Reports & Research

Explore proprietary research packed with data, insights, and real-world findings to help carriers make smarter decisions.

The 2021 Wildfire Season has Devastating Potential

A Data-Driven Conversation about the US West’s Megadrought

Current climate conditions in the West reveal that 2021 may have a higher than normal risk for wildfire losses. While much of this report focuses on California, historically the worst victim of wildfire in the US, the entire western US is of concern in 2021. In particular, the expansion of deep drought into Colorado is of major concern.

Drought is a leading factor in seasonal wildfire risk. With drought extending through every western state this spring, insurers should consider looking deeply into how they are addressing this growing peril. According to AON, last year’s wildfires in the US West cost insurers over $8 billion.

We've released a complete detailing the devastating potential for 2021's wildfire season. The full report is available here.

Nearly Doubling a Property’s Wildfire Survival Rate: New Study from ZestyAI in Collaboration with IBHS Shows Impact of Key Mitigation Action

Research across more than 71,000 properties involved in wildfires draws significant links between fuel management and property survival.

Oakland,Calif., April 8, 2021: ZestyAI, a leader in climate risk analytics powered by Artificial Intelligence (AI), and the Insurance Institute for Business & Home Safety (IBHS) today released new research on how fuel management impacts destruction rates from wildfires. They found property owners who clear vegetation from the perimeter of their home or building can nearly double their structure's likelihood of surviving a wildfire.

ZestyAI, in conjunction with, IBHS studied more than 71,000 properties involved in wildfires between 2016 and 2019 to assess the relationship between vegetation, buildings, and property vulnerability. To do this, ZestyAI leveraged a combination of computer vision and AI to analyze high resolution satellite and aerial imagery of the properties that fell within the wildfire perimeter, which allowed them to determine what effects a property's physical environment had on its likelihood of survival. They found buildings with a high amount of vegetation within 5 feet of the structure were destroyed in a wildfire 78 percent of the time -- a rate nearly twice as high as those with small amounts of perimeter vegetation. This pattern held true as ZestyAI analyzed the other defensible zones, ranging from 30 to 100 feet around the property.

"It's common sense that increased vegetation increases wildfire risk, but this study shows just how powerful individual action can be in safeguarding structures. Mitigation actions that can cut risk nearly in half are statistically meaningful to anyone with a stake in this peril," said Attila Toth, CEO of ZestyAI. "These findings also underscore how wildfire research at IBHS and artificial intelligence at ZestyAI translates to real-world impact at the intersection of homeowners, community leaders, regulators, and insurance carriers. This type of collective action will help protect our communities from the devastating impact of wildfire, which unfortunately has continued to increase over the last decade."

The study also supported and confirmed takeaways from IBHS's Suburban Wildfire Adaptation Roadmaps released last year, which go beyond the home ignition zone to detail additional actions needed across eight aspects of a home to address a home's wildfire vulnerability. ZestyAI's new research found that having other structures in close proximity to a property increases its wildfire risk, particularly for properties in areas with moderate to high vegetation coverage. Buildings in these areas that had another structure within 30 to 100 feet from the property were destroyed in a wildfire 60 percent of the time, compared to a 31 percent destruction rate for homes without another structure in close proximity.

"This research further demonstrates to homeowners, community leaders, and policy makers just how impactful taking the mitigation actions laid out in the Suburban Wildfire Adaptation Roadmaps can be in protecting homes from wildfire ignition," said Roy E. Wright, President & Chief Executive Officer at IBHS. "Quantifying the effect of mitigating fuel density risk, one of the critical actions identified in the Roadmaps, is a first piece in the larger puzzle of what groups of mitigation actions most improve the chance of home survival and by what level."

ZestyAI is uniquely equipped to support this type of research because of the proprietary wildfire property loss database it developed for Z-FIRE™, its AI model that generates property-specific predictive risk scores. Z-FIRE™ has been trained on more than 1,200 wildfire events across several decades and accounts for the property-level factors that contribute to wildfire risk, including defensible space, building material, and roof pitch, which legacy models fail to consider.

