Reports & Research

Explore proprietary research packed with data, insights, and real-world findings to help carriers make smarter decisions.

The Truth About Roof Age: 5 Critical Insights Every Insurer Should Know

For insurers, accurate roof age data is essential. Yet, self-reported information often falls short.

Our research shows that 1 in 5 homeowners underreport roof age by an average of 8 years. These discrepancies create hidden risks that can impact underwriting, pricing, and overall portfolio performance.

How can insurers get a more accurate picture?

AI-driven insights provide 97% nationwide coverage, combining verified roof age with real-time condition data for a more comprehensive risk assessment.

Download our latest research for a breakdown of five critical insights that every insurer should know about roof age.

Plus, get access to The Roof Age Advantage, an exclusive video that unveils how AI is setting a new standard for risk evaluation.

Now Streaming: Navigating California's Evolving Insurance Landscape

The California Department of Insurance (CDI) has introduced significant updates as part of its Sustainable Insurance Strategy. These new bulletins and draft regulations aim to accelerate regulatory approvals, embrace forward-looking models, and address critical reinsurance challenges.

But what do these changes mean for insurance carriers—and how can you prepare?

On January 29, 2025, we hosted a webinar, California’s Evolving Insurance Landscape: The Future of Insurance in the Golden State.

Designed for Legal & Compliance professionals, Product Managers, Underwriters, Actuaries, and Risk & Innovation leaders, the discussion featured expert insights from:

- Michael Peterson, Deputy Commissioner of Climate & Sustainability, California Department of Insurance

- Karen Collins, VP, Property & Environmental, APCIA

- Bryan Rehor, Head of Regulatory Affairs, ZestyAI

Missed the live event but want to gain actionable insights from industry leaders at the forefront of California’s insurance evolution? Watch on demand now!

Webinar: Regulatory Ready - How to Use AI Responsibly in Insurance

Gain a deeper understanding of the NAIC bulletin's principle-based approach to AI regulation and what it means for carriers.

Regulatory Ready: How to Use AI Responsibly in Insurance Under the NAIC Bulletin

AI innovation is revolutionizing the insurance industry, but with these advancements come new regulatory challenges. To ensure responsible use of AI in insurance, it’s essential to stay informed about the latest regulatory frameworks.

Join us on November 13 at 11 PT / 2 ET for an exclusive webinar where we’ll break down how to navigate AI regulations under the NAIC Model Bulletin.

In this session, led by

- Kevin Gaffney, Vermont’s Commissioner of Financial Regulation and Chair of the NAIC’s Innovation & Tech Committee

- Bryan Rehor, Director of Regulatory Strategy at ZestyAI

you'll gain critical insights on how to align AI usage with evolving regulatory expectations.

What You’ll Learn

This webinar will provide practical takeaways that can help insurance professionals understand and comply with the latest AI standards:

- NAIC Model Bulletin Overview: Understand the core principles behind the NAIC’s AI regulation framework.

- Ensuring AI Compliance: Learn how to ensure responsible AI usage according to NAIC standards.

- Preparing for Regulatory Oversight: Get ready for closer state-level inspections and regulatory scrutiny.

- Vendor & Partner Compliance: Ensure that your partners meet regulatory requirements for transparency and fairness.

- Interactive Q&A: Take advantage of the opportunity to ask our experts about the complex world of AI and insurance compliance.

Meet the Experts

Kevin Gaffney

Vermont Commissioner of Financial Regulation

As an expert in AI regulations and the NAIC’s Model Bulletin, Commissioner Gaffney will provide key insights into how insurance companies can effectively implement responsible AI practices. His experience in overseeing state-level financial regulation will offer attendees a unique perspective on aligning AI innovation with compliance.

Bryan Rehor

Director of Regulatory Strategy at ZestyAI

Bryan Rehor will offer practical advice on maintaining AI compliance while harnessing the full potential of AI innovation. His expertise lies in guiding insurers through regulatory demands, ensuring that AI practices meet industry standards while avoiding common pitfalls.

Why You Should Attend

This webinar is tailored for professionals in insurance, particularly those in Executive, Legal, Compliance, Product Management, Underwriting, Actuarial, Risk, and Innovation roles.

Whether you’re navigating the complexities of AI regulation or preparing for the next steps in compliance, this session will provide actionable insights to help you move forward confidently.

Bonus Content

By registering for the webinar, you’ll receive our interactive guide:

“When Innovation & Regulation Meet: What Insurers Need to Know About AI and Regulatory Compliance.”

This resource will deepen your understanding of how to stay compliant while leveraging the power of AI in your insurance operations.

Don’t miss out!

Register for the webinar and ensure your spot in this exclusive event.

.png)

The State of the Industry: AI Adoption in Climate Risk Management

A survey of insurance professionals highlights AI models gaining traction, key insurer priorities, and the impact of transparency and regulatory concerns.

