Reports & Research

Explore proprietary research packed with data, insights, and real-world findings to help carriers make smarter decisions.

The Truth About Roof Age: 5 Critical Insights Every Insurer Should Know

For insurers, accurate roof age data is essential. Yet, self-reported information often falls short.

Our research shows that 1 in 5 homeowners underreport roof age by an average of 8 years. These discrepancies create hidden risks that can impact underwriting, pricing, and overall portfolio performance.

How can insurers get a more accurate picture?

AI-driven insights provide 97% nationwide coverage, combining verified roof age with real-time condition data for a more comprehensive risk assessment.

Download our latest research for a breakdown of five critical insights that every insurer should know about roof age.

Plus, get access to The Roof Age Advantage, an exclusive video that unveils how AI is setting a new standard for risk evaluation.

Now Streaming: Navigating California's Evolving Insurance Landscape

The California Department of Insurance (CDI) has introduced significant updates as part of its Sustainable Insurance Strategy. These new bulletins and draft regulations aim to accelerate regulatory approvals, embrace forward-looking models, and address critical reinsurance challenges.

But what do these changes mean for insurance carriers—and how can you prepare?

On January 29, 2025, we hosted a webinar, California’s Evolving Insurance Landscape: The Future of Insurance in the Golden State.

Designed for Legal & Compliance professionals, Product Managers, Underwriters, Actuaries, and Risk & Innovation leaders, the discussion featured expert insights from:

- Michael Peterson, Deputy Commissioner of Climate & Sustainability, California Department of Insurance

- Karen Collins, VP, Property & Environmental, APCIA

- Bryan Rehor, Head of Regulatory Affairs, ZestyAI

Missed the live event but want to gain actionable insights from industry leaders at the forefront of California’s insurance evolution? Watch on demand now!

Webinar: Regulatory Ready - How to Use AI Responsibly in Insurance

Gain a deeper understanding of the NAIC bulletin's principle-based approach to AI regulation and what it means for carriers.

Regulatory Ready: How to Use AI Responsibly in Insurance Under the NAIC Bulletin

AI innovation is revolutionizing the insurance industry, but with these advancements come new regulatory challenges. To ensure responsible use of AI in insurance, it’s essential to stay informed about the latest regulatory frameworks.

Join us on November 13 at 11 PT / 2 ET for an exclusive webinar where we’ll break down how to navigate AI regulations under the NAIC Model Bulletin.

In this session, led by

- Kevin Gaffney, Vermont’s Commissioner of Financial Regulation and Chair of the NAIC’s Innovation & Tech Committee

- Bryan Rehor, Director of Regulatory Strategy at ZestyAI

you'll gain critical insights on how to align AI usage with evolving regulatory expectations.

What You’ll Learn

This webinar will provide practical takeaways that can help insurance professionals understand and comply with the latest AI standards:

- NAIC Model Bulletin Overview: Understand the core principles behind the NAIC’s AI regulation framework.

- Ensuring AI Compliance: Learn how to ensure responsible AI usage according to NAIC standards.

- Preparing for Regulatory Oversight: Get ready for closer state-level inspections and regulatory scrutiny.

- Vendor & Partner Compliance: Ensure that your partners meet regulatory requirements for transparency and fairness.

- Interactive Q&A: Take advantage of the opportunity to ask our experts about the complex world of AI and insurance compliance.

Meet the Experts

Kevin Gaffney

Vermont Commissioner of Financial Regulation

As an expert in AI regulations and the NAIC’s Model Bulletin, Commissioner Gaffney will provide key insights into how insurance companies can effectively implement responsible AI practices. His experience in overseeing state-level financial regulation will offer attendees a unique perspective on aligning AI innovation with compliance.

Bryan Rehor

Director of Regulatory Strategy at ZestyAI

Bryan Rehor will offer practical advice on maintaining AI compliance while harnessing the full potential of AI innovation. His expertise lies in guiding insurers through regulatory demands, ensuring that AI practices meet industry standards while avoiding common pitfalls.

Why You Should Attend

This webinar is tailored for professionals in insurance, particularly those in Executive, Legal, Compliance, Product Management, Underwriting, Actuarial, Risk, and Innovation roles.

Whether you’re navigating the complexities of AI regulation or preparing for the next steps in compliance, this session will provide actionable insights to help you move forward confidently.

Bonus Content

By registering for the webinar, you’ll receive our interactive guide:

“When Innovation & Regulation Meet: What Insurers Need to Know About AI and Regulatory Compliance.”

This resource will deepen your understanding of how to stay compliant while leveraging the power of AI in your insurance operations.

Don’t miss out!

Register for the webinar and ensure your spot in this exclusive event.