Wright added, "While it is not possible to eliminate wildfire risk we are not powerless against it. We must take a pragmatic approach to mitigate risk at all levels and ultimately reduce property damage through data and science. Through collaborations with modelling organizations like ZestyAI, advanced technology like computer vision and AI help us better understand the impact of these actions at a larger scale. It is encouraging to see emerging progress in just the first months of 2021."

For additional insights you can read the full research paper, ‘Wildfire Fuel Management and Risk Mitigation - Where to Start?' here. For more information on ZestyAI please visit www.zesty.ai, and for more information on IBHS please visit www.ibhs.org.

About ZestyAI (www.zesty.ai): Increasingly frequent natural disasters, such as wildfires, floods and hurricanes devastated communities and drove $2.2 Trillion in economic losses over the past decade. ZestyAI uses 200Bn data points, including aerial imagery, and artificial intelligence to assess the impact of climate change one building at a time. ZestyAI has partnered with leading insurance companies and property owners helping them protect homes, businesses and support thriving communities. ZestyAI was named Top 100 Most Innovative AI Company in the world by CB Insights in 2020, and Gartner Cool Vendor in Insurance by Gartner Research in 2019. For more information visit: https://www.zesty.ai/

About the Insurance Institute for Business & Home Safety (IBHS)

The IBHS mission is to conduct objective, scientific research to identify and promote effective actions that strengthen homes, businesses and communities against natural disasters and other causes of loss. Learn more about IBHS at DisasterSafety.org.

ZestyAI Research: Up to $9.8Bn in Losses Already Caused by Wildfires in 2020

As of September 18th, between $5.9Bn and $9.8Bn in losses have occurred this year alone.

The Zest

ZestyAI has been keeping a close eye on the wildfires burning in the Western United States. Whether by evacuation or smoke, most of our employees have felt the impact firsthand.