Facing Unprecedented Climate Challenges

The insurance industry is facing unprecedented challenges as natural catastrophic events like convective storms and wildfires become more frequent and severe. Traditional risk models, which often rely on broad territory-based segmentation, are struggling to keep up with these dynamic environmental threats. This has led to significant financial losses for insurers, who are now seeking more accurate and proactive methods to predict and manage climate risk.

AI Adoption in Property and Casualty Insurance

To shed light on the adoption of these cutting-edge techniques, ZestyAI conducted a survey of over 200 executives in the Property and Casualty (P&C) insurance sector. The survey reveals which AI-based models are gaining traction, what features insurers prioritize, and how transparency and regulatory concerns are shaping the industry. It also highlights the specific risks that are top of mind for carriers today.

AI Transforming Risk Assessment Models

The industry is turning to AI-based risk assessment models that offer a new level of precision. Companies like ZestyAI are leading the charge, providing tools that enable insurers to assess risk on a property-by-property basis, considering both individual property features and their interaction with surrounding environmental factors. These advanced models are transforming the way insurers underwrite policies, optimize portfolios, and align coverage with actual needs.

Dive deeper into our findings and explore the full report by clicking below.

Access the Report

Case Study: Adapting to Escalating Severe Convective Storm Risk

Insights from a 5-year retrospective on ZestyAI’s models in action

The Rising Threat of Severe Convective Storms

The past few decades have seen a dramatic rise in the frequency and intensity of severe convective storms, resulting in significant financial repercussions for the insurance industry. In the last year alone, insured losses from severe convective storms reached an astounding $60 billion, marking an average annual growth rate of over 11% over the past twenty years. This alarming trend means a new approach is needed to manage and mitigate the escalating risks associated with severe weather events.

In the last year alone, insured losses from severe convective storms reached an astounding $60B, marking an average annual growth rate of over 11% over the past twenty years.

The traditional methods of risk assessment and management are no longer sufficient to cope with the increasing unpredictability and severity of these weather events. As the risk evolves, so must the solutions. Changing risks call for innovative solutions that leverage advanced technology and data analytics to enhance the accuracy and effectiveness of risk modeling.

