Reports & Research

Explore proprietary research packed with data, insights, and real-world findings to help carriers make smarter decisions.

Why Non-Weather Water Losses Are Quietly Eroding Profitability

New research reveals how insurers can rethink their strategy for the 4th costliest peril in homeowners insurance

The Silent Peril Reshaping Homeowners Insurance

Non-weather water damage rarely makes headlines, but it’s quietly eroding profitability across the country.

It is now the fourth costliest peril in homeowners insurance, and claim severity has increased 80% in the last decade—a trend that’s accelerating even as frequency remains relatively flat.

Traditional risk models struggle to capture the early warning signs behind these losses, leading to mispriced policies, undetected exposure, and rising volatility for carriers.

Want the full analysis? Download the complete “Winning the Fight Against Non-Weather Water Losses” guide.

Why Loss Severity Keeps Rising

Aging homes and overlooked system failures

Many of the most expensive losses stem from aging plumbing, deteriorating materials, and slow-burn failures that often go undetected until damage is significant.

Frequency is flat—severity is not

Loss patterns suggest that while the number of events hasn’t surged, the financial impact of each event has—a signal that traditional models are not capturing the right property-level predictors.

The Property Features Most Predictive of Water Losses

The overlooked attributes that traditional models miss

Standard territory- or age-based assessments often ignore the property-specific details that meaningfully influence water loss risk, including:

- supply line material and age

- plumbing configuration

- occupancy patterns

- system maintenance and upgrades

- moisture exposure and prior loss indicators

These factors vary widely between neighboring homes—yet most models treat them as identical.

Where Traditional Underwriting Falls Short

ZIP-code and age-based proxies mask true risk

Legacy approaches rely heavily on broad territory-level assumptions that overlook structural vulnerabilities and system conditions.

Limited visibility creates mispriced policies

Without property-level insight, high-risk homes are often underpriced while lower-risk homes subsidize them—driving loss ratio volatility over time.

Get deeper insights on the drivers of water loss severity in our full guide → “Winning the Fight Against Non-Weather Water Losses”

How AI and Property-Level Data Are Changing the Landscape

AI models trained on real-world claims data can identify early signals of potential water loss by analyzing the interaction between:

- plumbing systems

- property attributes

- historical patterns

- material degradation

- repair history

This enables carriers to segment risk accurately, adjust pricing, and reduce preventable losses—long before small issues turn into major claims.

What Homeowners Actually Understand About Water Risk

Misconceptions around coverage and prevention

ZestyAI’s research shows that many policyholders:

- misunderstand what is and isn’t covered

- underestimate how much damage water can cause

- rarely take preventive actions unless prompted

This disconnect creates an opportunity for carriers to strengthen education, mitigation, and customer engagement.

Steps Carriers Can Take Today

Improve segmentation and rating accuracy

Property-level signals enable more precise risk tiers and more stable long-term portfolios.

Strengthen mitigation and reduce loss severity

Insights help identify which homes are at elevated risk and where targeted mitigation can reduce exposure.

Enhance underwriting workflows with explainable insights

Transparent, explainable AI helps underwriters understand the key drivers behind elevated risk—supporting both decision-making and regulatory review.

Get the Full Guide

Our new research paper, Winning the Fight Against Non-Weather Water Losses, breaks down the trends reshaping this growing peril—and the strategies carriers can use to get ahead of it.

Access the Guide

12.6 million US properties at high risk from hail damage

ZestyAI analysis reveals $189.5 billion in potential hail losses.

ZestyAI's analysis revealed that more than 12.6 million U.S. properties are at high risk of hail-related roof damage, representing $189.5 billion in potential replacement costs.

Powered by ZestyAI’s Z-HAIL™ model, the analysis underscores the growing financial threat of severe convective storms (SCS), including hail, tornadoes, and wind events. In 2024 alone, damages from SCS were estimated at $56 billion—surpassing losses from hurricanes.

Yet many insurers still rely on traditional models designed to estimate portfolio-level exposure, not property-level risk. As hail events increase in severity and frequency, these models often miss the structural and environmental conditions that drive real losses.

