Aon evaluates ZestyAI’s risk model, Z-FIRE™

Jun 6, 2019 | 2 min Read

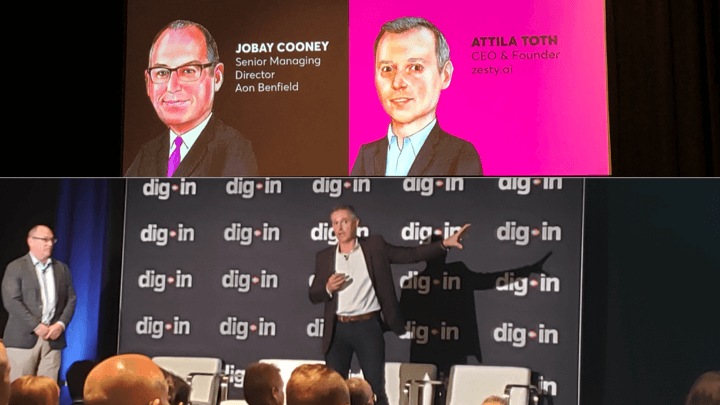

ZestyAI CEO Attila Toth and Aon Senior Managing Director & Head of InsurTech Jobay Cooney recently took the stage during the Digital Future of Insurance Conference (DigIn) in Austin, TX. In a dynamic session, the pair offered the audience, consisting of senior executives from Property and Casualty Carriers, Reinsurers, and MGAs a glimpse into how new applications of Artificial Intelligence (AI) have begun to shape the industry’s future.

Cooney explained Aon’s unfaltering commitment to vetting and channelling cutting-edge technologies from InsurTech start-ups that are best in their class to Aon’s customers. To that extent, after nearly two years of collaboration Aon has recently established a strategic partnership with ZestyAI. The objective of this alliance is to leverage computer vision and predictive analytics to enable insurance companies to better understand catastrophic risk across multiple perils, such as wildfires. Cooney stressed the importance of better understanding this specific peril in the wake of the California wildfires that caused up to US$34 billion in aggregate insured losses in less than two years.

Cooney explained how ZestyAI’s technology benefits insurers as the AI-powered model considers an individual homeowner’s risk characteristics and automatically assesses exposure to wildfire from high resolution satellite and aerial imagery and other data sources.

Cooney added that “Aon evaluated the ZestyAI Z-FIRETM wildfire risk score and observed significant value in the predictive nature of ZestyAI’s catastrophe risk model when evaluating it against actual loss data from multiple wildfires. We found that a property with a high Z-FIRETM score had 775% higher odds of being destroyed in a wildfire than a property with a low Z-FIRETM score.”

Toth explained in detail the opportunity in modernizing wildfire risk assessment through leveraging many property-specific risk modifiers as opposed to a handful of regional ones and building a predictive risk model as opposed to a heuristic one. “The way we trained our AI algorithms is deeply rooted in comprehensive fire science. We worked with experts from CalFire and other institutions to understand how wildfires originate, spread and get extinguished.”

Toth urged attendees to mobilize their organizations to embrace AI and a new way of thinking about wildfire risk to reduce risk exposure with surgical precision in their in-force books. Toth also shared that there is a significant growth opportunity to increase market share in wildfire-prone states of the Pacific West by making smart risk selection decisions while others may be aggressively cutting back.

About AON

Aon plc (NYSE:AON) is a leading global professional services firm providing a broad range of risk, retirement and health solutions. Our 50,000 colleagues in 120 countries empower results for clients by using proprietary data and analytics to deliver insights that reduce volatility and improve performance. To learn more about AON in numbers visit the attached fact sheet.

About ZestyAI

ZestyAI is the leading partner for property & casualty insurance companies embarking on digital transformation. The company harnesses the power of artificial intelligence on cutting-edge data sources including aerial imagery to model risk to real property. ZestyAI leverages predictive algorithms on 130+Bn data points to understand the potential impact of natural catastrophes on individual properties with unprecedented accuracy. Insurance companies rely on these property risk insights to make smart marketing, underwriting and rating decisions. For more information, visit https://zesty.ai.