A New Approach

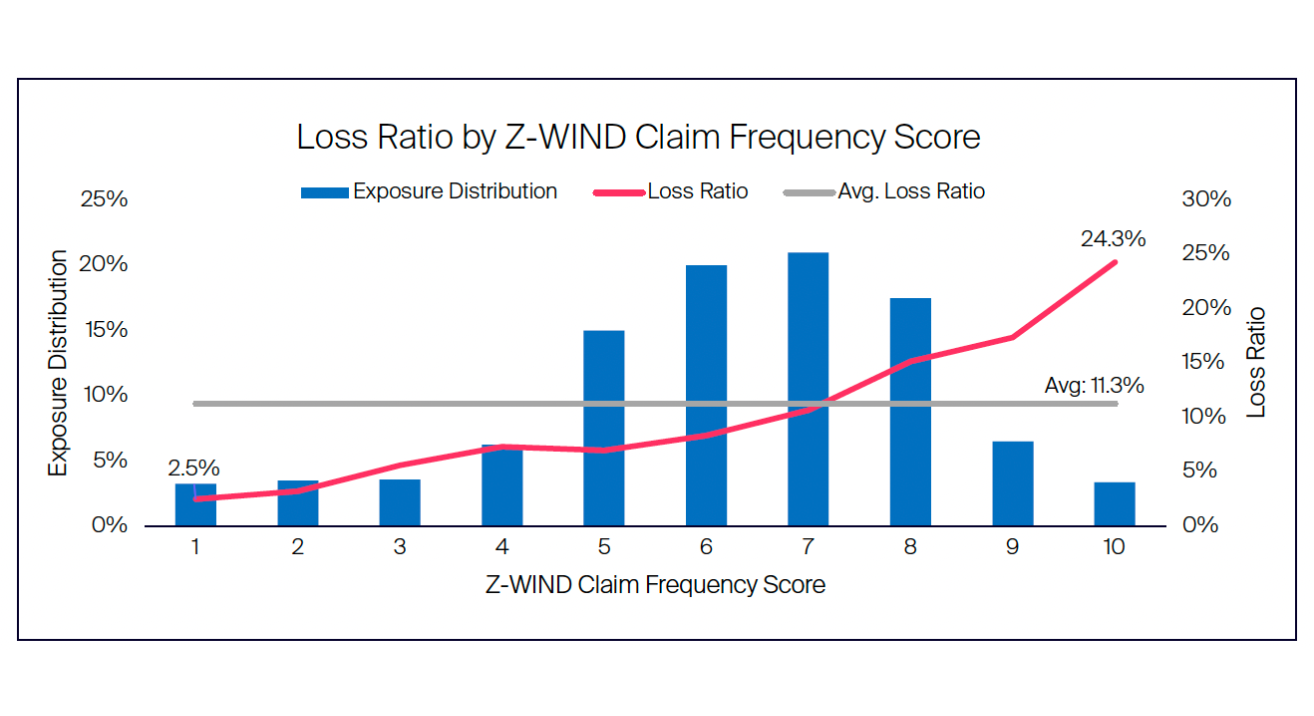

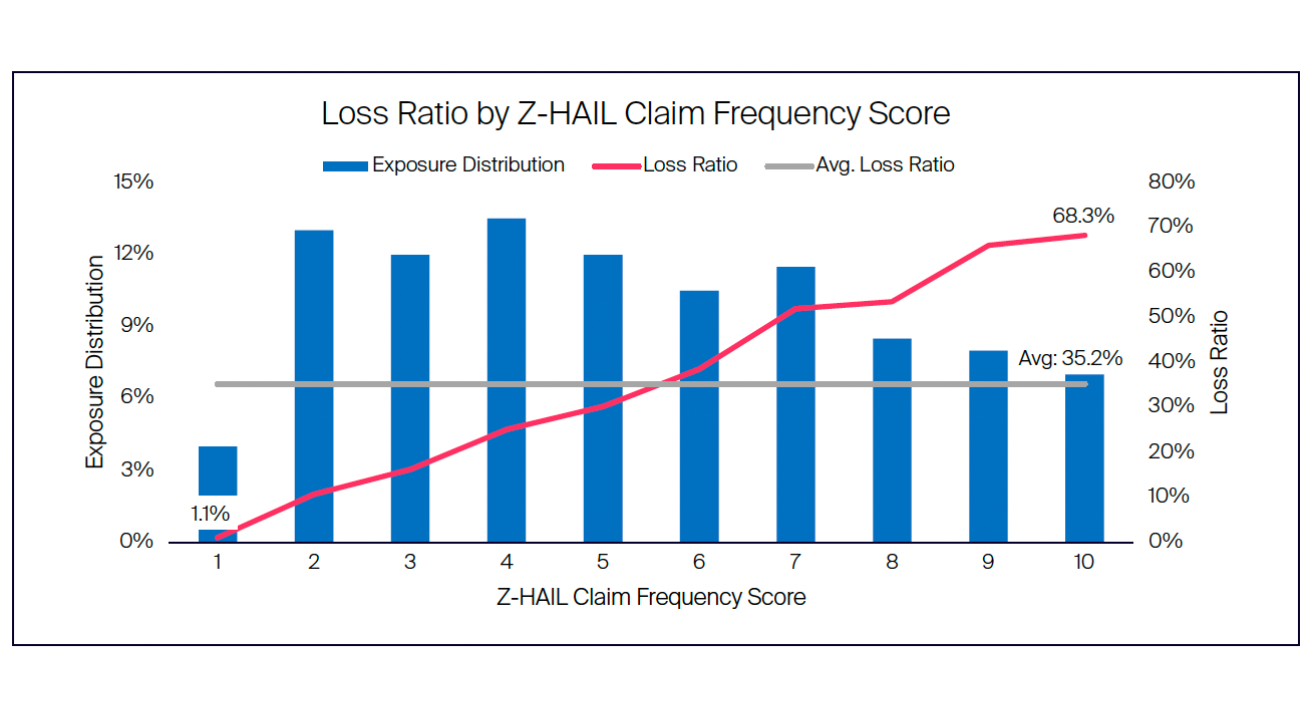

ZestyAI’s Z-HAIL and Z-WIND models are specifically designed to address the challenges posed by severe convective storms. In a new retroactive case study, we explore the performance of these models on a carrier’s book of business over the prior five years, highlighting their effectiveness in delivering comprehensive coverage and precise risk segmentation.

Key findings from the case study include:

Comprehensive Coverage with High Accuracy

One of the standout results from the case study is the exceptional hit rate of 99.7% achieved by Z-HAIL and Z-WIND. This shows the models were able to accurately identify and assess the risk of severe convective storms for nearly all the properties in the carrier's portfolio.

Strong Risk Segmentation

The models demonstrated remarkable capability in risk segmentation, with Z-HAIL generating a lift of 62X and Z-WIND achieving a lift of 9.7X. This means that the models were able to effectively differentiate between high-risk and low-risk properties, even within small geographic areas such as a single zip code. Accurate risk segmentation allows insurers to tailor their policies and pricing strategies more precisely, leading to better management of their risk exposure.