Kumar Dhuvur, Co-Founder and Chief Product Officer at ZestyAI said:

“Catastrophe models have helped insurers understand where storms may strike and how losses might add up at a portfolio level. But they weren’t built to assess risk at the individual property level, and they often miss the specific conditions that drive hail damage. By analyzing the interaction between structure-specific features and local storm patterns, we can distinguish risk between neighboring properties—enabling smarter underwriting, more precise pricing, and better protection for policyholders.”

Z-HAIL evaluates hail risk using a proprietary blend of climate, aerial, and property-specific data. By applying advanced machine learning to these inputs, Z-HAIL delivers highly granular predictions that reflect both the physical characteristics of a structure and the storm activity in its immediate surroundings.

Key findings from the analysis:

- 12.6 million U.S. structures flagged as high risk for hail-related roof damage

- $189.5 billion in total potential roof replacement exposure

Top five states by dollar exposure:

- Texas ($68B)

- Colorado ($16.7B)

- Illinois ($10.8B)

- North Carolina ($10.4B)

- Missouri ($9.5B)

States with the lowest dollar exposure:

- Maine ($4.7M)

- Idaho ($12.8M)

- New Hampshire ($18.5M)

- Nevada ($49.3M)

- Vermont ($64.7M)

In recent case studies, Z-HAIL has demonstrated the ability to pinpoint which properties are most susceptible to hail damage—even within the same neighborhood and exposed to the same storm. In one example from Allen, Texas, following a storm with 2.5-inch hailstones, Z-HAIL segmented risk across 483 policies, identifying no losses among properties rated “Very Low” by the model. This level of intra-territory precision gives insurers the ability to refine risk selection with confidence—even in the most hail-prone regions of the country.

.png)

2025 Storm Risk Webinar Now Available On Demand

Stream our webinar for a preview of severe convective storm risk in 2025 and see how AI-driven insights can help you stay prepared.

Severe convective storms are becoming more frequent and costly, putting pressure on insurers to refine underwriting and risk management strategies.

On April 2, our experts covered:

- Key drivers behind increasing severe storm losses

- What La Niña means for the 2025 season

- How AI-powered risk models improve risk segmentation

- Live Q&A – Get expert answers to your toughest questions!

Missed the live event? Stream now!

Report: Severe Convective Storm Preview 2025

Get the insights to manage risk in 2025 before claims surge.

Severe convective storms (SCS)—including tornadoes, hail, and damaging wind events—resulted in $58 billion in insured losses across the U.S in 2024.

Insurers face a dual challenge: navigating the uncertainty of storm patterns while ensuring their portfolios remain resilient enough to absorb the financial strain from clustered, high-loss events.

Research with IBHS confirms that SCS damage accumulates over time, particularly affecting rooftops after multiple exposures to intense storm activity. As housing stock deteriorates, insurers must reassess their portfolios to ensure underwriting, rating, and loss cost controls align with their risk appetite and maintain premiums that accurately reflect evolving exposure.

Get ahead of rising storm risks with expert insights that help you strengthen underwriting, risk assessment, and claims management.

$2.15 Trillion in Property Value at Risk as Wildfire Exposure Expands Across the U.S.

ZestyAI Identifies 4.3 Million U.S. Homes with High Wildfire Risk.

A staggering $2.15 trillion worth of U.S. residential property is at high risk of wildfire damage, according to a new AI-powered analysis from ZestyAI, the leader in climate and property risk analytics. The study, which assessed 126 million properties nationwide, found that 4.3 million individual homes face heightened wildfire risk—far beyond traditionally recognized high-risk areas.

Using advanced AI models trained on over 2,000 historical wildfires, ZestyAI mapped wildfire exposure at the property level, integrating satellite and aerial imagery, topography, and structure-specific characteristics. While California leads the nation with $1.16 trillion in wildfire-exposed property, other states such as Colorado ($190.5 billion), Utah ($100.3 billion), and North Carolina ($71.2 billion) also face significant risk.

Wildfire Risk is a Nationwide Challenge

While the Western U.S. has historically seen the most severe wildfire activity, ZestyAI’s findings confirm that high-risk properties exist across the country. States like North Carolina (4.6% of homes at high risk), Kentucky (2.9%), Tennessee (2.3%), and even South Dakota (11.0%) are now seeing increased wildfire exposure.