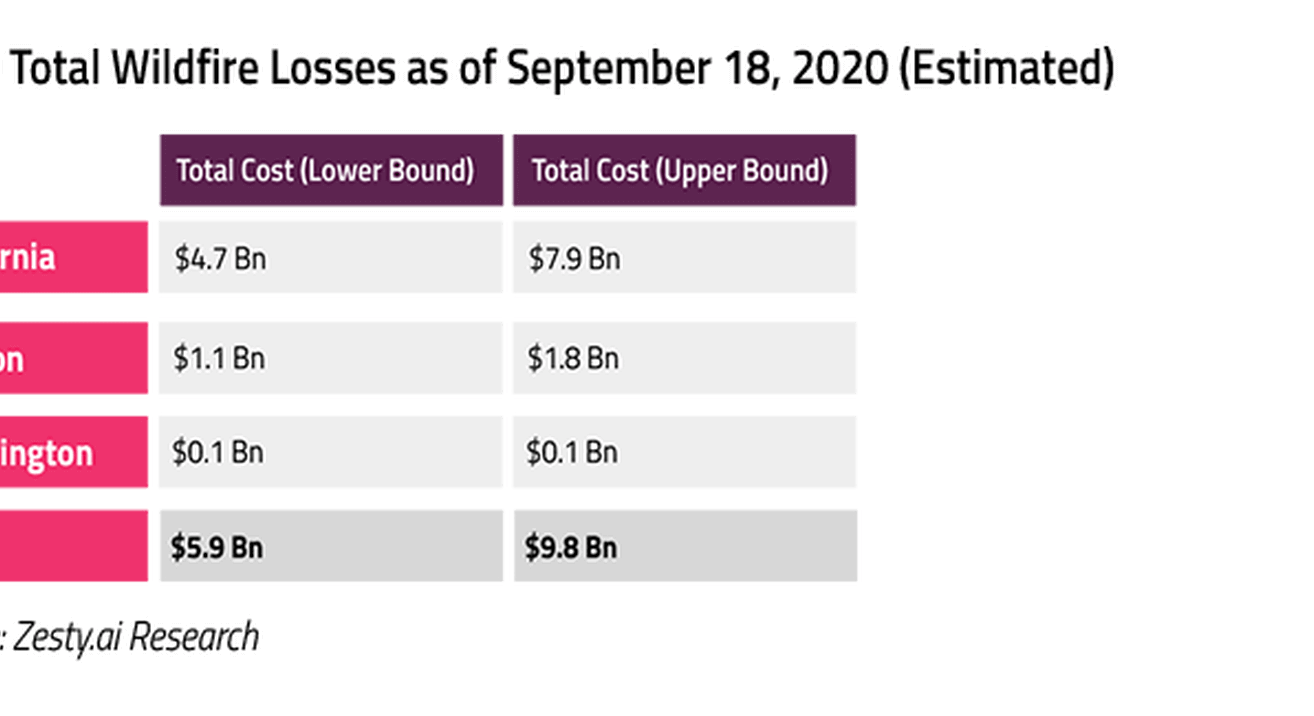

Utilizing our vast wildfire data and artificial intelligence resources, we have estimated that as of September 18th, between $5.9Bn and $9.8Bn in losses have occurred this year alone.

What has made 2020 unique?

Two key aspects have made the 2020 Wildfire Season exceptional: the number of acres burned and the timing of the fires.

2018, which previously held the California record for acres burned at 1,975,086 has been eclipsed with months left in the seasons. More than 3.3 million acres have already been charred by wildfire this year in California alone, and more than 5 million in the Western US.

Fire season tends to start in September and peak in November. In August, a large scale lightning event occurred, triggering many of the California wildfires. Oregon, which typically has a shorter wildfire season has also seen early and widespread wildfires.

Analysis Methodology

Using ZestyAI’s comprehensive historical wildfire loss data, up-to-date wildfire perimeter locations for the 2020 season, residential and commercial property information, and fueled by ZestyAI’s AI-driven wildfire damage risk scores, the expected destruction and cost of the 2020 wildfire season so far was calculated for California, Oregon, and Washington.

To estimate the destruction and damages, ZestyAI identified every structure involved in the 2020 wildfire perimeters and their associated wildfire vulnerabilities. Using the historical relationship between the risk profile of the structure, asset value, and economic loss, ZestyAI was able to estimate the full economic loss of those events (including non-insured assets such as uninsured property, and non-insured economic cost). Actual information from CalFire on CZU and LNU incident was used to validate the methodology.

From our extensive historical loss data, a relationship between structural damage expected and the cost of wildfire events was developed based on local property and loss information and expanded to include additional considerations such as smoke damage, displacement costs, and construction.

