The Great Debate: How to Fix California

Preparing for the Reopening of the World's 4th Largest Insurance Market

All Eyes On California

Is the California insurance market broken or are we overreacting? That is the topic of a recent debate, hosted by ZestyAI. For the debate, ZestyAI brought together two esteemed debaters and renowned industry experts, Pat Sullivan from Risk Information Inc. and Joel Laucher, former Deputy Commissioner of California, to lend their expertise and unpack this pressing issue.

ZestyAI’s role in the debate was that of moderator. We hosted this debate because we are passionate about transparency, collaboration, and finding solutions within the insurance industry. We work closely with carrier partners to understand regulations and ensure responsible use of our models. In fact, ZestyAI's Z-FIRE model was the first AI-powered wildfire model that was approved for use in California as part of a carrier rate filing.

What We Can Agree On

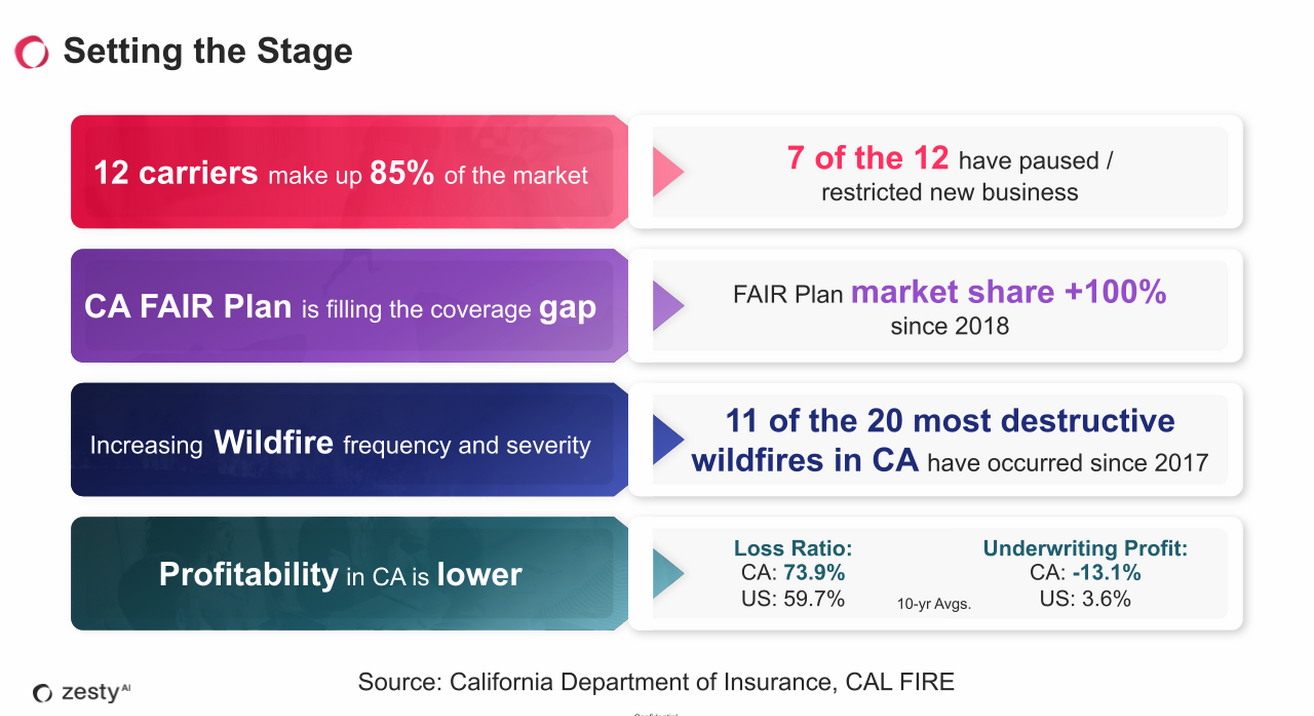

To set the stage for the debate, we set out a few facts that our debaters agreed on. Debate facts were taken directly from the California Department of Insurance (CDI) and CalFire:

- In California, 12 carriers make up 85% of the market, and 7 of those 12 have paused or limited additional business in the state

- California FAIR Plan, the insurer of last resort, is filling the coverage gap, increasing market share by more than 100% since 2018

- California is experiencing increased wildfire frequency and severity with 11 of the 20 most destructive wildfires in California history having occurred since 2017

- Profitability in California is lower than the national average with a loss ratio of 73.9% and an underwriting profit of -13.1%

It’s Hard But It’s Not Complicated

On one side of the table, Sullivan argued that increased wildfire activity has upended the California market creating a capacity crisis for homeowners and an exposure crisis for insurers. He believes there are four resulting issues that need to be addressed:

- The CDI’s rate approval and disapproval timeline

- Restrictions on the use of catastrophe modeling

- California does not allow for reinsurance costs in rates

- Growing California FAIR Plan exposure

Sullivan believes it will be hard to fix the issues in California, but also believes it is not complicated. To address the issues above, he proposes hiring additional staff at the CDI to cut approval and disapproval times, allowing for CAT modeling, and allowing for reinsurance costs as a passthrough. He reminded the room that procedures and regulations are already in place for other perils, such as Quake and Fire Following. For the California Fair Plan, Sullivan suggests a recoupment plan, similar to what is done in auto insurance.

Bringing in Goldilocks

On the other side of the debating table, Laucher noted that small increases in pricing can have a huge impact on certain segments of the market and that the CDI will need to bring in Goldilocks to figure out what is ‘just right’ to balance insurance availability and affordability.

Laucher believes the current system in California is not broken, supporting his argument with the fact that a number of insurers have been able to secure double-digit rate increases in recent months and years. He believes the risk landscape is changing in a good way, with a host of mitigation efforts being successfully executed in the state.

California Is Not Beyond Repair

No matter what side of the debate table you are on, it is clear that the seriousness of the California insurance crisis cannot be understated. It is an issue impacting millions of people, threatening their homes and livelihoods, and one that has implications far beyond California’s state lines.

Finding the right balance between carrier risk exposure and insurance availability is the solution to the problem, and time is of the essence.

If you missed the debate or would like to watch it again you can find the replay here!

Pat Sullivan is a leading voice in property and casualty insurance. As Senior Editor of the acclaimed Property Insurance Report and Auto Insurance Report, Pat has his finger on the pulse of the industry. He's not just an observer – he's a convener, chairing major industry conferences that bring together key players for insightful discussions. Pat brings diverse experience in Insurtech, data analysis, and reporting.

Joel Laucher is an industry veteran with an impressive 35-year career at the California Department of Insurance. Joel's held key positions in market conduct, consumer services, and rate regulation, giving him a deep understanding of the regulatory landscape and its impact on the industry. Before joining the CDI, Joel honed his skills as a commercial insurance underwriter, providing him with valuable real-world experience. Joel now works as an independent consultant and part time with United Policyholders.