As more homes and businesses are built in fire-prone landscapes, the Wildland-Urban Interface (WUI) continues to expand. This, combined with intensifying climate conditions, is driving higher insurance costs and growing availability concerns. Today, one in eight U.S. homeowners already lacks adequate insurance coverage, and that number is expected to rise.

AI Expands Insurance Access in High-Risk Areas

Attila Toth, Founder and CEO of ZestyAI said:

"Wildfires are threatening more properties than ever before, with billions of dollars in exposure even in areas many people don’t associate with fire risk. Yet, too many homeowners are finding themselves uninsured or underinsured just as these disasters become more frequent and severe. Insurers have traditionally relied on broad, regional models that don’t account for individual property characteristics."

"That means some homeowners are denied coverage even when their true risk is much lower than their neighbors'.’"

AI-driven risk analytics are reshaping the way insurers assess wildfire exposure. By providing granular, property-specific insights, we’re helping insurers make smarter underwriting decisions—keeping coverage available in high-risk areas while ensuring that homeowners who take mitigation steps are recognized.

Last year, our models helped insurers extend coverage to 511,000 properties that had previously struggled to secure insurance due to outdated risk models. In 2025, we expect that number to reach a million, ensuring that even in high-risk areas, responsible homeowners have access to protection when disaster strikes.

AI in Insurance: How to Stay Ahead of the Curve

Artificial intelligence is reshaping the P&C insurance industry, offering new ways to streamline underwriting, enhance risk management, and navigate evolving regulations.

But as AI adoption accelerates, insurers must ensure they’re using these technologies effectively—balancing innovation with compliance.

Our latest guide explores the most impactful AI applications in insurance, including:

- AI-powered underwriting and predictive analytics

- How regulators are shaping the future of AI in insurance

- Best practices for integrating AI while ensuring fairness and transparency

As AI-driven tools become the new standard, insurers who adapt early will gain a competitive edge.

Download our free guide to leverage these innovations while staying aligned with evolving regulations.

ZestyAI Recognized as a Top Startup Employer by Forbes

We’re excited to share that, for the second year in a row, ZestyAI has been named one of America’s best startup employers by Forbes. This recognition highlights our commitment to fostering an exceptional workplace culture while fostering a healthier insurance market.

What It Means to Be a Top Startup Employer

Forbes, in partnership with research firms, evaluated over 20,000 U.S. startups based on three key factors: employer reputation, employee satisfaction, and business growth. Only 500 companies made the final cut, and we’re incredibly proud to be among them.

At ZestyAI, we believe that fostering a collaborative and supportive work environment isn’t just beneficial for our team—it’s essential to our mission. By enabling insurers to make more precise, data-driven decisions, we help drive resilience across communities, ultimately benefiting the homeowners and business owners they serve.

A Remote-First, People-First Culture

As a fully remote company, ZestyAI gives team members the flexibility to design a work-life balance that fits their needs. We go beyond traditional benefits by offering an unlimited time-off policy, which includes vacation and mental health days to support well-being and prevent burnout.

For team members across North America, our local hubs bring “Zesties” together for in-person events and networking, fostering connection and collaboration.

“Culture is not just a buzzword at ZestyAI—it’s the glue that holds our team together,” said Attila Toth, Founder and CEO of ZestyAI.

“Like a great sports team, we believe that the whole is greater than the sum of its parts. Our commitment to collaboration and well-being empowers us to deliver exceptional results.”

Industry Recognition

This honor joins a list of awards celebrating our work. ZestyAI has also been recognized by Inc. 5000 as one of America’s fastest-growing private companies, included in the Deloitte Technology Fast 500, and named to the CB Insights Insurtech 50. We have also received an AI Breakthrough Award for Machine Learning and a PropertyCasualty360 Insurance Luminary award for Risk Management Innovation.

Interested in joining us? Check out our careers page!

NEXT Insurance and ZestyAI Join Forces to Bring AI-Powered Risk Insights to Small Business Insurance

By leveraging AI-powered risk models, NEXT Insurance enhances risk assessment for smarter commercial insurance for SMEs.