.png)

The State of the Industry: AI Adoption in Climate Risk Management

A survey of insurance professionals highlights AI models gaining traction, key insurer priorities, and the impact of transparency and regulatory concerns.

Facing Unprecedented Climate Challenges

The insurance industry is facing unprecedented challenges as natural catastrophic events like convective storms and wildfires become more frequent and severe. Traditional risk models, which often rely on broad territory-based segmentation, are struggling to keep up with these dynamic environmental threats. This has led to significant financial losses for insurers, who are now seeking more accurate and proactive methods to predict and manage climate risk.

AI Adoption in Property and Casualty Insurance

To shed light on the adoption of these cutting-edge techniques, ZestyAI conducted a survey of over 200 executives in the Property and Casualty (P&C) insurance sector. The survey reveals which AI-based models are gaining traction, what features insurers prioritize, and how transparency and regulatory concerns are shaping the industry. It also highlights the specific risks that are top of mind for carriers today.

AI Transforming Risk Assessment Models

The industry is turning to AI-based risk assessment models that offer a new level of precision. Companies like ZestyAI are leading the charge, providing tools that enable insurers to assess risk on a property-by-property basis, considering both individual property features and their interaction with surrounding environmental factors. These advanced models are transforming the way insurers underwrite policies, optimize portfolios, and align coverage with actual needs.

Dive deeper into our findings and explore the full report by clicking below.

Access the Report

Case Study: Adapting to Escalating Severe Convective Storm Risk

Insights from a 5-year retrospective on ZestyAI’s models in action

The Rising Threat of Severe Convective Storms

The past few decades have seen a dramatic rise in the frequency and intensity of severe convective storms, resulting in significant financial repercussions for the insurance industry. In the last year alone, insured losses from severe convective storms reached an astounding $60 billion, marking an average annual growth rate of over 11% over the past twenty years. This alarming trend means a new approach is needed to manage and mitigate the escalating risks associated with severe weather events.

In the last year alone, insured losses from severe convective storms reached an astounding $60B, marking an average annual growth rate of over 11% over the past twenty years.

The traditional methods of risk assessment and management are no longer sufficient to cope with the increasing unpredictability and severity of these weather events. As the risk evolves, so must the solutions. Changing risks call for innovative solutions that leverage advanced technology and data analytics to enhance the accuracy and effectiveness of risk modeling.