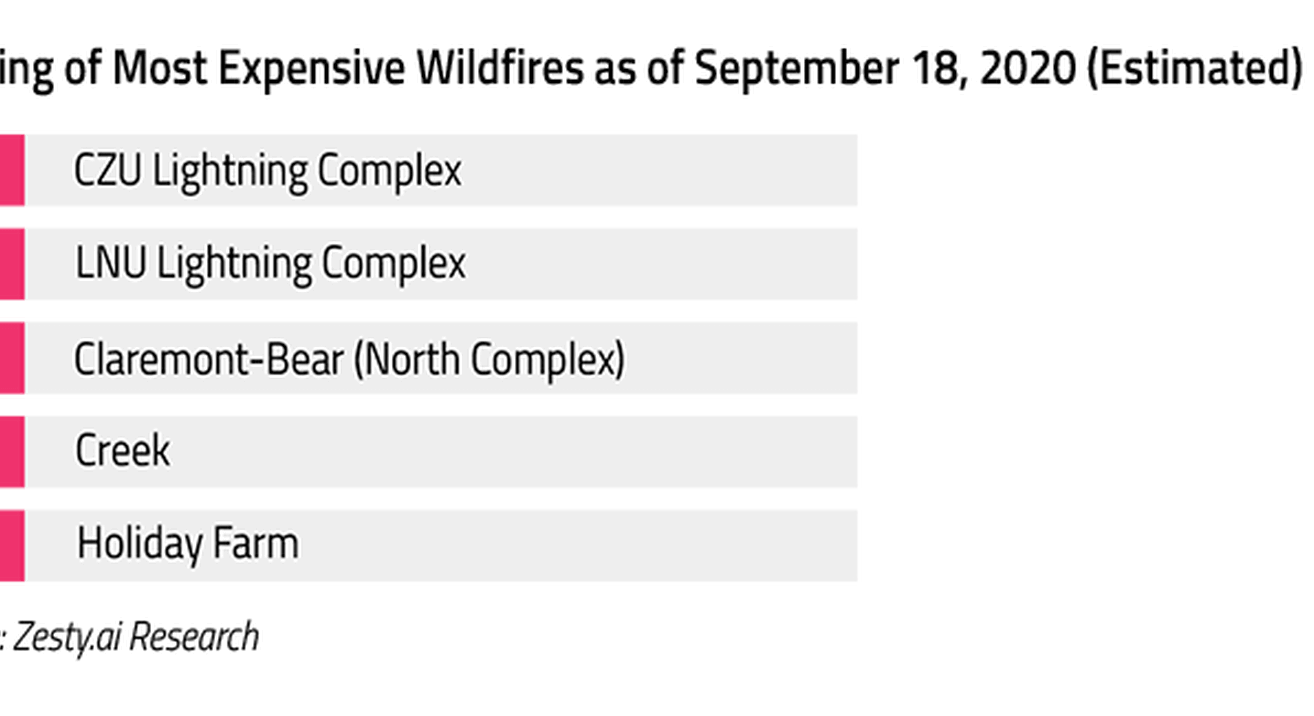

The 5 Most Destructive Fires So Far

Our estimates place the Claremont-Bear (North Complex) at the top of the list of most destructive in terms of number of properties lost. Four of these five wildfires occurred in California with the Alameda Drive fire occurring in Oregon.

The 5 Most Expensive Fires So Far

While the Claremont-Bear (North Complex) fire is estimated to have destroyed the most properties, the CZU Lightning Complex fire is currently estimated to be the most costly at up to $2.6B. That makes it responsible for ~27% of all total economic losses from fires in the 2020 season so far.

Putting Numbers on Destruction

By ZestyAI estimates, between $5.9Bn and $9.8Bn of economic losses have occurred in California, Oregon, and Washington so far this year. California, which also leads in acres burned (5M+) makes up the lion’s share at up to $7.9B.

It’s important to state that the fire season is not yet over. In much of the Western US, it could be just beginning. With a number of fires still active and the potential for more to start, these numbers are almost certain to rise between now and the end of the year.

Looking Forward

Multiple estimates place the 2018 wildfire season at around $15Bn in total losses. While exceptional in terms of total acres burned, the 2020 wildfire season has not yet reached that level of economic loss. Without any doubt, this will be one of the costliest years on record, and with months left in the season, the potential exists for this year to surpass 2018 if it continues at its current pace.

ZestyAI will continue to monitor this fire season. As in years past, new data continues to refine our models and analyses. Insurance professionals and media who would like more information about this analysis or about how artificial intelligence can help insurers protect themselves and their customers from wildfire should contact us.

Merging Centuries of Expertise with AI for a New Era of Risk Assessment

In 2024, U.S. insured catastrophe losses soared to $113 billion. Learn how we combine centuries of insurance expertise with AI to help insurers navigate an increasingly volatile climate.

The property and casualty (P&C) insurance industry has always been about protecting people and property against the unexpected. But in 2024, U.S. insured catastrophe losses reached $113 billion—nearly double the 25-year average of $58 billion.

For many carriers, the gap between collected premiums and total payouts, including operating costs, continues to widen, underscoring the growing financial strain of climate-driven risks. At ZestyAI, we can’t control the forces of nature, but we’re helping insurers adapt.

From Franklin’s Fire Policies to AI-Powered Resilience

The concept of insurance dates back to the Middle Ages, when merchants sought protection from unpredictable events like storms and piracy. Over time, the practice evolved into today’s property and casualty insurance, safeguarding homes, businesses, and communities.

In the United States, Benjamin Franklin advanced the industry by founding the nation’s first fire insurance company in 1752. By refusing to insure fire-prone buildings, his company not only mitigated risk but also set new safety standards. This principle of risk reduction has guided the industry ever since.