ZestyAI, the leading provider of AI-powered property and climate risk analytics, today announced a strategic partnership with NEXT Insurance, a top commercial insurer specializing in small to medium-sized businesses.

Under this agreement, NEXT will adopt ZestyAI’s Z-PROPERTY™ and Z-FIRE™ models to enhance its underwriting processes with precise, property-level risk insights. Z-PROPERTY uses high-resolution aerial imagery and AI-powered analytics to assess roof condition, structural risks, and environmental hazards, helping insurers make more informed underwriting decisions.

Z-FIRE, adopted by over one-third of California’s insurance market, delivers highly accurate wildfire risk assessments based on 2,000+ historical wildfires, satellite imagery, and topographic data, ensuring that premiums reflect true wildfire exposure.

Lance Poole, Head of AI Underwriting at NEXT Insurance, said:

“ZestyAI’s peril-based risk models stood out for their ability to provide precise, actionable insights at scale, perfectly complementing our mission to help entrepreneurs thrive. This partnership strengthens our underwriting capabilities by delivering advanced data analytics that allows us to offer a faster, fully digital purchasing experience while maintaining best-in-class underwriting. By streamlining workflows and enhancing decision-making, we’re able to create innovative, tailored insurance solutions that meet the unique needs of small business owners, all while staying true to our commitment to simplicity and excellence."

Attila Toth, CEO of ZestyAI said:

"At ZestyAI, we are committed to bringing the power of AI-driven risk intelligence to the insurance industry. NEXT Insurance is redefining small business insurance with a fully digital experience, and we are proud to support that vision by providing precise, property-specific risk insights. With Z-PROPERTY and Z-FIRE, NEXT can enhance underwriting efficiency, optimize risk selection, and ultimately deliver smarter, more tailored coverage to small business owners across the country."

Safepoint Holdings Selects ZestyAI for Precision Underwriting and Streamlined Inspections

AI-driven property risk insights to enhance Safepoint’s efficiency and improve insurance offerings.

ZestyAI today announced its partnership with Safepoint Holdings, a regional property insurance group operating Safepoint, Cajun, and Manatee. Together, these platforms manage over 200,000 policyholders across Florida, Louisiana, Texas, Mississippi, and Alabama.

By leveraging ZestyAI’s advanced risk platform, Safepoint Holdings can analyze a high volume of properties with precision, enhancing underwriting accuracy and improving access to coverage for homeowners. Additionally, Safepoint Holdings is strengthening its loss cost control program by utilizing ZestyAI’s property insights to better predict and manage risk.

The partnership also enables Safepoint Holdings to optimize its inspection strategy, reducing costs and streamlining operations through high-resolution aerial imagery.

David Flitman, CEO of Safepoint Holdings. said:

“ZestyAI’s property insights have set a new benchmark for accuracy and innovation. The flexibility of their solutions and the ability to evaluate large insured portfolios in a matter of days provide tremendous value to us. This partnership will allow us to better serve our policyholders by proactively managing risk while making our operations more efficient.”

ZestyAI’s Advanced Risk Solutions Adopted by Safepoint:

- Z-PROPERTY Digital Roof™: Analyzes key drivers of roof-related risk—including material, shape, pitch, and condition—using AI-powered 3D modeling of high-resolution aerial imagery. These insights improve Safepoint’s risk selection process and optimize inspections by identifying properties requiring on-site evaluations, ensuring underwriting and renewals are both accurate and efficient.

- Z-PROPERTY Location Insights: Delivers detailed, property-specific risk insights for over 150 million properties across the U.S. Combining computer vision, machine learning, and high-resolution imagery,

Location Insights provides critical risk insights on overhanging vegetation, lot debris, and more, enabling Safepoint uncover hidden risks, streamline workflows, and better align premiums to risk. - Roof Age: Combines over 20 years of historical aerial imagery with verified building permit data to determine the accurate age of a roof with 92%+ accuracy. By eliminating reliance on self-reported or incomplete data, Safepoint can enhance pricing precision, reduce claims exposure, and make informed decisions about eligibility and coverage.