A New Approach

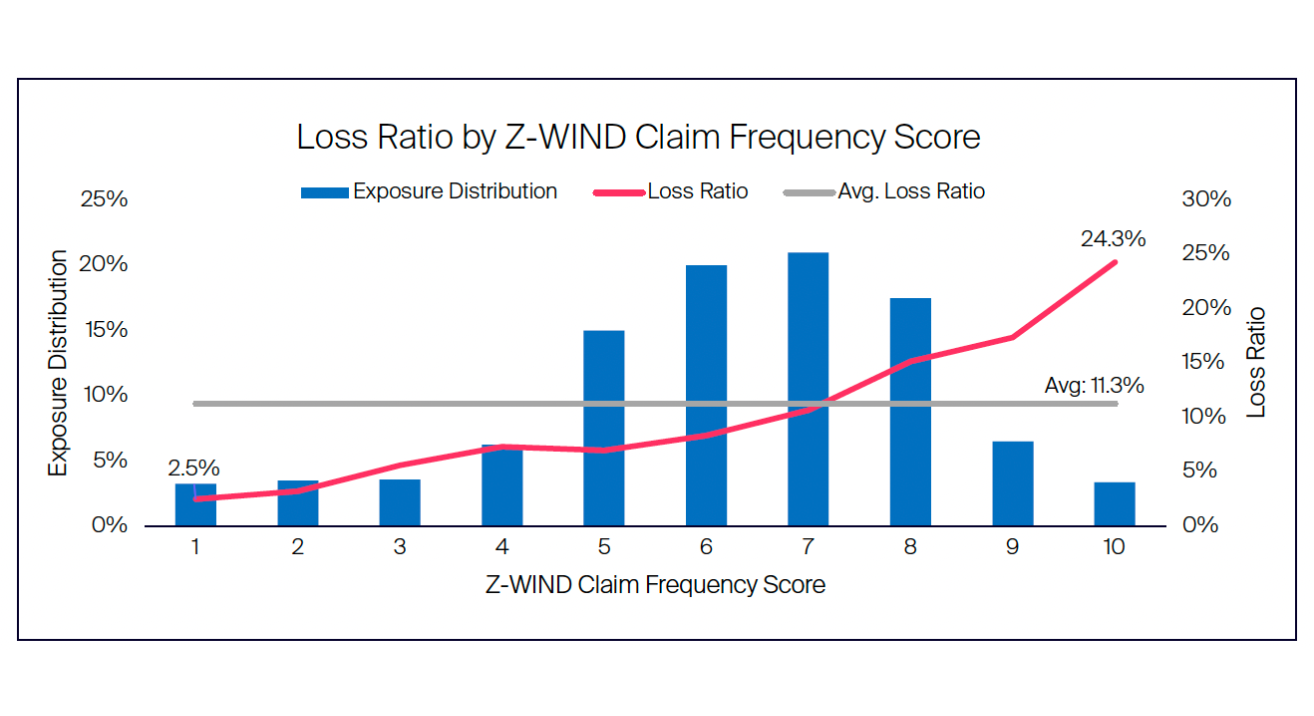

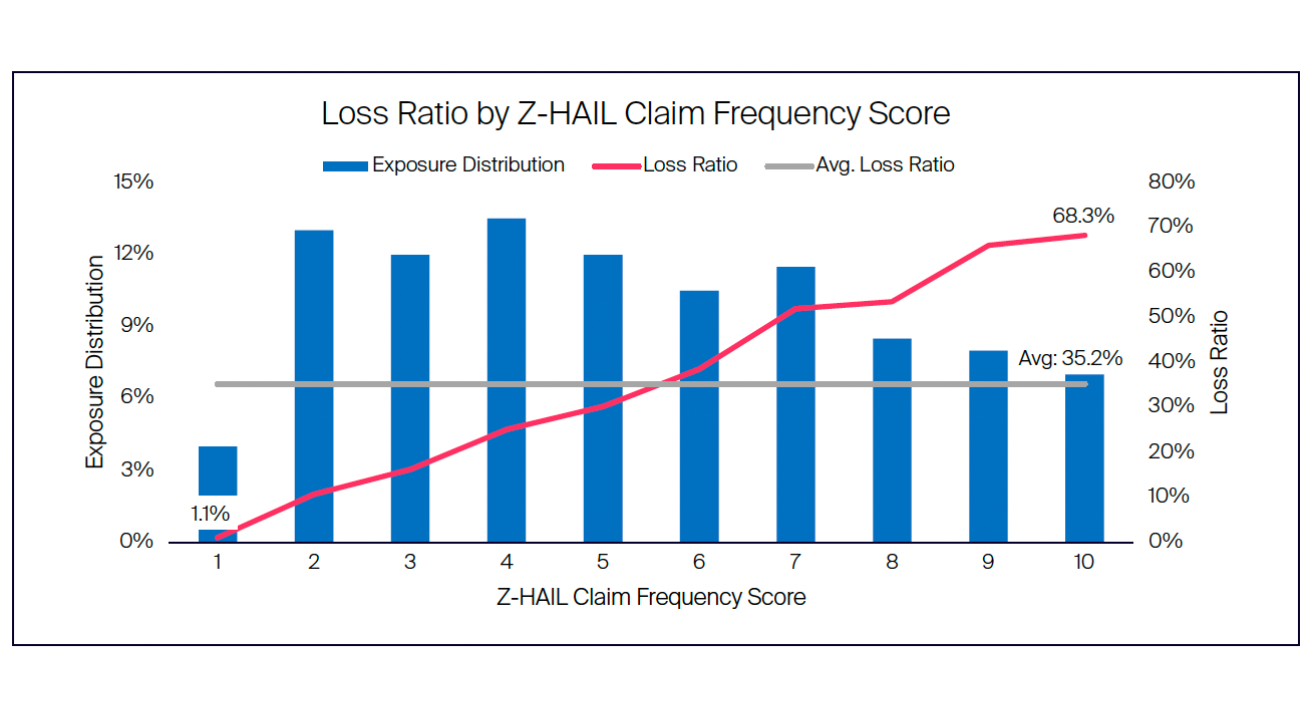

ZestyAI’s Z-HAIL and Z-WIND models are specifically designed to address the challenges posed by severe convective storms. In a new retroactive case study, we explore the performance of these models on a carrier’s book of business over the prior five years, highlighting their effectiveness in delivering comprehensive coverage and precise risk segmentation.

Key findings from the case study include:

Comprehensive Coverage with High Accuracy

One of the standout results from the case study is the exceptional hit rate of 99.7% achieved by Z-HAIL and Z-WIND. This shows the models were able to accurately identify and assess the risk of severe convective storms for nearly all the properties in the carrier's portfolio.

Strong Risk Segmentation

The models demonstrated remarkable capability in risk segmentation, with Z-HAIL generating a lift of 62X and Z-WIND achieving a lift of 9.7X. This means that the models were able to effectively differentiate between high-risk and low-risk properties, even within small geographic areas such as a single zip code. Accurate risk segmentation allows insurers to tailor their policies and pricing strategies more precisely, leading to better management of their risk exposure.