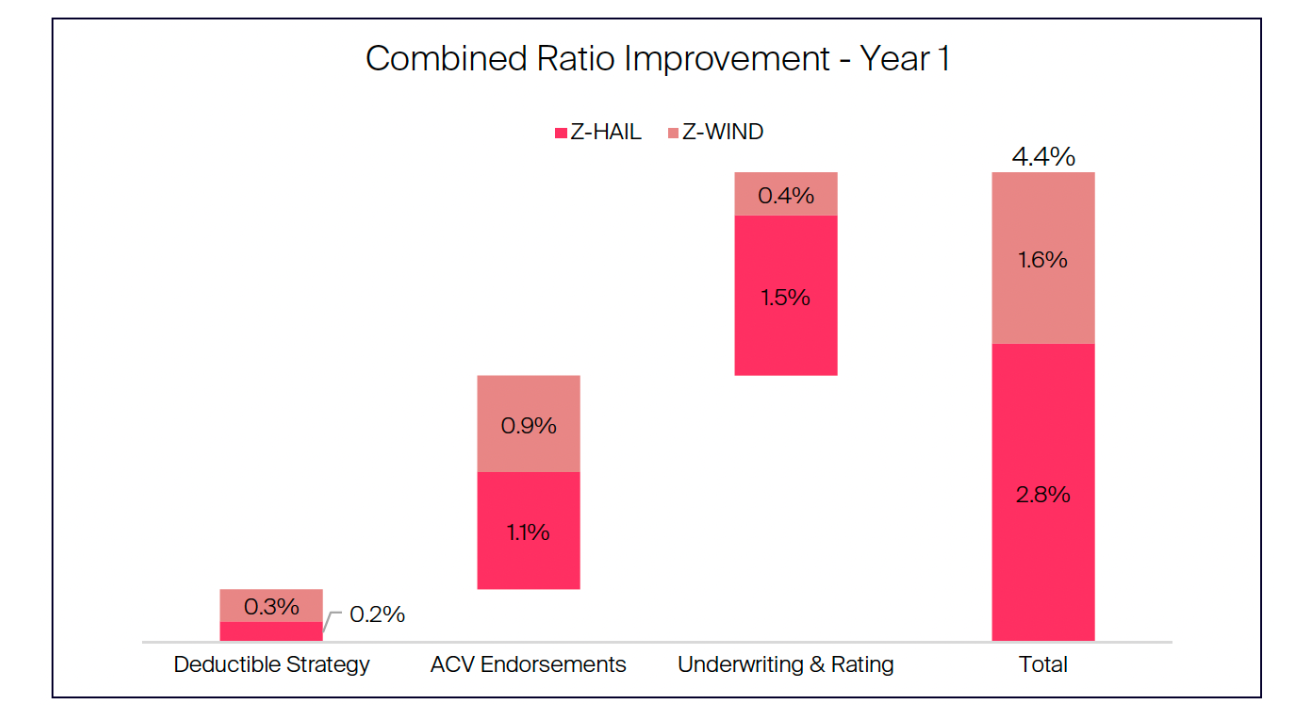

Improved Combined Ratio

Implementing Z-HAIL and Z-WIND would significantly enhance a carrier’s combined ratio, calculated to be approximately 4 points in the first year. This improvement can be attributed to the models’ ability to optimize underwriting, rating, and the application of deductibles and Actual Cash Value (ACV) endorsement strategies. By accurately assessing the risk and applying appropriate measures, insurers can reduce their loss ratios and improve overall profitability.

The Need for Innovative Solutions

As severe convective storms continue to pose significant challenges to the insurance industry, adopting innovative solutions like ZestyAI’s severe convective storm models can help insurers better manage this escalating risk.

These models provide comprehensive coverage, accurate risk segmentation, and improved financial performance. By embracing advanced technology and data-driven analytics, insurers can navigate the complexities of severe weather events and safeguard their portfolios against future losses.

To learn more about the detailed findings and benefits

Download the full case study.

Now Streaming: Roof Risk Master Class

Effective strategies for better risk management

Are rising storm costs and inaccurate roof assessments impacting your bottom line?

Now available to stream, The Science of Roof Risk master class will equip you with the latest strategies and techniques to master roof risk assessment.

- Enhance your roof risk assessment by 60X

- Improve your combined ratio

- Reduce storm-related roof claims

- Strengthen new business selection

What we cover:

Your presenters, Ross Martin (VP, Risk Analytics) and Sam Fetchero (Head of Marketing) will share with you:

- The Problem of the Roof: Uncover the underlying factors driving rising storm losses and why traditional risk assessment methods fall short.

- The Science Behind Predicting Losses: Explore key factors impacting roof risk and loss prediction, including roof age, condition, complexity, and peril-specific models.

- Accuracy-focused Risk Models: Discover advanced modeling techniques that enhance predictive accuracy.

- Understanding Storm Climatology: Learn how storm climatology impacts roof risk and how to integrate these insights into your risk assessment strategies.

