ZestyAI Releases Revolutionary Property Change Detection Product Powered by AI

Z-BOOK™ Improves Risk Assessment, Ensures Accurate Insurance Coverage, and Customer Safety by Monitoring Property Changes

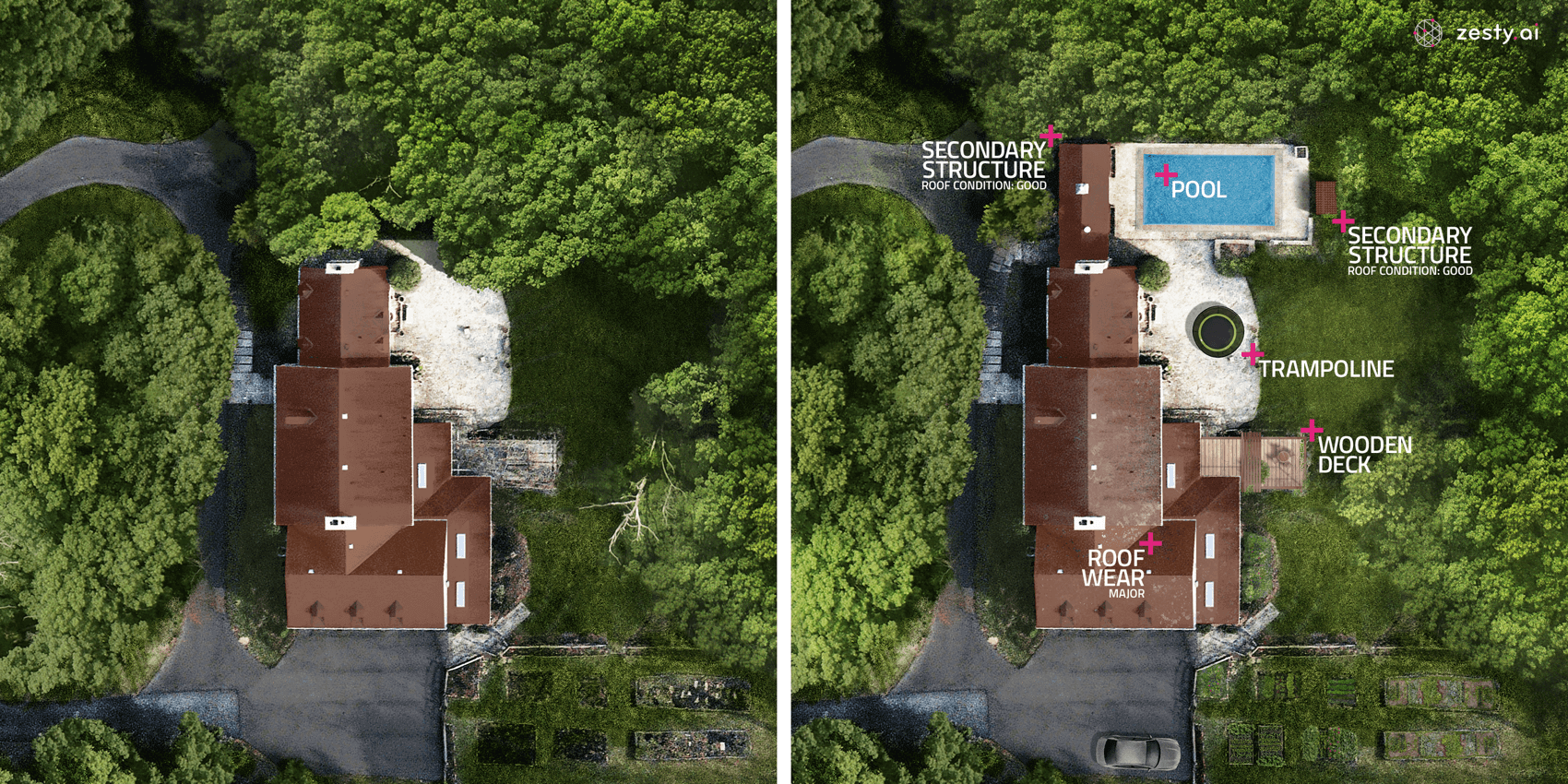

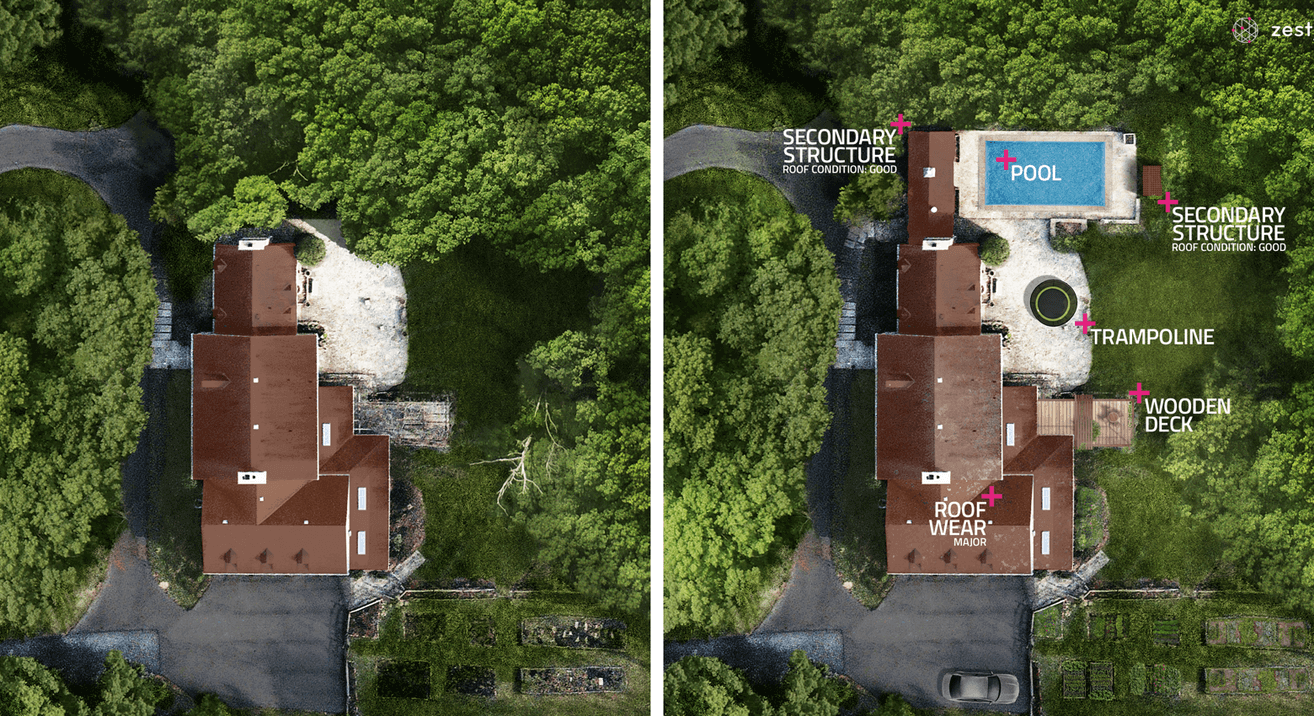

Oakland, CA. November 19, 2019 – ZestyAI announced the release of Z-BOOK⁽ᵀᴹ⁾, a revolutionary property change detection solution targeting the global Property and Casualty Insurance Industry. Z-BOOK™ leverages artificial intelligence (AI) on multiple comprehensive data sources to detect when an improvement is made to a property, and to track maintenance history and quality changes over time, which may affect insurance coverage and customer safety. Relying on Z-BOOK™ allows property insurance companies to maintain a more accurate view of risk in their portfolio (also referred to as in-force book of business) over time and ensure safer residential and commercial properties for their customers.

Z-BOOK™ is a unique solution in the market given the large number of property risk modifiers (60+) it tracks and its utilization of 20+ data sources including high-resolution aerial, satellite and terrestrial imagery, building permits, and real estate transaction databases, among others.

“Z-BOOK™ uses the latest advancements in computer vision and Natural Language Processing powered by AI” says Kumar Dhuvur, ZestyAI’s Founder & Head of Product. “Our technology accurately detects property-specific risk factors from imagery captured from the sky or the ground through computer vision. Natural Language Processing helps us extract structured data from text, such as building permits.”

In 2016 and 2017 alone, Americans undertook 53 million home improvement projects such as installation of new roofs, additions of swimming pools, secondary structures, and decks. These home improvement projects, in addition to natural changes that occur on a property over time—such as roof quality degradation and vegetation overgrowth—affect more than just appropriate insurance coverage. These occurrences also impact resident safety.

