Hyper-accurate risk mapping with the first AI-powered 3D risk model for precision underwriting of every home & business in the US

Dec 10, 2020 | 5 min Read

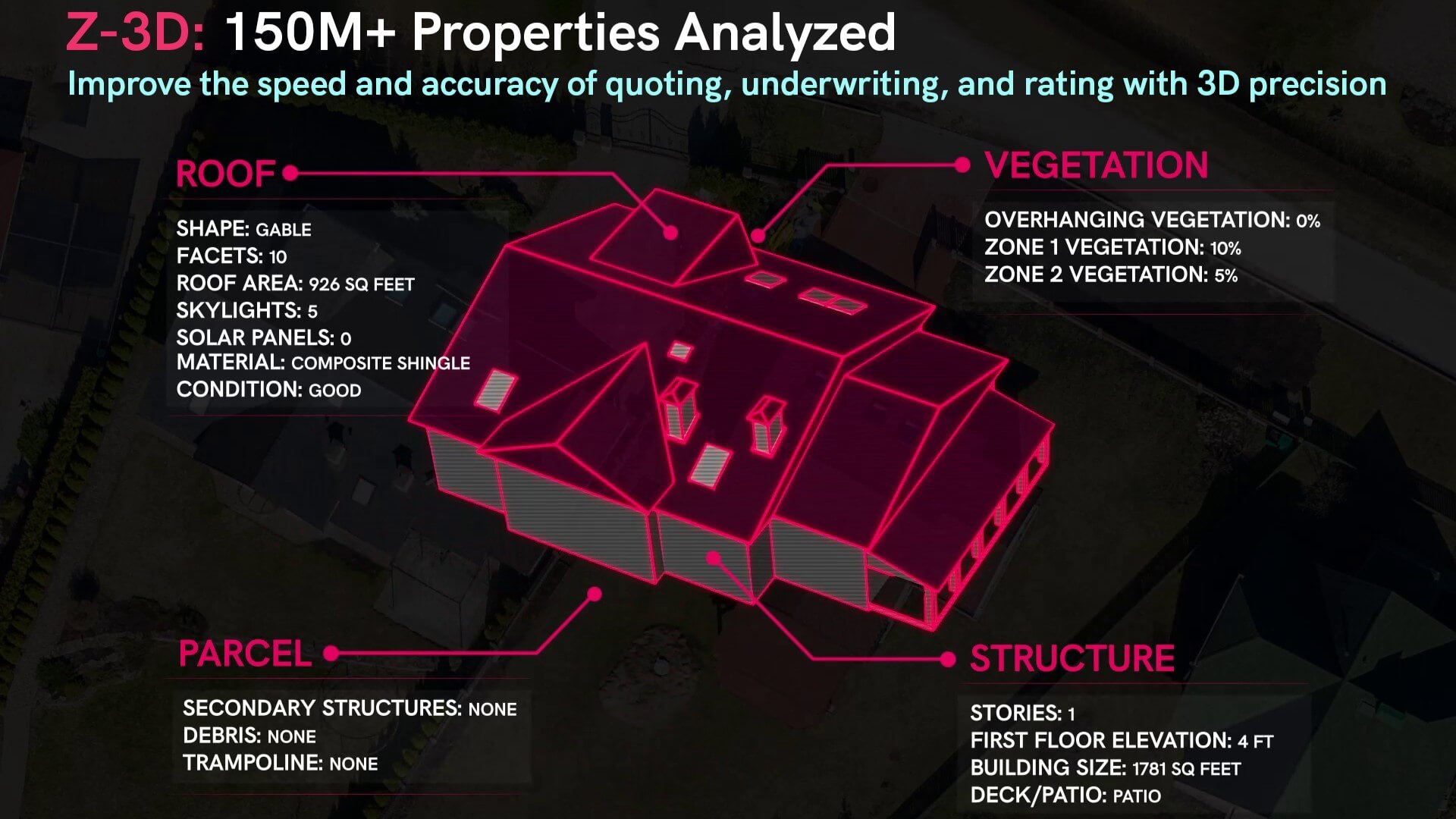

Oakland, California, December 10, 2020 — ZestyAI, the leader in Artificial Intelligence (AI) for insurance and climate risk analytics today announced the official launch of Z-3D: the insurance industry’s first 3D property intelligence system. This new technology allows carriers to assess unique building characteristics like roof pitch, the number and size of roof facets, building height, parcel slope, and more, to precisely measure risk at an individual property level for both personal and commercial lines of business. With more than 150 million properties in true-to-life renders, Z-3D brings a new generation of AI-based insights to insurers for improving the speed and accuracy of nearly every aspect of the property insurance lifecycle.

Fully integrated with the ZestyAI suite of artificial intelligence technologies, Z-3D also provides a powerful dataset for training predictive models on how to identify the growing climate risks to man made structures. Just as our eyes perceive depth by viewing objects from multiple angles, ZestyAI's Z-3D technology leverages imagery from multiple angles and AI to create 3D models of properties.

“Risk simply does not exist in two dimensions - it is multi-faceted and constantly changing - our risk models must reflect that reality,” said Kumar Dhuvur, Founder & Head of Product of ZestyAI. “The digital transformation sweeping the insurance industry is not only a reflection of the rapid change in consumer expectations for smooth digital experience, but also a testament to the quantum leap in AI technologies available to assess risk. Ultimately, the intelligence of any AI model relies primarily on the quality of its underlying data. With a 3D description of every US property available at our fingertips, each part of the insurance policy life cycle becomes easier and more accurate.”

ZestyAI’s property risk analytics platform uses more than 200 Bn data points, including aerial imagery, weather, and real estate data to understand the risk inherent to each and every building. Z-3D modeling allows the company’s AI models to dynamically and accurately assess the impact of natural disasters, such as wildfires, severe convective storms and flood events as well as vastly simplifying the insurance application process.

