Top Strategies for Navigating the Tough Reinsurance Market in 2024 and Beyond

How to gain stability amidst catastrophes, inflation, and the evolving risks in the global insurance market

In a world where unexpected catastrophes have become the norm, reinsurance remains the unsung hero, quietly ensuring the stability of the global insurance market. Yet, recent shifts in our global realities are threatening the stability of this safety net. From unprecedented catastrophic events to the relentless march of inflation and the evolution of risk profiles, navigating the reinsurance landscape has become a tightrope walk.

Events like hail, wind, and wildfire catastrophes are resulting in higher losses than the industry has ever seen, forcing carriers and the reinsurance market to change and adapt to the new realities. Carriers now grapple with predicting these growing threats, leading to difficulty in setting premiums and coverages that reflect the real risk. As reinsurers cope with large payouts, they are becoming more selective and stringent in underwriting policies, making it harder for insurance carriers to secure appropriate coverage.

Walking the Tightrope: Negotiating With Intelligence

For both reinsurers and the wider market, the risks are not going away. Reinsurers are placing insurers into two buckets - the "haves and have nots," and they want to do business with the “haves. ” These are the insurers appropriately pricing to risk and taking a property-by-property approach to underwriting and rating. For this group, reinsurers can open capacity for carriers growing safely.

In this challenging reinsurance market, insurance carriers can take several proactive steps to manage their portfolios more effectively and position themselves favorably to reinsurers:

- Demonstrate the portfolio management steps taken to assess risks and mitigate losses

- Improve secondary modifiers and supplement traditional CAT models with a more precise property-specific risk evaluation

- Make the case to reinsurers for improved terms, conditions, and price based on lower inherent risk and adequate pricing on a portfolio

It All Starts With the Relationship

The relationship between brokers and reinsurers is paramount. Brokers always seek avenues to demonstrate their commitment to proactive risk management and portfolio precision. One of the key challenges brokers face is how to accurately assess and communicate the risks and losses of their clients’ portfolios, especially for climate perils that are historically challenging to model, such as wildfires, hail, and wind storms.