Yet, because of the difficulty of obtaining up-to-date property data from traditional sources, such as county tax assessors and the added cost of physical inspections at the time of renewal, many insurance carriers let too many years pass before they reevaluate the risk of a property. This leaves the risk profile of a property unclear, and the property itself more susceptible to both attritional and catastrophic loss.

For instance, whether a property owner is aware of the potential danger or not, a deterioration in roof quality puts the property at risk in the case of inclement weather, including severe convective storms or hurricanes. Z-BOOK recognizes this risk and alerts the insurer via an Application Programming Interface (API) and a software application. The insurer can then notify the customer and provide specific risk mitigation strategies to ensure that the roof quality issues are properly attended to, keeping the home and family safe.

Now, with Z-BOOK, insurance carriers are able to update policies with the changed risks of the property prior to the time of renewal, while also improving customer experience by engaging in a proactive dialogue with the customer on risk mitigation strategies and adequate coverage levels.

Media Contact

hello@zesty.ai

650.999.9900

About ZestyAI

ZestyAI is the leading partner for property & casualty insurance companies embarking on digital transformation. The company harnesses the power of artificial intelligence on cutting-edge data sources including aerial imagery to model risk to real property. ZestyAI leverages predictive algorithms on 130+Bn data points to understand the potential impact of natural catastrophes on individual properties with unprecedented accuracy. Insurance companies rely on these property risk insights to make smart marketing, underwriting and rating decisions. For more information, visit https://zesty.ai.