Today, ZestyAI is building on that foundation with AI-driven risk models that help insurers address modern challenges. While the tools have changed, the mission remains the same: to protect people, property, and the future.

Modern Tools for Today’s Challenges

At ZestyAI, we’re helping insurers address modern challenges with solutions designed to fit seamlessly into their workflows. Our AI-driven platform combines high-resolution aerial imagery, proprietary data, and advanced modeling to provide a clearer, more reliable view of risk.

Unlike broad, traditional approaches, we focus on delivering actionable insights at the property level, helping insurers:

- Modernize outdated processes without overhauling their systems,

- Improve underwriting precision,

- Optimize inspections and resources, and

- Strengthen their portfolios.

A key example of this is our work in wildfire risk modeling. ZestyAI’s proprietary wildfire loss database—built using data from 1,500 events over the last 20 years—helps insurers predict property-specific risks with precision. By understanding wildfire risk at this granular level, insurers can proactively reduce losses, guide mitigation strategies, and protect their customers with greater confidence.

Discover how ZestyAI’s regulator-approved solutions set new standards for accuracy, compliance, and fairness in insurance.

ZestyAI Models Approved to Transform Storm Risk Analysis in Minnesota

Regulatory approval for property specific insights will help insurers tackle severe convective storm risks after three billion-dollar weather events in Minnesota in 2024

ZestyAI, the leading provider of AI-powered property and risk analytics, today announced that its Severe Convective Storm suite, including Z-HAIL™, Z-WIND™, and Z-STORM™, has received regulatory approval from the Minnesota Department of Commerce.

This milestone supports Minnesota insurers in improving storm risk assessment, enhancing underwriting precision, and supporting proactive risk management strategies.

Minnesota has seen significant losses from severe convective storms. According to data from NOAA’s National Centers for Environmental Information (NCEI), the state experienced three billion-dollar weather events in 2024 alone, with hail and wind causing extensive damage. A July storm in the Twin Cities resulted in more than $1.8 billion in insured losses, highlighting the need for innovative solutions to manage storm-related risks.

ZestyAI’s Severe Convective Storm suite delivers property-specific risk insights by combining climatology analysis with granular property data. Built on extensive loss data and validated by regulatory authorities, the suite equips insurers to assess and address storm risks with a higher level of accuracy and confidence. Key features include:

- Z-HAIL: Evaluates each roof’s unique characteristics, including accumulated damage, to predict which properties are likely to file a claim, even in the same neighborhood.

- Z-WIND: Uses AI-generated 3D analysis revealing pivotal insights about roof condition, complexity, and potential points of failure.

- Z-STORM: Predicts the frequency and severity of storm damage claims, examining the interaction between climatology and the unique characteristics of every structure and roof

These models allow insurers to move beyond reactive damage assessments, helping them identify high-risk properties, allocate resources effectively, and support policyholders in reducing risks.

Bryan Rehor, Director of Regulatory Affairs at ZestyAI said:

“Minnesota’s exposure to hail and wind damage underscores the importance of property-specific insights. With this approval, insurers can access validated models to deliver precise underwriting and rating decisions and encourage risk-reduction measures among policyholders.”

This approval builds on a series of regulatory endorsements in key wind and hail-prone states across the Great Plains, Midwest, and U.S. South, including Texas, Colorado, Indiana, Missouri, and Iowa, among others.

Elevating Insurance Risk Models: How ZestyAI Powers Smarter Data-Driven Decisions

ZestyAI delivers predictive insights and refined risk profiles to help you stay ahead in an increasingly competitive market.

National insurance carriers have long relied on sophisticated models to drive underwriting accuracy and profitability.

But even the most advanced systems can benefit from fresher, more granular, and unique data inputs.

That’s where ZestyAI comes in. With 97%+ U.S. property coverage and exclusive data points—like roof condition and building permits—ZestyAI provides national carriers with the data needed to supercharge their existing models and achieve unparalleled accuracy in risk assessment.