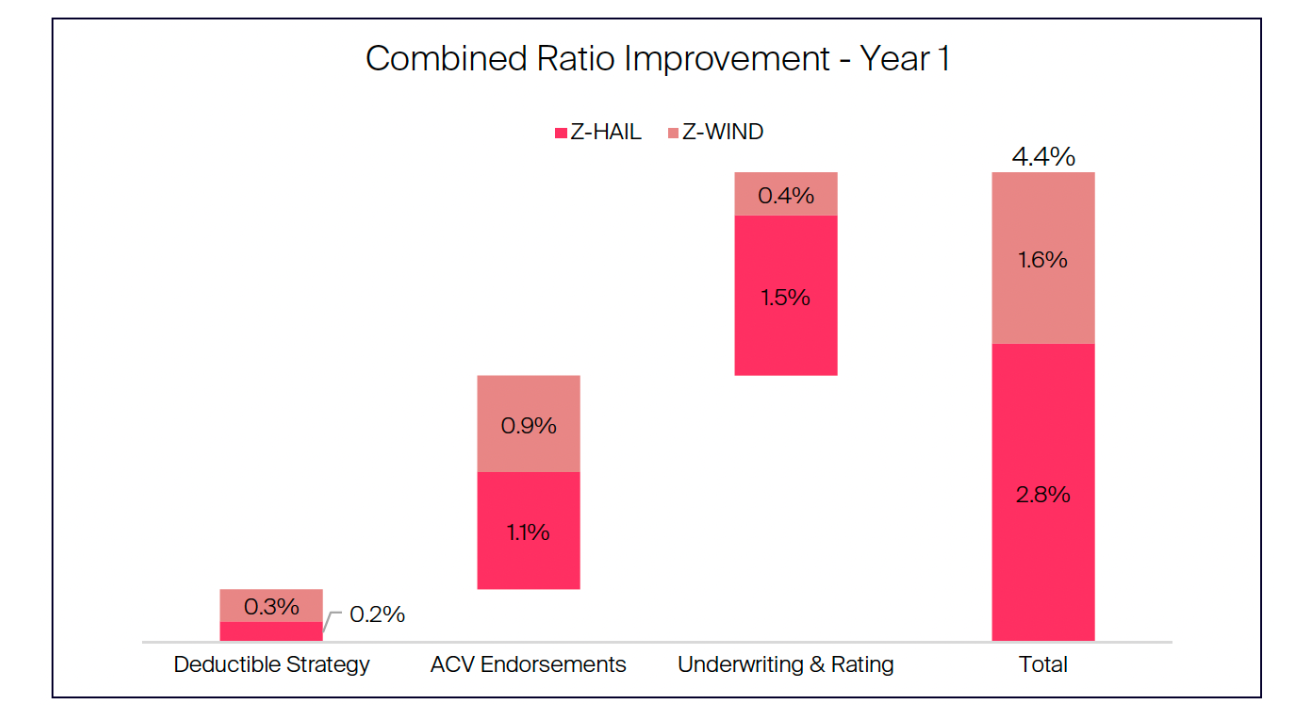

Improved Combined Ratio

Implementing Z-HAIL and Z-WIND would significantly enhance a carrier’s combined ratio, calculated to be approximately 4 points in the first year. This improvement can be attributed to the models’ ability to optimize underwriting, rating, and the application of deductibles and Actual Cash Value (ACV) endorsement strategies. By accurately assessing the risk and applying appropriate measures, insurers can reduce their loss ratios and improve overall profitability.

The Need for Innovative Solutions

As severe convective storms continue to pose significant challenges to the insurance industry, adopting innovative solutions like ZestyAI’s severe convective storm models can help insurers better manage this escalating risk.

These models provide comprehensive coverage, accurate risk segmentation, and improved financial performance. By embracing advanced technology and data-driven analytics, insurers can navigate the complexities of severe weather events and safeguard their portfolios against future losses.

To learn more about the detailed findings and benefits

Download the full case study.

Now Streaming: Roof Risk Master Class

Effective strategies for better risk management

Are rising storm costs and inaccurate roof assessments impacting your bottom line?

Now available to stream, The Science of Roof Risk master class will equip you with the latest strategies and techniques to master roof risk assessment.

- Enhance your roof risk assessment by 60X

- Improve your combined ratio

- Reduce storm-related roof claims

- Strengthen new business selection

What we cover:

Your presenters, Ross Martin (VP, Risk Analytics) and Sam Fetchero (Head of Marketing) will share with you:

- The Problem of the Roof: Uncover the underlying factors driving rising storm losses and why traditional risk assessment methods fall short.

- The Science Behind Predicting Losses: Explore key factors impacting roof risk and loss prediction, including roof age, condition, complexity, and peril-specific models.