- Real-World Results: Witness a comparative analysis of these predictive factors using actual carrier data. Understand the strengths and weaknesses of each approach.

- Priorities of Leading P&C Insurers:

See what your peers asked with valuable insights to take back to your team.

Who Should Watch?

This video is ideal for Executives, Product Managers, Actuaries, Underwriters, and CAT Modelers committed to enhancing their roof risk assessment capabilities.

Bonus Guide

As a bonus for watching, you'll receive a downloadable study on the latest roof risk assessment strategies: Preparing for the Storm: The Insurers Guide to Roof Risk.

Access Now

A ZestyAI Refresher: Timeless Insurance Meets Trustworthy AI

New to ZestyAI or need a refresher? Learn why nearly half of the top 100 U.S. insurers rely on our AI-powered platform to revolutionize property and climate risk management.

Who We Are: Revolutionizing Risk Management with AI

ZestyAI is the leading property and climate risk platform, leveraging advanced AI and data science to provide property-level risk insights to insurers across the United States. Our mission is to redefine how insurers assess and manage risk while fostering a healthier, more sustainable, and more affordable insurance market.

At its core, ZestyAI empowers carriers to assess risk with unmatched precision, aligning premiums with actual property-level data. Our data-driven recommendations help insurers improve underwriting, streamline operations, and optimize portfolios—all while ensuring transparency and regulatory compliance.

ZestyAI’s solutions are rigorously validated by state departments of insurance, including in California, Texas, and Colorado. Our wildfire risk model became the first to gain approval as part of a carrier rate filing from the California Department of Insurance (CDI), setting a benchmark for the responsible adoption of AI in the industry.

With over 200 billion data points analyzed and nearly 100% aerial imagery coverage across the contiguous U.S., ZestyAI transforms vast amounts of data into actionable intelligence. From roof conditions to vegetation density, our platform enables insurers to reduce loss ratios, improve profitability, and increase the availability of insurance to underserved markets.

Proven Performance in the Toughest Conditions

ZestyAI's AI models have been tested and trusted under the industry’s most challenging scenarios:

- Z-FIRE™: The gold standard for wildfire risk, adopted across all wildfire-prone markets in the U.S.

- Z-HAIL™: Predicts hail claim frequency and severity with up to 58X greater accuracy than traditional models, as validated by IBHS research.

- Z-WIND™ and Z-STORM™: Deliver granular risk assessments for wind and storm frequency and severity, with regulatory approval across several states.

- Z-WATER™: Our newest model predicts non-weather-related water damage claims using insights from property construction, local water systems, and environmental factors.

Powered by 30+ proprietary computer vision algorithms, our peril-specific models provide carriers with the flexibility to use ZestyAI’s risk scores or integrate detailed property insights directly into their own workflows.

The Origin of ZestyAI: A Bold Pivot

ZestyAI’s journey began not in insurance, but in clean energy. Founded as Powerscout, we made a pivotal shift in 2017 when the devastating California wildfires revealed a critical gap in how insurers assess risk. Recognizing the potential of our imagery and AI models to become a lifeline for carriers and communities alike, we refocused our mission. By 2018, ZestyAI was born, dedicated to revolutionizing insurance through AI-driven insights.

Why ZestyAI?

Today, our platform empowers carriers to achieve transformative outcomes:

- Set Precise Rates: Move beyond broad territory-based pricing to property-level assessments, attracting low-risk customers with precision pricing while helping high-risk properties mitigate exposure.

- Enhance Risk Selection: Leverage comprehensive risk profiles for smarter underwriting, optimizing combined ratios and profitability.

- Improve Product Fit: Tailor coverage options with appropriate deductibles and endorsements, reducing losses and improving customer satisfaction.

- Optimize Inspections: Direct resources to properties that need attention, reducing unnecessary on-site inspections and cutting costs.

- Streamline Operations: Automate approvals for low-risk properties, freeing underwriting teams to focus on complex cases.

- Optimize Portfolios: Reassess books of business to identify accumulated risks and adjust premiums or coverage based on real-time data.

At the heart of these capabilities is our commitment to delivering a 10X return on investment (ROI) for our customers. By combining precise risk assessment with actionable insights, ZestyAI helps carriers achieve measurable results.

Building a Healthier Insurance Ecosystem

ZestyAI’s impact extends beyond carriers—we’re reshaping the insurance ecosystem to be more accessible, equitable, and efficient.

- Fair Pricing: Align premiums with actual risk to attract low-risk customers while offering guidance for mitigating high-risk exposures.

- Proactive Risk Mitigation: Empower policyholders with tailored guidance, like improving roof conditions or clearing vegetation, to reduce exposure.

- Operational Efficiency: Streamline processes to lower costs and focus resources on the most impactful areas.

