insurers can reduce their loss ratios and improve overall profitability.

The Need for Innovative Solutions

As severe convective storms continue to pose significant challenges to the insurance industry, adopting innovative solutions like ZestyAI’s severe convective storm models can help insurers better manage this escalating risk.

These models provide comprehensive coverage, accurate risk segmentation, and improved financial performance. By embracing advanced technology and data-driven analytics, insurers can navigate the complexities of severe weather events and safeguard their portfolios against future losses.

To learn more about the detailed findings and benefits

Download the full case study.

What Sets ZestyAI Apart

Setting new standards in climate and property risk analytics

As part of our relentless focus on helping property and casualty insurers make smart risk decisions, every month I travel across the country to meet with insurance executives. One of the first questions I am asked is what sets ZestyAI apart from our competitors. I love being asked this question because it allows me the opportunity to share our passion for building an impactful company amidst the rapid technological transformation of the more than 650-year-old Property & Casualty (P&C) industry.

In my previous blog post, we delved into the origins of ZestyAI.

Now, let's explore what makes us stand out.

1. We Are a Risk Analytics Platform. Not an Aerial Imagery Data Company.

A Distinct Information Advantage

At ZestyAI, our primary focus is delivering comprehensive insights on climate and property risk for every residential and commercial property in the US. We are not just a data vendor; we are a risk analytics platform.

Our models create a distinct information advantage through their ability to split risk "intra-territory," which can not only help avoid risky policies, but more importantly price to risk allowing companies to grow with quality risk. This provides our clients with actionable insights that go beyond mere data points. Think about ZestyAI products as the FICO score for property and casualty insurance. Just as the FICO score, a measure of consumer credit risk, has become a fixture of consumer lending in the United States, ZestyAI’s peril models aim to simplify climate and property risk assessment for insurance carriers and mortgage lenders.

We are not just a data vendor; we are a risk analytics platform.

Our team of data scientists, deep learning and machine learning experts, and climate scientists are constantly refining and expanding our capabilities. This dynamic approach ensures that we stay at the forefront of technological advancements and deliver unparalleled value to our clients.

ZestyAI's Focus on Results

ZestyAI’s emphasis on data and artificial intelligence is not an end but a means to achieve the ultimate goal: improving risk management and pricing strategies for insurers. By focusing on the end results—better risk assessment and pricing—we ensure that our innovations translate into real-world benefits for our customers.