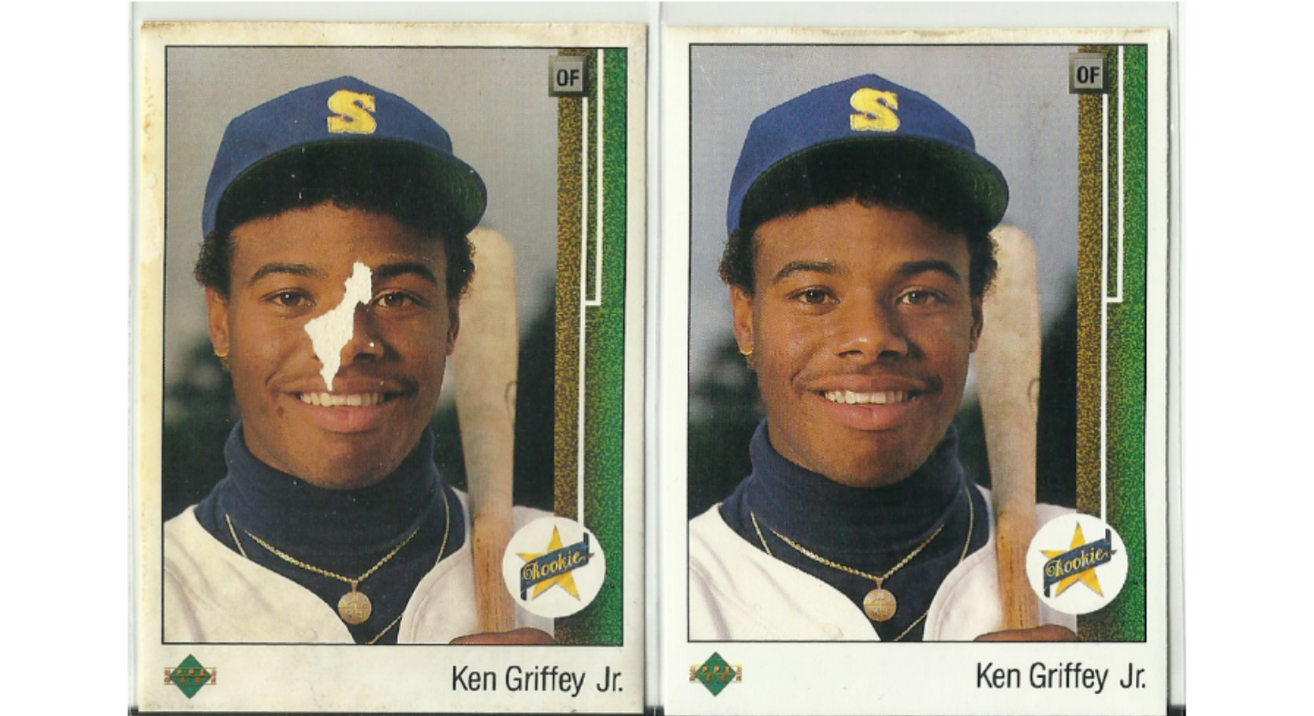

Sports memorabilia collectors will be able to appreciate the nuanced difference between evaluating a reinsurance treaty and the operational precision offered by AI-powered models, like the ones offered by ZestyAI. Think of Beckett's Price Guides, the gold standard in pricing sports cards. This guide gives you a ballpark range of what your beloved Ken Griffey Jr. rookie card might be worth. However, that range is not precise enough if you intend to sell it. For that, you would need a specialized appraisal to determine the exact condition of your card—whether it's Mint, Near Mint, or perhaps Fair-to-Poor. Only with this detailed evaluation can you hone in on the exact value within that broader range.

In a similar vein, stochastic models used in a reinsurance treaty provide a generalized idea—a ballpark figure, so to speak—of potential outcomes. They give a range but lack the granularity of specifics for individual properties. ZestyAI, on the other hand, operates like the specialized card appraiser, drilling down to detailed assessments for each property and saving millions of dollars in losses. This platform helps in refining the general estimates of stochastic models by introducing property-specific risk evaluations, ensuring an accurate and precise understanding of each property's risk profile.

Crafting a Convincing Case

Data analytics and advanced modeling should be at the forefront of risk management strategies and reinsurance conversations. By leveraging technologies like artificial intelligence and machine learning, carriers can better understand and predict emerging risks. This enhanced capability allows them to present a more precise risk profile to reinsurers, which can lead to more favorable terms. Moreover, by integrating non-traditional data sources, such as aerial imagery, carriers can continually refine their risk assessments, leading to more accurate and responsive pricing and coverage decisions.

By fostering relationships built on transparency and mutual understanding, carriers can ensure that they and their reinsurers have aligned interests and a shared view of real risk, leading to robust and enduring reinsurance agreements. In essence, through innovation, diversification, and partnership, carriers can navigate the challenges of the reinsurance market and secure the protection and capacity they need for the evolving risk landscape.

Carriers and brokers need to make the case to reinsurers for improved terms, conditions, and price. To do this, they must demonstrate the portfolio management steps undertaken to assess risks and mitigate losses. By using the latest climate risk models and AI-driven property insights, brokers can show how cedants are identifying high-risk properties, adjusting coverage and pricing, implementing mitigation measures, and monitoring exposure changes over time. Armed with this enriched data and refined models, brokers can show the sophistication of their clients and position them as “haves,” not “have-nots.”

Brokers can enhance their CAT modeling results by using accurate, property-specific data from AI-driven property models as secondary modifiers, such as roof condition, building materials, and vegetation, or use the more advanced models as an alternative altogether. The latest AI models like ZestyAI’s Z-FIRE, Z-WIND, and Z-HAIL examine the interaction of climatology, geography, and the unique characteristics of every structure and roof, analyzed in 3D, for unparalleled risk insights.

New, AI-powered climate models like those offered from ZestyAI are powerful tools for carriers and brokers to secure the most favorable reinsurance prices, terms, and conditions. Carriers can present a more precise risk profile to reinsurers, and brokers can position their clients for improved reinsurance terms and showcase their dedication to meticulous portfolio management.

Want to learn more about how ZestyAI helps carriers and brokers negotiate better reinsurance terms?

Sign up to see ZestyAI in action today.