Leading the AI Revolution in Insurance

As climate risks grow more intense, insurers must adopt innovative tools to assess and mitigate these challenges. ZestyAI is at the forefront of this transformation, enabling carriers to not only adapt but thrive in an evolving market.

The future of insurance lies in AI-driven precision, and with ZestyAI, that future is already here.

Schedule a demo today to see how ZestyAI can transform your risk strategy in 2025.

2024 in Review

As we close out 2024, we’re taking a moment to reflect on a year defined by deeper partnerships, relentless innovation, and measurable progress in the insurance industry.

Watch the video message from our CEO, Attila Toth, to learn more about the milestones we achieved and what’s next for ZestyAI.

Strengthening Relationships

This year, we deepened our collaborations with existing partners and welcomed new customers across the country. Nearly half of the top 100 insurance carriers now trust ZestyAI to deliver precise, AI-driven insights that enhance underwriting, streamline operations, and address emerging risks in high-peril areas.

Innovation That Delivers Value

At ZestyAI, innovation is never just for its own sake—it’s about delivering actionable value that solves real-world challenges. In 2024, we launched:

- Z-WATER™: Our new model that predicts non-weather-related water damage claims, helping carriers identify and mitigate this growing risk.

- Roof Age: Leveraging historical imagery and building permit data to provide accurate roof condition insights for better underwriting and risk management.

We also delivered substantial enhancements to Z-PROPERTY™, our leading property insights platform:

- Increased Coverage and Improved Hit Rates: Ensuring more comprehensive and reliable property assessments.

- New Features: Including driveway condition insights and support for multi-structure properties, enabling insurers to prioritize resources and streamline inspections.

Tremendous Regulatory Momentum

This year brought significant progress in regulatory approvals, further validating ZestyAI’s solutions in key markets like California, Texas, and Colorado. Our models continue to set a benchmark for responsible AI adoption, ensuring insurers can confidently integrate advanced property risk insights into their workflows.

Delivering Performance Across Perils

ZestyAI’s AI-powered models continued to prove their value under the industry’s most challenging conditions:

- Z-FIRE™: Recognized as the gold standard for wildfire risk across the U.S.

- Z-HAIL™: Predicting hail claim frequency and severity with up to 58 times greater accuracy than traditional models.

- Z-WIND™ and Z-STORM™: Delivering granular risk assessments for wind and storm-related risks.

These innovations are helping insurers reduce loss ratios, improve profitability, and ensure coverage availability where it’s needed most.

Looking Ahead to 2025

As we move into the new year, ZestyAI remains committed to revolutionizing risk management through AI-driven precision and proven performance. We will continue to help insurers navigate emerging challenges, drive efficiency, and build a more resilient future for their policyholders.

From all of us at ZestyAI, thank you for being part of this journey. Wishing you a wonderful holiday season and a successful year ahead.

Now Streaming: Navigating California's Evolving Insurance Landscape

The California Department of Insurance (CDI) has introduced significant updates as part of its Sustainable Insurance Strategy. These new bulletins and draft regulations aim to accelerate regulatory approvals, embrace forward-looking models, and address critical reinsurance challenges.

But what do these changes mean for insurance carriers—and how can you prepare?

On January 29, 2025, we hosted a webinar, California’s Evolving Insurance Landscape: The Future of Insurance in the Golden State.

Designed for Legal & Compliance professionals, Product Managers, Underwriters, Actuaries, and Risk & Innovation leaders, the discussion featured expert insights from:

- Michael Peterson, Deputy Commissioner of Climate & Sustainability, California Department of Insurance

- Karen Collins, VP, Property & Environmental, APCIA

- Bryan Rehor, Head of Regulatory Affairs, ZestyAI

Missed the live event but want to gain actionable insights from industry leaders at the forefront of California’s insurance evolution? Watch on demand now!

ZestyAI’s Severe Convective Storm Models Receive Regulatory Approval in Iowa

Regulatory approval empowers Iowa insurers to tackle rising storm losses with AI-powered property risk models.

ZestyAI, the leading provider of AI-powered climate and property risk analytics solutions, has received regulatory approval from the Iowa Insurance Division for its Severe Convective Storm suite, including Z-HAIL, Z-WIND, and Z-STORM.

This approval marks a critical milestone in helping insurers address the growing challenges posed by severe weather in one of the Midwest’s most storm-affected states.

In 2024, Iowa experienced five billion-dollar severe weather events, with hailstorms driving billions in damages and insurance losses. In one instance, a hailstorm caused $2.4 billion in damage, underscoring the urgent need for innovative tools to assess and manage storm-related risks.

ZestyAI’s Severe Convective Storm suite delivers property-specific risk assessments, enabling insurers to predict and mitigate extreme weather impacts with precision. Designed with regulatory compliance at its core, Z-HAIL is validated using actual loss data and provides a clear breakdown of the top three risk drivers for each score. This transparency empowers insurers to make informed decisions and share actionable insights with policyholders.