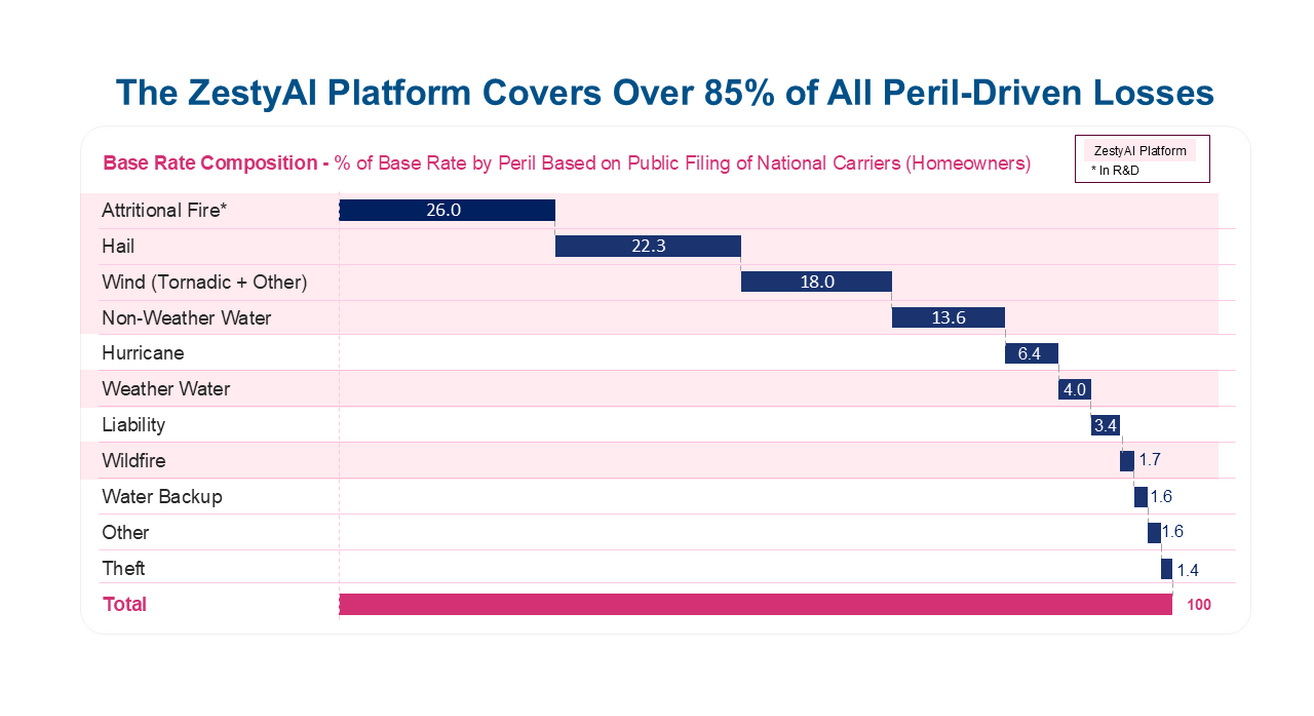

The powerful platform we have built provides, at an individual property level, a holistic view of the multitude of peril-specific risks that insurers face. This includes property intelligence for essential parcel, structure, and roof insights; climate models covering wildfire, wind, hail, and storms; and our most recent addition Z-WATER, tackling the challenge of interior water damage. This allows insurers to move from territory-based segmentation to a property-by-property risk assessment. In total, the ZestyAI platform covers over 85% of all peril-driven losses.

2. Built by Data Junkies for Data Junkies

The Depth and Breadth of Our Data Is Unmatched

While high-resolution imagery is an important component of our models, it is by no means the only input. ZestyAI stands out by integrating 200 billion data points across more than a dozen unique data sources that are new to the P&C industry to maximize risk differentiation. We extract insights from non-imagery data, such as building permits, property sales databases, tax assessment data, and localized weather stations, among others. This comprehensive approach allows us to create a unified and federated database for every property.

Unique Approach to Data

Our approach to imagery is also unique. ZestyAI products leverage satellite, aerial, and terrestrial imagery to create AI-generated 3D analysis of every structure. As for aerial imagery, we have been partnering with all leading providers and as such we have been training our models on multiple image sources for almost a decade. Having integrated with all major providers rather than relying on a single vendor also allows us to achieve a nearly 100% hit rate. This flexibility ensures that we have the most up-to-date and accurate data available, enhancing the precision of our models.

As for aerial imagery, we have been partnering with all leading providers and as such we have been training our models on multiple image sources for almost a decade.

By combining these diverse data sources and applying proven artificial intelligence to identify risk, such as roof quality, lot debris, and driveway condition, we provide insurers with a holistic view of property risks. This enables them to make more informed decisions for underwriting, rating, and portfolio management. This multi-faceted data integration is a key differentiator that sets ZestyAI apart from other data vendors in the industry.

3. We Live and Die by ROI and We Know How to Deliver It.

Industry Expertise and Customer Success

One of our strongest assets is our deep understanding of the insurance business and the key value drivers for carriers. We have built a team that includes former executives from leading carriers like Farmers, MetLife, and Progressive, and data analytics providers like CoreLogic, RMS and Guidewire, who bring invaluable industry expertise to our company.

“We have walked a mile in your shoes” is a phrase we often use when partnering with our customers. Because of this, we don't just throw data over the fence. Rather, we align our models and risk scores to key use cases, ensuring that they are relevant and actionable for our clients. Through our customer success program, we operationalize what each customer needs. We engage closely with our partners, working side-by-side to implement our models and monitor value capture. ZestyAI’s commitment to delivering 10X ROI is a cornerstone of our philosophy and sets us apart from those with a more transactional approach.

ZestyAI’s commitment to delivering 10X ROI is a cornerstone of our philosophy

Engagement with Regulators

Our deep engagement with regulators further underscores the company’s commitment to delivering value in the context of a highly regulated business. Despite initial skepticism from industry experts about the feasibility of getting an AI model approved, ZestyAI became the first to gain approval as part of a carrier rate filing from the California Department of Insurance (CDI).

Since then, our model has been adopted for rating in all wildfire-prone markets across the US, providing our clients with the confidence that our solutions are innovative, effective, and compliant. Similarly, our severe convective storm suite of models, including Z-HAIL, Z-WIND, and Z-STORM, have been filed, reviewed, and approved by regulators in multiple states across the country, including Texas, Colorado, and Illinois.

Protecting What Matters Most

At ZestyAI, our mission goes beyond just providing cutting-edge risk analytics—we are dedicated to protecting communities and livelihoods from the perils they face. By focusing on risk analytics, leveraging unique data sources, and drawing on deep industry expertise, we empower insurers to make smarter, more precise decisions that ultimately contribute to safer, more resilient communities.