Every insurance model thrives or falters based on the quality of its inputs. Using computer vision and AI-powered insights, ZestyAI captures property-specific features with unmatched precision and is updated multiple times annually. This allows carriers to access insights they’ve never had before, including:

- Roof Condition and Complexity: ZestyAI’s 3D analysis evaluates every facet, penetration, and angle of a roof, providing a complete view that powers complex rating models.

- Parcel-Level Features: Detailed property-level data, such as driveway condition, building permits, lot debris, and overhanging vegetation, reveal nuanced risks for underwriting.

Climate, Geography, and Infrastructure Variables: Comprehensive data encompassing topography, slope, climate factors, and critical infrastructure.

Why National Carriers Choose ZestyAI as a Data Partner

Adopting an off-the-shelf solution isn’t always the right fit for national carriers with robust internal modeling teams. Instead, these insurers benefit from ZestyAI’s ability to integrate powerful datasets into their existing infrastructure seamlessly. Key advantages include:

- Data Uniqueness: Proprietary insights like property updates and nuanced parcel-level conditions unavailable from public or conventional sources.

- Broad and Deep Coverage: 97%+ U.S. property coverage ensures nationwide relevance.

- Change Detection and Data Recency: AI-driven updates keep your models ahead of evolving risks with near-real-time insights.

By integrating ZestyAI’s data, carriers can complement their models and ensure their outputs are informed by the latest, most comprehensive property-level information.

Driving Precision with a Science-Driven Approach

At ZestyAI, science and a hypothesis-driven approach form the foundation of our offerings. Hundreds of variables are tested for each model, carefully selected and validated to ensure they meet both logical and causal standards—not just correlations. This rigorous methodology ensures compliance with regulatory scrutiny and real-world risk prediction.

Immediate Benefits, Long-Term Value

- Enhanced Model Accuracy: ZestyAI’s data serves as a diagnostic lens, revealing what’s missing in your existing frameworks and sharpening predictions.

- Operational Efficiency: Recent upgrades to ZestyAI’s API infrastructure, including a 50% reduction in response times and a 10x increase in data processing power, ensure carriers can seamlessly integrate real-time insights into their workflows. These enhancements enable faster decision-making and improved scalability, helping insurers stay ahead in an evolving risk landscape.

- Regulatory Readiness: Transparent, explainable data sources ensure compliance with even the most stringent underwriting regulations.

THORE Insurance Taps ZestyAI to Power Texas Growth

ZestyAI, the leader in AI-powered property and climate risk analytics, today announced a partnership with THORE Insurance, a Texas-based company.

Johnathan Yazdani, President and CEO of THORE Insurance, said:

"After evaluating several options, ZestyAI was the clear choice for our underwriting needs. Far too often, our industry suffers preventable, foreseeable losses and chalks it up to a cost of doing business. No more. Zesty's comprehensive property insights and roof age solution stood out, offering the precision and scalability we need to grow our business in Texas year over year and maintain low prices for our members through underwriting excellence."

"Their data-driven insights and depth of 40+ property features made the decision easy for us, and we’re confident ZestyAI will be a key partner as we build for the future."

ZestyAI’s Roof Age insights, derived from building permits, aerial imagery, and advanced AI analysis, provide 97% data coverage across the U.S., addressing inaccuracies in self-reported roof data.

Recent research shows that 15% of roofs are at least eight years older than reported, highlighting the need for reliable, data-driven solutions.

The Digital Roof™platform uses AI-generated 3D analysis to assess roof attributes like condition, complexity, and potential failure points, while Z-PROPERTY™ Location Insights identifies property features such as vegetation overhang, swimming pools, and solar panels. Together, these capabilities deliver deeper insights to refine risk assessment and pricing.

“In addition to their appetite for innovation, THORE’s leadership clearly communicated a vision to serve Texas homeowners with fairly-priced, best-in-class insurance products,” said Sebastian Kasza, Director of Strategy and Business Development at ZestyAI.

Leveraging AI-powered, property-specific insights in underwriting and pricing is the best way that a carrier can achieve that ambition sustainably.

We are thrilled to partner with Jonathan and his team as they serve the Texas insurance market.”

Is SaaS Dead?