- Accuracy-focused Risk Models: Discover advanced modeling techniques that enhance predictive accuracy.

- Understanding Storm Climatology: Learn how storm climatology impacts roof risk and how to integrate these insights into your risk assessment strategies.

- Real-World Results: Witness a comparative analysis of these predictive factors using actual carrier data. Understand the strengths and weaknesses of each approach.

- Priorities of Leading P&C Insurers:

See what your peers asked with valuable insights to take back to your team.

Who Should Watch?

This video is ideal for Executives, Product Managers, Actuaries, Underwriters, and CAT Modelers committed to enhancing their roof risk assessment capabilities.

Bonus Guide

As a bonus for watching, you'll receive a downloadable study on the latest roof risk assessment strategies: Preparing for the Storm: The Insurers Guide to Roof Risk.

Access Now

Roof Age in Rate Filings is Down: What’s Taking Its Place?

For the first time in two decades, regulatory filings using Roof Age have declined as a new standard emerges.

For years, insurers asked:

“How old is this roof?”

Now, the real question is:

“How will this roof perform?"

The way insurers assess roof risk has evolved significantly over the past two decades. What began as a simple Roof Age-based surcharge has transformed into a sophisticated approach that considers real-time condition, storm resilience, and structural complexity.

A closer look at SERFF regulatory filings traces the first recorded use of Roof Age back to 2004 when The Hartford introduced Roof Age-based pricing in Iowa.

At the time, the insurer applied a flat 10% surcharge to roofs 26 years and older—a figure that now seems outdated, as many carriers won’t insure roofs older than 15 years.

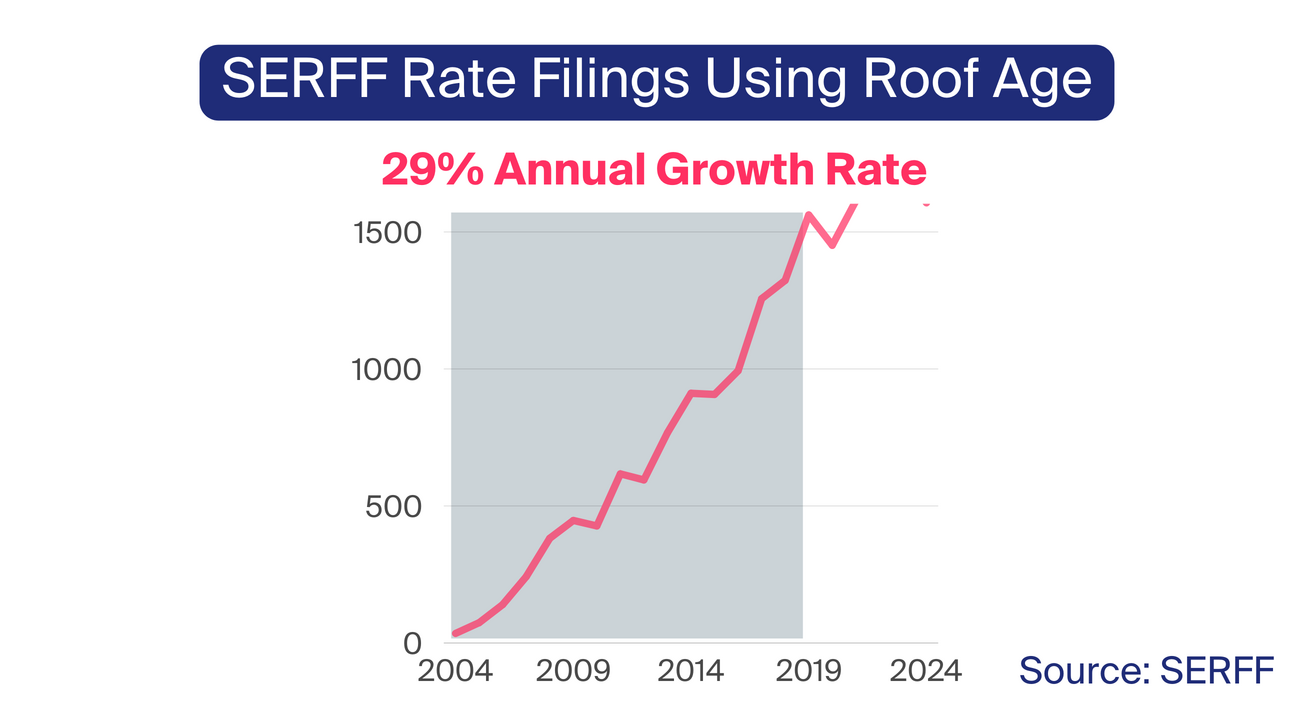

Roof Age quickly became a key rating factor—by the 2010s, Roof Age adoption in rate filings surged, growing at an annual rate of 29%.