“By integrating our solutions, Safepoint Holdings can make better risk decisions, reduce costs, and expand coverage in states with high climate risk like Florida, Louisiana, Texas, Mississippi, and Alabama,” said Attila Toth, Founder and CEO of ZestyAI. “We’re excited to support Safepoint Holdings with the insights they need to serve their policyholders.”

This partnership comes at a pivotal time as Safepoint Holdings focuses on expanding its portfolio. With ZestyAI’s property-specific data, Safepoint Holdings can scale efficiently while maintaining reliable, cost-effective coverage for its policyholders. Safepoint Holdings operates with a combined policyholder surplus of approximately $150 million, with Safepoint Insurance Co. holding $70 million.

ZestyAI’s AI-Powered Wildfire Risk Model Available for Immediate Use in California Rate Filings

ZestyAI’s Z-FIRE™ Continues to Support California Insurers Amid Regulatory Changes.

ZestyAI, the leader in AI-powered climate and property risk analytics, announced that Z-FIRE™, its advanced wildfire risk model, is filing-ready in California.

Z-FIRE can continue to be filed for rate segmentation and underwriting without further review under the Pre-Application Required Information Determination (PRID) process, which is currently focused on models that determine a catastrophe load factor.

Z-FIRE was last included in an approved California rate filing in 2024.

Z-FIRE leverages AI-driven analysis of over 2,000 historical wildfires, integrating satellite and aerial imagery, topography, and property-level characteristics to provide precise risk assessments. This approach is rooted in decades of science and experimentation by researchers, including the Insurance Institute for Business & Home Safety (IBHS).

With coverage spanning nearly 100% of U.S. properties, Z-FIRE is already trusted by more than one-third of California’s insurance market, including the California FAIR Plan, the state's insurer of last resort, to refine underwriting, enhance risk segmentation, and ensure that premiums accurately reflect the true wildfire exposure and vulnerability of each individual structure.

"For years, leading insurers have trusted ZestyAI to manage wildfire exposure in California and refine pricing segmentation with precision," said Attila Toth, Founder and CEO of ZestyAI. "Now, insurers can continue to confidently integrate it into their rate filings."

They can trust that Z-FIRE meets the highest actuarial and scientific standards, ensuring transparency and reliability for regulators, carriers, and policyholders alike.

ZestyAI continuously validates Z-FIRE’s performance through post-event analyses, assessing how well its risk designations align with real-world fire impacts.