What Microsoft's Satya Nadella’s Vision for AI Means for P&C Insurance Executives

By Attila Toth, Founder and CEO, ZestyAI

“SaaS is dead.”

With these three words, Microsoft CEO Satya Nadella sparked a global debate, challenging the foundation of enterprise operations. His prediction? AI agents will soon replace traditional SaaS workflows, moving business logic to a dynamic AI layer and leaving legacy tools behind.

For property and casualty (P&C) insurers, this prediction is more than a tech trend—it’s a wake-up call. Carriers have invested heavily in SaaS platforms to modernize underwriting, claims, and risk management. But with AI agents poised to dominate, are these investments like castles built in the sand, vulnerable to the rising tide of AI?

Let’s unpack what Nadella’s claim means for P&C insurers and explore how to prepare for a future where agentic workflows reshape this $2.6 trillion global industry.

From Static Systems to Agentic Workflows

Over the past decade, P&C carriers have focused on modernizing their technology stacks, moving

to SaaS-based systems for policy management including underwriting, claims, and billing. These platforms promise efficiency gains, streamlined workflows, and improved business intelligence. Yet Nadella’s vision points to a future where AI agents bypass these systems altogether, directly interact- ing with data to execute tasks dynamically.

Enter agentic workflows.

Agentic workflows are powered by AI agents—autonomous systems that can analyze data, make decisions, and execute tasks in real-time without rigid reliance on predefined rules or interfaces. Unlike traditional workflows that depend on user interaction, agentic workflows dynamically adapt to the situation, accessing real-time data and leveraging advanced decision models to solve problems creatively.

Let’s Break it Down With Examples:

- Underwriting: Traditionally, underwriters rely on policy management systems to assess risk, manually inputting and analyzing data. In an agentic workflow, an AI agent pulls data from internal and external sources, such as property imagery or weather patterns, and evaluates risk in real time, and proposes pricing autonomously.

- Claims: Instead of adjusters triaging claims by reviewing data and making decisions step by step, AI agents analyze First Notice of Loss (FNOL) data, cross-reference it with historical patterns, flag potential fraud, and recommend payouts or next steps—all in seconds.

Think of agentic workflows as moving from a ‘static map’ to a ‘smart GPS.’ Traditional SaaS systems provide fixed routes, like a printed map or a AAA TripTik, where users must plan and follow a predefined path. In contrast, AI agents function like a GPS that dynamically adjusts to roadblocks or detours, guiding you in real-time to reach your destination more efficiently.

This doesn’t eliminate the roles of underwriters or adjusters—it amplifies them. With agentic workflows, professionals transition from being data processors to strategic decision-makers, supported by AI agents that execute repetitive and analytical tasks.

The question is not if, but how fast this shift will occur. In P&C, where SaaS investments are relatively new, the transition may take time. But the direction is unmistakable, and forward-thinking executives should prepare now.

How Insurance Leaders Can Prepare for the AI Era

The shift to AI-driven workflows brings both challenges and opportunities. To stay ahead, insurance leaders must act now. Here’s how:

1. Build AI-First Architectures

Insurers must prioritize modular, API-driven platforms that enable seamless integration with AI agents. An AI-first architecture treats applications as interchangeable layers rather than static end- points, ensuring adaptability to future innovations without extensive system overhauls.

2. Unify Siloed Data

AI agents thrive on data, yet fragmented, siloed data remains a significant challenge for insurers. It’s not about choosing the “right” database—AI agents can interact with any data store. What matters is creating a unified and federated data structure that breaks down silos and provides AI agents with a cohesive view of organizational information.

CIOs should prioritize data integration, ensuring underwriting, claims, customer, and risk data are accessible across the enterprise. A federated approach bypasses the need for lengthy consolidation projects while enabling AI-driven insights.

3. Engage Regulators Early

AI workflows will only succeed if regulators are on board. Departments of Insurance (DOIs) need to trust the decision-making processes of AI agents and ensure they meet standards for transparency, fairness, and compliance.