If you fast forward just 10 years after The Hartford’s initial filing, you’ll find a stark contrast in how roof risk was assessed. By 2014, The Hartford’s rate filing in Iowa contained 51 pages of actuarial tables, detailing various roof materials and rate adjustment factors for age.

This shift reflected a broader trend—Roof Age moved from a simple surcharge to a more nuanced risk model that accounted for material durability, wear patterns, and structural longevity.

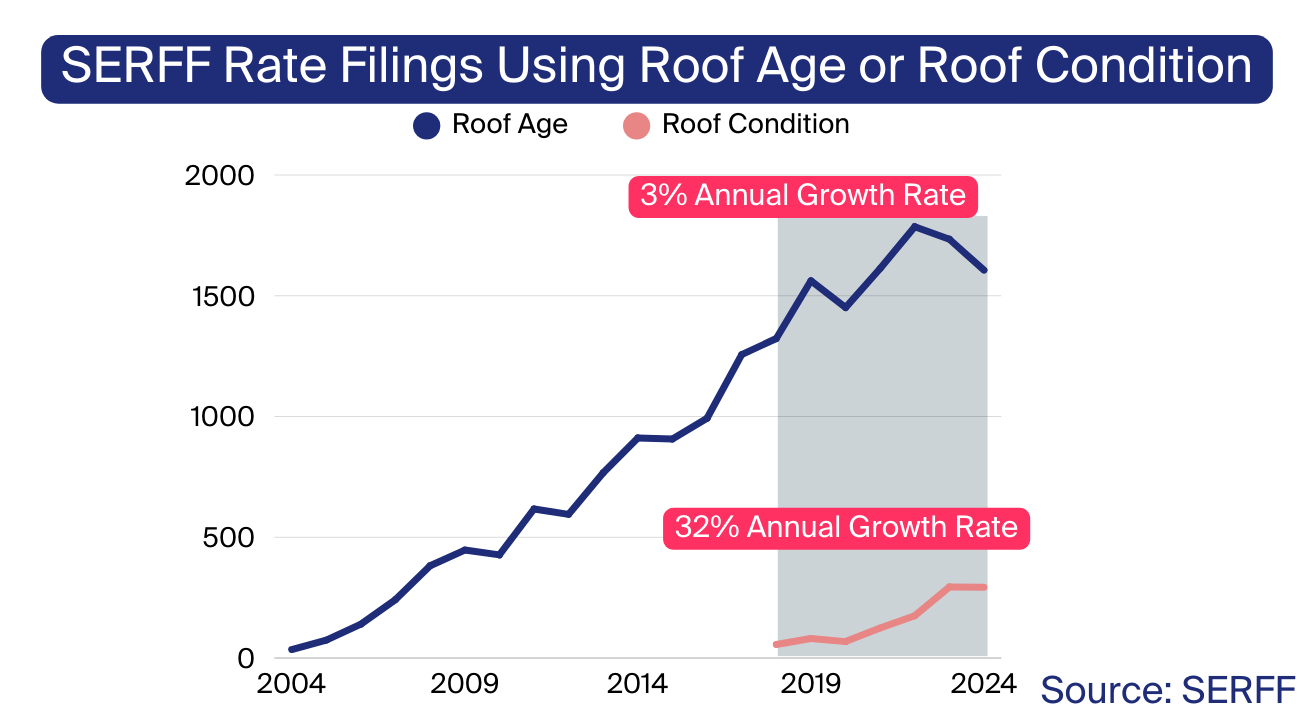

By 2018, insurers began looking beyond Roof Age, and that’s when Roof Condition first appeared in regulatory filings.

Over the past five years, its adoption has surged 32% annually, outpacing Roof Age at its peak. Insurers also began incorporating roof complexity variables, such as pitch and facets, to further refine their risk assessment models.

These advancements provided a more nuanced view of risk, moving beyond the assumption that all old roofs posed the same level of hazard.

Now, for the first time in two decades, Roof Age is plateauing. Over the past two consecutive years, we've seen a decline in the number of filings incorporating Roof Age, bringing its usage close to 2019 levels.

This decline suggests that carriers are moving toward more sophisticated approaches, leveraging real-time condition assessments rather than relying solely on the number of years since installation. After all, a 10-year-old roof in poor condition can present a greater risk than a 20-year-old roof that has been well-maintained—and insurers are recognizing the importance of capturing these distinctions.

With severe convective storm-related insured losses reaching $58 billion in 2024, traditional risk assessment methods can no longer keep up.

A new paradigm is emerging, where advanced AI-driven risk models provide the precision and resilience needed to navigate an increasingly volatile climate.