By analyzing climatology, geography, and building characteristics, ZestyAI equips insurers to identify high-risk properties, allocate resources strategically, and encourage proactive risk-reduction measures among policyholders.

"This approval empowers our carrier partners to act quickly and confidently in addressing Iowa’s severe weather challenges," said Bryan Rehor, Director of Regulatory Affairs at ZestyAI.

"By streamlining subsequent filings, we help insurers save time and resources, ultimately making high-quality property insurance more accessible to Iowa homeowners."

ZestyAI’s Severe Convective Storm suite has already received approvals in other key hail belt states, including Texas, Colorado, Illinois and Indiana, with additional filings in progress. These models enable insurers to move beyond reactive damage assessments, improving their ability to assess and manage storm-related risks at a granular, property-specific level.

With this approval, ZestyAI continues to lead the charge in equipping insurers with the tools they need to navigate an era of climate uncertainty, ensuring communities and insurers alike can better weather the storm.

Redesigning Our ML Infrastructure: 50% Faster APIs and 10x the Data Processing Power

Discover How the 'Monster Pod' Revolutionized Our Approach to Scaling Machine Learning Models.

Scaling a complex system of machine learning models while delivering real-time insights is no small feat. ZestyAI’s engineering team reimagined its architecture to overcome these challenges, leveraging NVIDIA’s Triton Inference Server and introducing the “Monster Pod.” This transformation halved API response times, increased throughput by 10x, and cut cloud costs by 75%. Dive into how strategic experimentation and innovative design unlocked efficiency and positioned ZestyAI for future growth.

By Andrew Merski, VP, Engineering

The Challenge: A Complex and Scaling System

Business Context

At ZestyAI, we deliver critical insights to insurance clients using machine learning models. Our API processes a significant volume of data, including imagery, geolocation, and structured data, to produce real-time results. The complexity of each request places immense demands on our infrastructure:

- Synchronous API Calls: Each request must be processed in real-time, with all insights delivered back to the client in a single response. Low latency is non-negotiable, as our clients’ workflows rely on immediate feedback.

- Multiple ML Models Per Request: Each request may invoke up to 30 ML models, ranging from computer vision models analyzing aerial imagery to models synthesizing geospatial and tabular data.

- Growing Model Catalog: The catalog of ML models we deploy continues to expand, driven by both customer needs and internal innovation. Each new model adds additional complexity to the system.

- Exceptional Reliability: Our clients in the insurance sector demand a system that operates flawlessly, with uptime and accuracy critical to their decision-making processes.

Previous Architecture: A Decentralized Model

In our previous system, each ML model operated as an independent microservice. Each model scaled independently, and each instance required its own GPU. While functional, this architecture introduced critical issues:

- Resource Underutilization: GPUs were underutilized, with non-GPU tasks consuming significant time.

- Scaling Challenges: Periods of high API traffic put additional strain on system components, leading to some inefficiencies.

- Capacity Limitations: The previous architecture had constraints that limited scalability, which could have restricted future growth.

This architecture also resulted in significant operational complexity. Each model’s independent deployment meant substantial manual effort in testing, scaling, and troubleshooting. Cloud costs also escalated rapidly as new models were added, creating diminishing returns for each improvement in service quality.

The Solution: A Centralized Architecture with Triton

Faced with scaling challenges and rising customer demand, we reimagined the entire architecture. At the heart of the solution was NVIDIA’s Triton Inference Server, a tool designed for efficient multi-model serving.

Why Triton?

Triton enabled:

- Shared GPU resources across models.

- Ensemble models to define workflows using configuration rather than code.

- Extensive benchmarking tools for performance optimization.

- Support for various backends, including Python and Pytorch.

However, Triton required significant investment in layers of customization to meet our needs. Its low-level interface and lack of native autoscaling demanded a tailored implementation.

New Architecture: The Monster Pod

To maximize Triton’s potential, we introduced the “Monster Pod,” consolidating all models and supporting microservices into a single Kubernetes pod. Key features included:

- Single-host model serving: All models resided in a unified Triton instance.

- Integrated workflow management: The workflow orchestrator and other microservices were co-located with Triton.

- Streamlined scaling: Each pod functioned as an independent unit, simplifying horizontal scaling.

This “Monster Pod” approach offered numerous benefits:

Improved Resource Utilization

- Maximized GPU usage by serving multiple models per instance.

- Reduced the overhead associated with multiple nodes and microservices.

Simplified Testing and Benchmarking

- Each pod contained all necessary components, enabling comprehensive testing in isolation.

- Benchmarking provided clear insights into throughput and resource requirements.

Reduced Scaling Overhead

- Eliminated dependency on Istio for internal traffic management.

- Simplified node provisioning and scheduling.