At ZestyAI, we’ve worked with state Departments of Insurance across the U.S. to gain approval for our AI models. Building trust with regulators requires proactive engagement, clear communication, and ongoing education. Insurers that lead in this area will not only gain competitive advantages but also shape the regulatory frameworks that govern the use of AI.

4. Pilot Agentic Workflows

Start small, but start now. Deploy AI agents in low-risk areas like claims triage or fraud detection. Early pilots provide valuable lessons and build organizational confidence in agentic workflows.

5. Expand ROI Thinking

AI agents are poised to fundamentally transform operations, requiring a broader perspective on ROI. Beyond traditional metrics like cost reduction or workflow efficiency, consider strategic gains such as:

- Faster speed to market.

- Improved customer satisfaction. - Enhanced risk segmentation.

6. Put Technology Partners to the Test

Carriers should evaluate their SaaS providers on their readiness to transition to agentic workflows. Ask pointed questions: What is their AI strategy? How do they plan to integrate AI agents into their products? - Are they prepared to support modular, dynamic workflows?

The Bottom Line

The future Nadella outlines—a world driven by AI agents—is as disruptive as it is exciting. For P&C insurance executives, it’s a call to action: the technology stack of today may not meet the demands of tomorrow. Preparing now by investing in AI-first architectures, building unified data structures, and engaging with regulators will position insurers to thrive in this new era.

SaaS isn’t dead yet, but the writing is on the wall. The question is, are you ready to embrace the future? Are you building a castle ready to weather the waves?

Missouri Insurers Gain Precision with ZestyAI’s Approved Severe Storm Models

Regulatory approval equips Missouri insurers to tackle rising storm losses with AI-driven property risk solutions.

Missouri’s severe convective storms are growing more destructive, with hailstorm-related claims skyrocketing by 245% in 2024 alone. To address this rising risk, ZestyAI has secured regulatory approval from the Missouri Department of Insurance for its Severe Convective Storm suite, including Z-HAIL™, Z-WIND™, and Z-STORM™.

Missouri’s Rising Storm Losses

Missouri’s vulnerability to severe convective storms is well-documented. Since 1980, 82 weather events have each caused over $1 billion in damages. In 2024, a March hailstorm—dubbed the “Gorilla Hail” storm—resulted in nearly 7,000 claims, a dramatic increase from just over 2,000 hail claims the previous year.

How ZestyAI’s Models Make a Difference

ZestyAI’s Severe Convective Storm suite provides property-specific risk assessments, enabling insurers to predict and manage extreme weather impacts with precision.

Key Features:

- Z-HAIL™: Identifies a roof’s susceptibility to hail damage and estimates potential claim severity using property-specific attributes like roof complexity and historical losses.

- Z-WIND™: Predicts wind claim frequency and severity by combining climatology with property-specific data such as roof structure and damage history.

- Z-STORM™: Delivers granular risk scores for storm claim frequency and severity, factoring in climatology, building characteristics, and roof design.

These AI-driven models help insurers proactively manage storm-related risks, allocate resources effectively, and encourage policyholders to take preventive measures.

Empowering Insurers with Advanced Risk Insights

Bryan Rehor, Director of Regulatory Affairs at ZestyAI, said:

Missouri’s exposure to tornadoes, hail, and damaging winds makes advanced risk assessment tools essential. By streamlining the regulatory process, we enable insurers to focus on protecting policyholders while reducing losses.

With regulatory compliance and validated loss data at its core, ZestyAI’s suite enables insurers to:

- Enhance underwriting precision and optimize deductible strategies.

- Provide policyholders with actionable insights to reduce risks and prevent losses.

- Move beyond reactive damage assessments to proactive storm risk management.

Looking Ahead

ZestyAI’s Severe Convective Storm suite has already received regulatory approvals in Texas, Colorado, Illinois, Indiana, and Iowa, with additional filings in progress. By equipping insurers with AI-powered tools, ZestyAI is modernizing the way storm risks are assessed, ensuring communities and insurers are better prepared to weather the storm.

See How Insights Turn Into Decisions

ZestyAI transforms data into action. Get a demo to see how the same AI powering our reports helps carriers make faster, smarter, regulator-ready decisions.