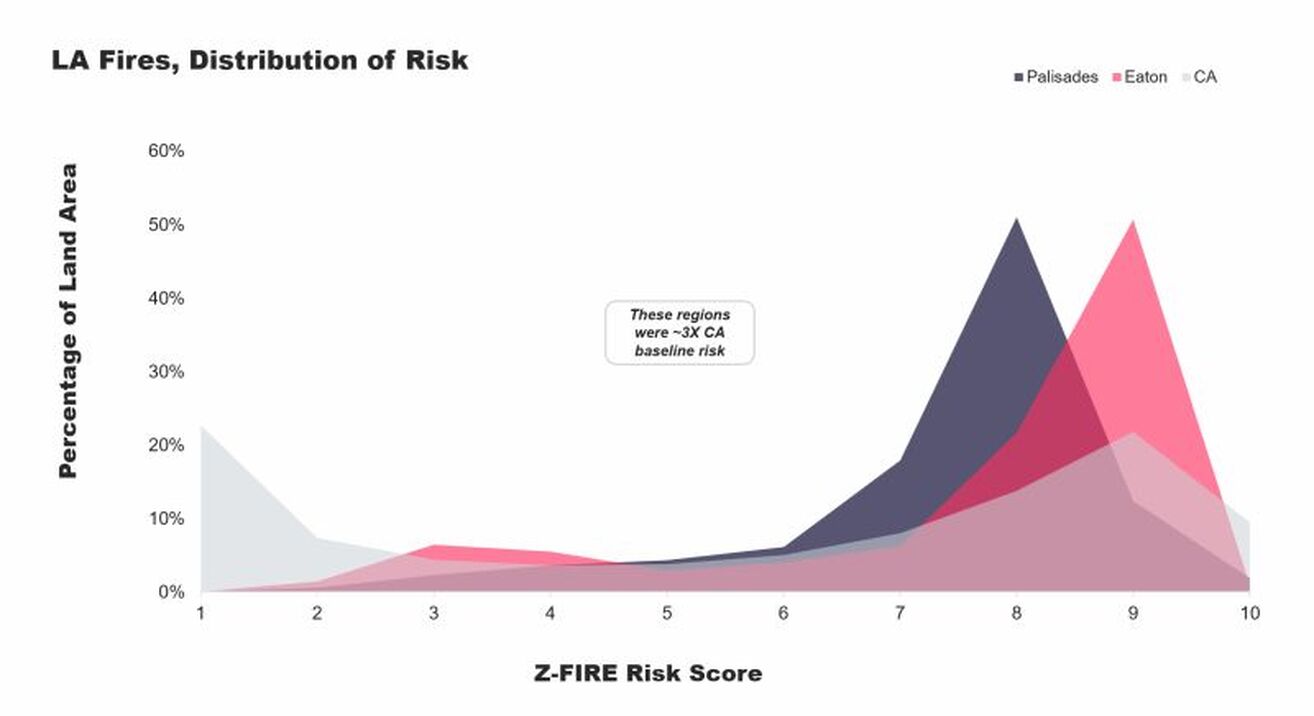

Following the recent Los Angeles wildfires, preliminary analysis indicates that Z-FIRE’s highest-risk ratings closely correspond with the hardest-hit areas, with 94% and 87% of the areas affected by the Palisades and Eaton fires rated as high or very high risk by the model.

The model also captured how property-specific characteristics influenced damage patterns, even within the same fire perimeter, reinforcing the importance of granular, structure-level insights in wildfire risk assessment. Z-FIRE’s data also reveals more than 1.5 million structures in California face a high or very high risk of being within a wildfire perimeter.

With granular, property-specific insights, Z-FIRE allows insurers to move beyond binary "insure or drop" decisions. Instead, they can work with policyholders to reduce vulnerability—whether through defensible space measures, fire-resistant roofing, or other mitigation efforts.

Since its adoption, Z-FIRE has helped insurers confidently write hundreds of thousands of policies that might have otherwise been non-renewed or declined. By incorporating vegetation density, roof materials, and structural characteristics, the model enhances risk segmentation, reduces volatility, and strengthens market stability.

ZestyAI has engaged with the California Department of Insurance (CDI) over the years, including discussions during the early regulatory considerations of Z-FIRE. After an independent actuarial review in 2020, multiple carrier rate and underwriting filings leveraging Z-FIRE have been approved by the CDI. Moreover, ZestyAI participated in seven CDI workshops in 2023-24 and co-hosted a January 2025 webinar on the new regulatory framework.

AI in Insurance: How to Stay Ahead of the Curve

Artificial intelligence is reshaping the P&C insurance industry, offering new ways to streamline underwriting, enhance risk management, and navigate evolving regulations.

But as AI adoption accelerates, insurers must ensure they’re using these technologies effectively—balancing innovation with compliance.

Our latest guide explores the most impactful AI applications in insurance, including:

- AI-powered underwriting and predictive analytics

- How regulators are shaping the future of AI in insurance

- Best practices for integrating AI while ensuring fairness and transparency

As AI-driven tools become the new standard, insurers who adapt early will gain a competitive edge.

Download our free guide to leverage these innovations while staying aligned with evolving regulations.

The Truth About Roof Age: 5 Critical Insights Every Insurer Should Know

For insurers, accurate roof age data is essential. Yet, self-reported information often falls short.

Our research shows that 1 in 5 homeowners underreport roof age by an average of 8 years. These discrepancies create hidden risks that can impact underwriting, pricing, and overall portfolio performance.

How can insurers get a more accurate picture?

AI-driven insights provide 97% nationwide coverage, combining verified roof age with real-time condition data for a more comprehensive risk assessment.

Download our latest research for a breakdown of five critical insights that every insurer should know about roof age.

Plus, get access to The Roof Age Advantage, an exclusive video that unveils how AI is setting a new standard for risk evaluation.

See How Insights Turn Into Decisions

ZestyAI transforms data into action. Get a demo to see how the same AI powering our reports helps carriers make faster, smarter, regulator-ready decisions.