Previously, the cost of highly manual 3D risk analysis limited its use to high value claims adjustment. The development of Z-3D vastly expands its impact to underwriting and rating through integration with the full suite of ZestyAI property insights that are offered through the following methods:

- Z-FILLᵀᴹ: all extracted property information used to dramatically improve the speed of the marketing, application or claims processes by pre-filling forms with accurate data.

- Z-BOOKᵀᴹ: a revolutionary property change detection solution that detects deterioration in quality and upkeep or when an improvement is made to any property, allowing insurance companies to maintain a more accurate view of risk in their portfolio over time.

- Z-VIEWᵀᴹ: every detail about a property matters so Z-VIEWTM provides insurance agents and underwriters with access to ZestyAI’s unique insights through an interactive virtual view of any address in the US.

Named “Best AI Startup” in the 2020 AI Breakthrough Awards, a CB Insights Most Innovative AI Startup, and a 2019 Gartner Cool Vendor, ZestyAI already provides AI risk solutions for large carriers, reinsurers and brokerage firms..

“Both the challenges and opportunities facing the insurance industry today are unprecedented, but much of the industry relies on data and models born before the turn of the century,” said Attila Toth, ZestyAI co-Founder and CEO. “Our mission is to dramatically and constantly evolve the insurance industry to protect families, communities, and their financial well-being. Because our climate is also constantly changing, we can only deliver on that mission if we leave no stone unturned, no data source unmined. The coverage and accuracy of Z-3D shows our commitment to meeting this challenge, and even at 150 million properties, it is only the first step.”

To learn more about ZestyAI 3D modeling visit http://zesty.ai/

About ZestyAI:

ZestyAI accelerates digital transformation in the Property & Casualty insurance market with powerful data and new artificial intelligence technologies. The company accurately models the potential impact of catastrophic and attritional loss events using the latest advancements in AI on 200+Bn data points on residential and commercial properties. In a world where outdated tools often left insurance carriers with a zip code-level visibility into risk, ZestyAI brings the industry into a new age that enables data-driven dialogue between insurers, customers, agents and regulators. Visit https://zesty.ai for more information.