Commitment to Transparency and Compliance

Our transparent approach, coupled with deep industry expertise, allows us to deliver unparalleled insights into property risk. We work closely with insurers to understand the factors driving risk at each property, enabling them to partner with homeowners to mitigate potential losses. Our commitment to transparency extends beyond our product. We maintain open communication with regulators to ensure our models align with evolving regulations. This rigorous approach guarantees that our solutions are not only innovative but also practical and effective in addressing real-world challenges.

Vision for the Future

As we continue to push the boundaries of what’s possible in risk management, our vision remains clear: to harness the power of data and AI to help our clients safeguard the future. Together, we are setting new standards in the P&C industry—standards that prioritize resilience, innovation, and above all, the well-being of the communities we serve.

Our vision remains clear: to harness the power of data and AI to help our clients safeguard the future.

Ah, and there is one more differentiator, probably the one that I am most proud of: at ZestyAI we don’t hire B-players or jerks. You will know what I mean once you meet our Zesties.

In our next post, I will explore how ZestyAI's relentless focus on value creation is driving a 10X ROI for our customers and making a meaningful difference in the world.

Now Streaming: Roof Risk Master Class

Effective strategies for better risk management

Are rising storm costs and inaccurate roof assessments impacting your bottom line?

Now available to stream, The Science of Roof Risk master class will equip you with the latest strategies and techniques to master roof risk assessment.

- Enhance your roof risk assessment by 60X

- Improve your combined ratio

- Reduce storm-related roof claims

- Strengthen new business selection

What we cover:

Your presenters, Ross Martin (VP, Risk Analytics) and Sam Fetchero (Head of Marketing) will share with you:

- The Problem of the Roof: Uncover the underlying factors driving rising storm losses and why traditional risk assessment methods fall short.

- The Science Behind Predicting Losses: Explore key factors impacting roof risk and loss prediction, including roof age, condition, complexity, and peril-specific models.

- Accuracy-focused Risk Models: Discover advanced modeling techniques that enhance predictive accuracy.

- Understanding Storm Climatology: Learn how storm climatology impacts roof risk and how to integrate these insights into your risk assessment strategies.

- Real-World Results: Witness a comparative analysis of these predictive factors using actual carrier data. Understand the strengths and weaknesses of each approach.

- Priorities of Leading P&C Insurers:

See what your peers asked with valuable insights to take back to your team.

Who Should Watch?

This video is ideal for Executives, Product Managers, Actuaries, Underwriters, and CAT Modelers committed to enhancing their roof risk assessment capabilities.

Bonus Guide

As a bonus for watching, you'll receive a downloadable study on the latest roof risk assessment strategies: Preparing for the Storm: The Insurers Guide to Roof Risk.

Access Now

Exclusive Webinar: Mitigating Non-Weather Water Risk

New strategies to turn off the tap on insurance losses

From Costly Water Losses to Millions in Savings

Non-weather water claims are a leading cause of property insurance losses, costing insurers over $20 billion annually.

Join us for a FREE live webinar where our experts will discuss the latest trends, challenges, and insights to help you mitigate non-weather water risk.

What We'll Cover

Our experts Rob Silva, ACAS (Director of Customer Success) & Sam Fetchero (Head of Marketing) will present:

- Current Trends: Understand the rise in severity and total loss costs of non-weather water claims.

- Risk Assessment Challenges: Learn why traditional methods fall short in assessing non-weather water vulnerability.

- Key Risk Factors: Identify the main drivers of non-weather water damage.

- Strategic Insights: Discover strategies to improve your management of non-weather water claims.

- Z-WATER in Action: Experience our new AI-powered model that predicts non-weather water risk with unparalleled accuracy.

- Interactive Q&A: Get your questions answered by our experts.

Who Should Attend

This webinar is ideal for Executives, Product Managers, Actuaries, Underwriters, and CAT Modelers committed to enhancing their understanding and management of non-weather water risks.

Bonus Content

As a bonus, you'll receive our exclusive infographic, "Below the Surface: Research Reveals Knowledge Gap in Homeowner Water Loss Prevention and Coverage."

This research gives key insights into water loss experiences, coverage details, homeowner protection measures, and information on water shutoff devices and heater conditions.

Register Now

See How Insights Turn Into Decisions

ZestyAI transforms data into action. Get a demo to see how the same AI powering our reports helps carriers make faster, smarter, regulator-ready decisions.