ZestyAI CEO Attila Toth’s editorial on using AI to combat wildfire risk was featured in Forbes.

Sep 25, 2018 | 1 min Read

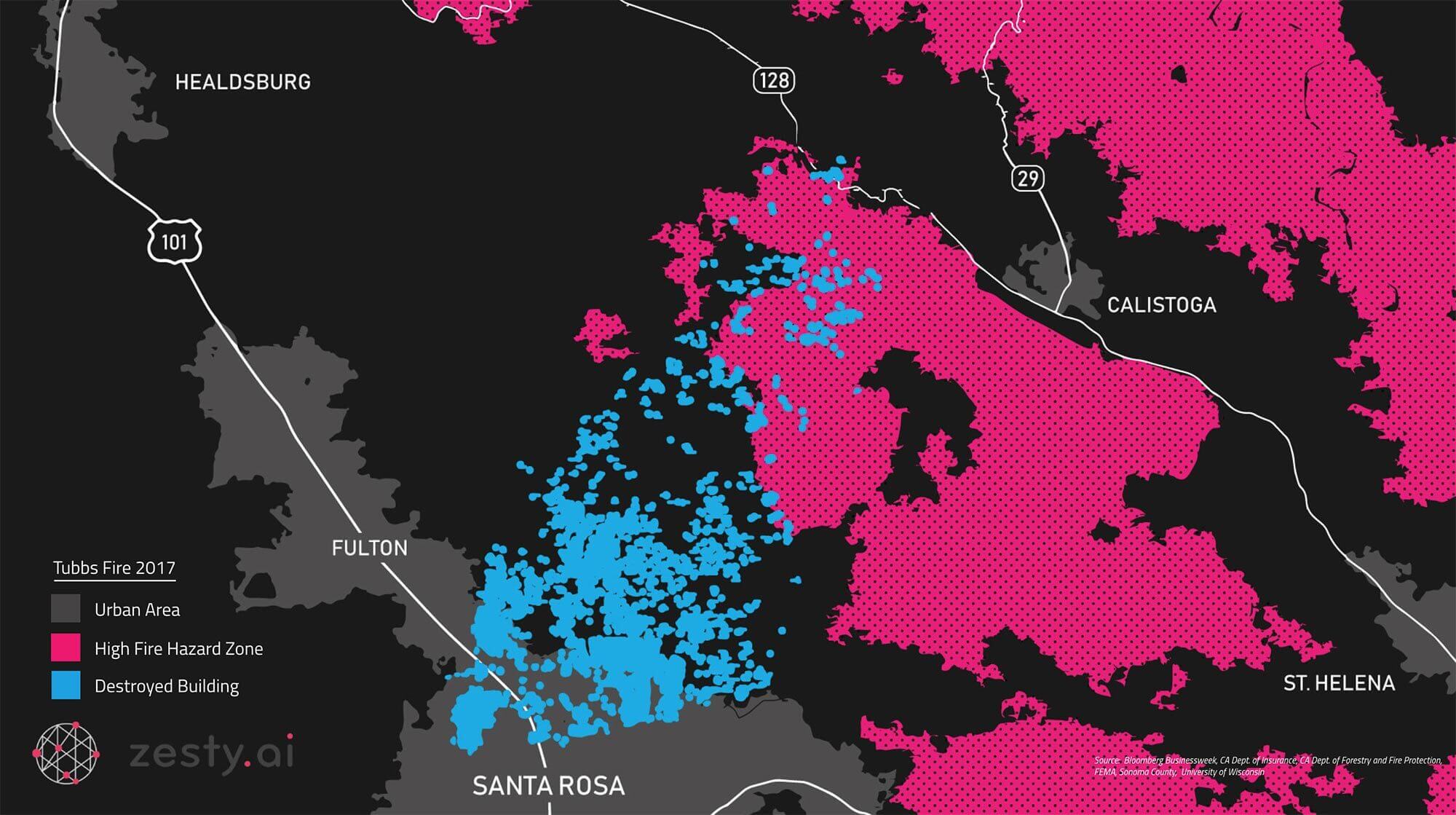

In his piece titled Using Technology To Assess Wildfire Risk And Combat Wildfires, Mr. Toth spotlights the flaws in wildfire risk models. “Insurance companies rely on third-party wildfire risk models and maps produced in the early 2000s to assess the risk of homes to the threat of wildfire. However, in 2017, these models performed poorly: The vast majority of buildings that were destroyed were not classified as high risk on California’s Fire Hazard Zone Map” he states.

Attila goes on to explain how computer vision models will enable insurance carriers and firefighters to take into account individual homeowners’ situations when assessing risk and preparing to contain wildfires. “With more homes than ever being constructed in wildfire-prone areas, it is clear that current wildfire risk models are missing important inputs,” he argues. “By incorporating AI-based data, insurance companies can more completely assess wildfire risk, and with other forms of technology that have recently been developed, firefighters can do a better job minimizing the damage that wildfires can cause.”

Read the whole piece on Forbes here.

About ZestyAI

ZestyAI is the leading partner for property & casualty insurance companies embarking on digital transformation. The company harnesses the power of artificial intelligence on cutting-edge data sources including aerial imagery to model risk to real property. ZestyAI leverages predictive algorithms on 130+Bn data points to understand the potential impact of natural catastrophes on individual properties with unprecedented accuracy. Insurance companies rely on these property risk insights to make smart marketing, underwriting and rating decisions. For more information, visit https://zesty.ai.