Predictable Costs

- Each pod corresponds to a fixed node cost, allowing accurate cost planning.

Lessons Learned

This project revealed critical insights that extend beyond Triton or even ML systems:

1. The "Microservices vs. Monolith" Debate Isn’t Binary

Architectural decisions don’t have to be all-or-nothing. For instance, while our deployment consolidated models into a single pod, we retained microservices for other aspects of the platform. Evaluating “single vs. many” decisions at multiple levels allowed us to optimize each layer independently.

2. Understand the Bottlenecks Before Designing Solutions

Identifying the root causes of inefficiency—scaling overhead, resource underutilization, network traffic—helped us design a system that addressed these challenges holistically rather than incrementally.

3. The Power of Consolidation

Integrating multiple components into a single deployment reduced complexity, improved performance, and simplified scaling. This approach may not suit every scenario, but in our case, it delivered transformative results.

4. Be Open to Temporary Solutions (Flexibility Leads to Innovation)

The “Monster Pod” started as a quick workaround but became a permanent fixture due to its outsized impact. Being open to experimentation unlocked unexpected benefits, such as easier resource planning and reduced operational complexity.

Business Impact

Rebuilding our ML inference platform was a bold move that paid off. The new architecture produced dramatic improvements across key metrics:

- Latency: API response times were halved.

- Capacity: System throughput increased by 10x, eliminating the previous capacity ceiling.

- Cost Efficiency: Cloud costs for model serving dropped by 75%.

These gains position us to scale with growing demand while maintaining industry-leading performance. Additionally, the simplified architecture has freed up engineering resources to focus on innovation rather than maintenance.

While Triton Inference Server played a critical role, the real success lay in our architectural decisions and willingness to rethink the status quo. This project underscores the value of experimentation and the importance of tailoring solutions to meet unique challenges.

The lessons learned from this journey will continue to inform our approach to system design and scalability as we look ahead. The Monster Pod has not only transformed our current capabilities—but has also set the stage for future growth and innovation.

For a deeper dive into the technical details, check out Andrew Merski’s original blog on Medium.

ZestyAI Earns Top Recognition in Insurance Tech and Climate Risk

In an industry as established and thoughtful as insurance, bold innovation isn’t always easy to come by. ZestyAI is working to change that by integrating artificial intelligence into the core of how insurers manage risk, optimize pricing, and drive growth.

We are honored to receive two recognitions this year, highlighting the growing role of technology in driving meaningful progress and affirm our commitment to being a trusted partner for property insurers navigating an ever-evolving landscape

Leading the Way in P&C Insurance Technology

ZestyAI has been named one of the Everest Group’s Leading 50™ Property & Casualty (P&C) Insurance Technology Providers for 2024. This recognition celebrates technology providers that are transforming the P&C insurance sector through advanced platforms and solutions.

The Everest Group evaluated companies based on metrics such as revenue derived from P&C-focused technology, value chain coverage, and innovation in product offerings and partnerships.

ZestyAI earned accolades in two categories: Emerging Risks Intelligence and Assessment (Climate) and Risk Intelligence for Property Insurance.

These honors reflect the proven performance of our AI-driven platform under the most challenging conditions. From the devastating California wildfires of 2020 and 2021 to the unprecedented 2023 convective storm season, our models—Z-FIRE, Z-HAIL, Z-WIND, and Z-STORM—have consistently delivered reliable insights and results

Shaping the Future of Climate Risk Analytics

Chartis Research ranked ZestyAI 47th out of 175 organizations in climate risk analytics, recognizing our significant contributions to addressing climate risk challenges in insurance. This acknowledgment highlights our commitment to tackling secondary perils—including wildfire, hail, wind, and severe convective storms—through advanced AI-powered property insights and predictive models.

Our platform-driven approach, grounded in climate science, equips insurers with actionable, peril-specific insights. These tools empower them to navigate the complexities of climate risk, adapt to an evolving regulatory and environmental landscape, and optimize risk management strategies.

Driving Innovation and Excellence

This year’s recognitions join a growing list of accolades celebrating our contributions to innovation and excellence. ZestyAI has been named one of Forbes’ Top Startups to Work For in America, as well as one of Inc. 5000’s Fastest Growing Private Companies in America. Additional honors include recognition on the Deloitte Technology Fast 500, inclusion in the CB Insights Insurtech 50, an AI Breakthrough Award for Machine Learning, and a PropertyCasualty360 Insurance Luminary award for Risk Management Innovation.

These accolades inspire us to keep pushing boundaries, delivering exceptional value, and pursuing our mission to create a more sustainable and resilient insurance ecosystem.

See How Insights Turn Into Decisions

ZestyAI transforms data into action. Get a demo to see how the same AI powering our reports helps carriers make faster, smarter, regulator-ready decisions.