At ZestyAI, we’re helping insurers make this shift with models like Z-STORM, Z-HAIL, and Z-WIND, which are already filed and approved in 14 states, including Texas, Colorado, Illinois, Oklahoma, and Louisiana.

Those who embrace these innovations will gain a competitive edge—reducing loss costs, improving operational efficiency, and ultimately shaping the future of risk assessment in property insurance.

Report: Severe Convective Storm Preview 2025

Get the insights to manage risk in 2025 before claims surge.

Severe convective storms (SCS)—including tornadoes, hail, and damaging wind events—resulted in $58 billion in insured losses across the U.S in 2024.

Insurers face a dual challenge: navigating the uncertainty of storm patterns while ensuring their portfolios remain resilient enough to absorb the financial strain from clustered, high-loss events.

Research with IBHS confirms that SCS damage accumulates over time, particularly affecting rooftops after multiple exposures to intense storm activity. As housing stock deteriorates, insurers must reassess their portfolios to ensure underwriting, rating, and loss cost controls align with their risk appetite and maintain premiums that accurately reflect evolving exposure.

Get ahead of rising storm risks with expert insights that help you strengthen underwriting, risk assessment, and claims management.

$2.15 Trillion in Property Value at Risk as Wildfire Exposure Expands Across the U.S.

ZestyAI Identifies 4.3 Million U.S. Homes with High Wildfire Risk.

A staggering $2.15 trillion worth of U.S. residential property is at high risk of wildfire damage, according to a new AI-powered analysis from ZestyAI, the leader in climate and property risk analytics. The study, which assessed 126 million properties nationwide, found that 4.3 million individual homes face heightened wildfire risk—far beyond traditionally recognized high-risk areas.

Using advanced AI models trained on over 2,000 historical wildfires, ZestyAI mapped wildfire exposure at the property level, integrating satellite and aerial imagery, topography, and structure-specific characteristics. While California leads the nation with $1.16 trillion in wildfire-exposed property, other states such as Colorado ($190.5 billion), Utah ($100.3 billion), and North Carolina ($71.2 billion) also face significant risk.

Wildfire Risk is a Nationwide Challenge

While the Western U.S. has historically seen the most severe wildfire activity, ZestyAI’s findings confirm that high-risk properties exist across the country. States like North Carolina (4.6% of homes at high risk), Kentucky (2.9%), Tennessee (2.3%), and even South Dakota (11.0%) are now seeing increased wildfire exposure.

As more homes and businesses are built in fire-prone landscapes, the Wildland-Urban Interface (WUI) continues to expand. This, combined with intensifying climate conditions, is driving higher insurance costs and growing availability concerns. Today, one in eight U.S. homeowners already lacks adequate insurance coverage, and that number is expected to rise.

AI Expands Insurance Access in High-Risk Areas

Attila Toth, Founder and CEO of ZestyAI said:

"Wildfires are threatening more properties than ever before, with billions of dollars in exposure even in areas many people don’t associate with fire risk. Yet, too many homeowners are finding themselves uninsured or underinsured just as these disasters become more frequent and severe. Insurers have traditionally relied on broad, regional models that don’t account for individual property characteristics."

"That means some homeowners are denied coverage even when their true risk is much lower than their neighbors'.’"

AI-driven risk analytics are reshaping the way insurers assess wildfire exposure. By providing granular, property-specific insights, we’re helping insurers make smarter underwriting decisions—keeping coverage available in high-risk areas while ensuring that homeowners who take mitigation steps are recognized.

Last year, our models helped insurers extend coverage to 511,000 properties that had previously struggled to secure insurance due to outdated risk models. In 2025, we expect that number to reach a million, ensuring that even in high-risk areas, responsible homeowners have access to protection when disaster strikes.

.png)

ZestyAI’s AI-Powered Hail and Wind Risk Models Continue Rapid Expansion with Approvals in Five States

Amid rising storm threats, regulatory approvals in Oklahoma, North Carolina, Louisiana, Wisconsin, and Arkansas bring AI-driven risk insights to millions of properties.

Property and climate risk analytics leader ZestyAI today announced regulatory approval of its Severe Convective Storm Suite in Oklahoma, North Carolina, Louisiana, Wisconsin, and Arkansas—covering more than 12 million residential and commercial properties.

Severe convective storms caused $58 billion in insured losses in 2024, marking the second-costliest year on record. A recent ZestyAI analysis revealed that in these five newly approved states, more than 2.1 million properties face a high risk of filing a hail claim—putting over $31 billion in potential roof replacement costs on the line.

Unlike traditional models, ZestyAI’s AI-driven risk models predict the likelihood and severity of claims at the individual property level by analyzing the interaction of local climatology with property-specific characteristics.

Built, tested, and validated on an extensive claims database, the models provide a granular, transparent understanding of risk—delivering the top risk factors for each property, and equipping insurers with the accuracy needed to improve underwriting, optimize pricing, and reduce preventable losses.

“Severe convective storms now cost insurers more than hurricanes, yet traditional underwriting tools don’t provide the precision needed to keep pace with rising losses,” said Bryan Rehor, Director of Regulatory Affairs at ZestyAI.

“These approvals reinforce the insurance industry’s shift toward data-driven, property-level risk assessment."

ZestyAI’s SCS models have now been thoroughly vetted and approved by regulators across 14 states—covering more than 44 million properties across the Midwest, Great Plains, and South.

.webp)

Lemonade Partners with ZestyAI to Elevate Underwriting Precision

See how Lemonade is leveraging ZestyAI’s advanced risk insights to strengthen coverage.

ZestyAI announced today that Lemonade, the digital insurance company powered by AI and social impact, has adopted the ZestyAI platform to further optimize underwriting for key catastrophe perils in the U.S., building on the company’s existing technology and underwriting operations.

ZestyAI’s predictive analytics platform leverages advanced AI models to analyze the interplay of climatology, geography, and the unique characteristics of each structure and roof, enabling precise and transparent property risk assessments.

By leveraging unique risk insights, Lemonade can make smarter catastrophe risk mitigation decisions. Additionally, ZestyAI’s proactive regulatory approach, with approvals in key states, simplifies compliance and enables Lemonade to implement these models faster.

“Since our launch, we've always been committed to using technology to create smarter, more accessible insurance products,” said Ori Hanani, Senior Vice President of Insurance at Lemonade.

“In leveraging ZestyAI’s advanced risk models, we're able to further support homeowners in securing comprehensive coverage for their most valuable assets, while also continuing to strengthen our underwriting capabilities as we continue to grow."

Attila Toth, Founder and CEO of ZestyAI, said:

Lemonade is a natural partner for ZestyAI.

“Their innovative approach to insurance and customer-centricity aligns perfectly with our commitment to provide actionable insights that drive smarter risk decisions.”

This partnership reflects a shared vision for addressing increasing climate risks and sets a new standard for resilience, efficiency, and innovation in the insurance industry.

Colorado FAIR Plan Taps ZestyAI to Expand Insurance Accessibility Amid Climate Risks

AI-driven risk models to improve wildfire, hail, and wind assessments while enhancing insurance availability and affordability in Colorado.

ZestyAI today announced a partnership with the Colorado FAIR Plan to expand insurance access for homeowners facing coverage challenges.

The partnership leverages ZestyAI’s AI-driven risk models—Z-FIRE™, Z-HAIL™, and Z-WIND™—to deliver property-specific risk assessments for wildfire, hail, and wind. These insights will support risk-based pricing and help the Colorado FAIR Plan guide homeowners on mitigation strategies.

“Our mission is to ensure every Coloradan has access to insurance that reflects their property’s actual risk, not outdated assumptions,” said Kelly Campbell, Executive Director of the Colorado FAIR Plan.

“ZestyAI’s models will help us bring greater fairness and resilience to the market while equipping homeowners with practical mitigation guidance.”

Over the next year, Colorado FAIR Plan expects to provide coverage to nearly 30,000 families previously classified as high-risk under traditional models.

By incorporating granular risk data, the plan can better align premiums with actual risk while offering homeowners actionable steps to protect their properties.

Those who invest in mitigation may also transition back to the standard insurance market over time.

Colorado regulators have prioritized risk-based pricing and transparency to stabilize the insurance market. Colorado Insurance Commissioner Michael Conway has led efforts to integrate mitigation into coverage decisions, aligning with the FAIR Plan’s adoption of ZestyAI’s AI-driven insights.

“This partnership ensures risk assessments reflect real property conditions—not just broad classifications—so homeowners can access both coverage and meaningful mitigation guidance,” said Bryan Rehor, Director of Regulatory Affairs at ZestyAI.

“Through AI-powered insights, we’re helping homeowners secure risk-aligned coverage options.”

ZestyAI’s risk platform integrates aerial imagery, historical building permits, geospatial data, and structural attributes to provide precise, property-level risk insights.

Insurers using ZestyAI’s models can assess key risk factors—including vegetation proximity, roof condition, and building materials—to inform underwriting, pricing, and mitigation recommendations to policyholders.

The collaboration builds on ZestyAI’s success with the California FAIR Plan, which expanded coverage for hundreds of thousands of homeowners in 2024.

See How Insights Turn Into Decisions

ZestyAI transforms data into action. Get a demo to see how the same AI powering our reports helps carriers make faster, smarter, regulator-ready decisions.