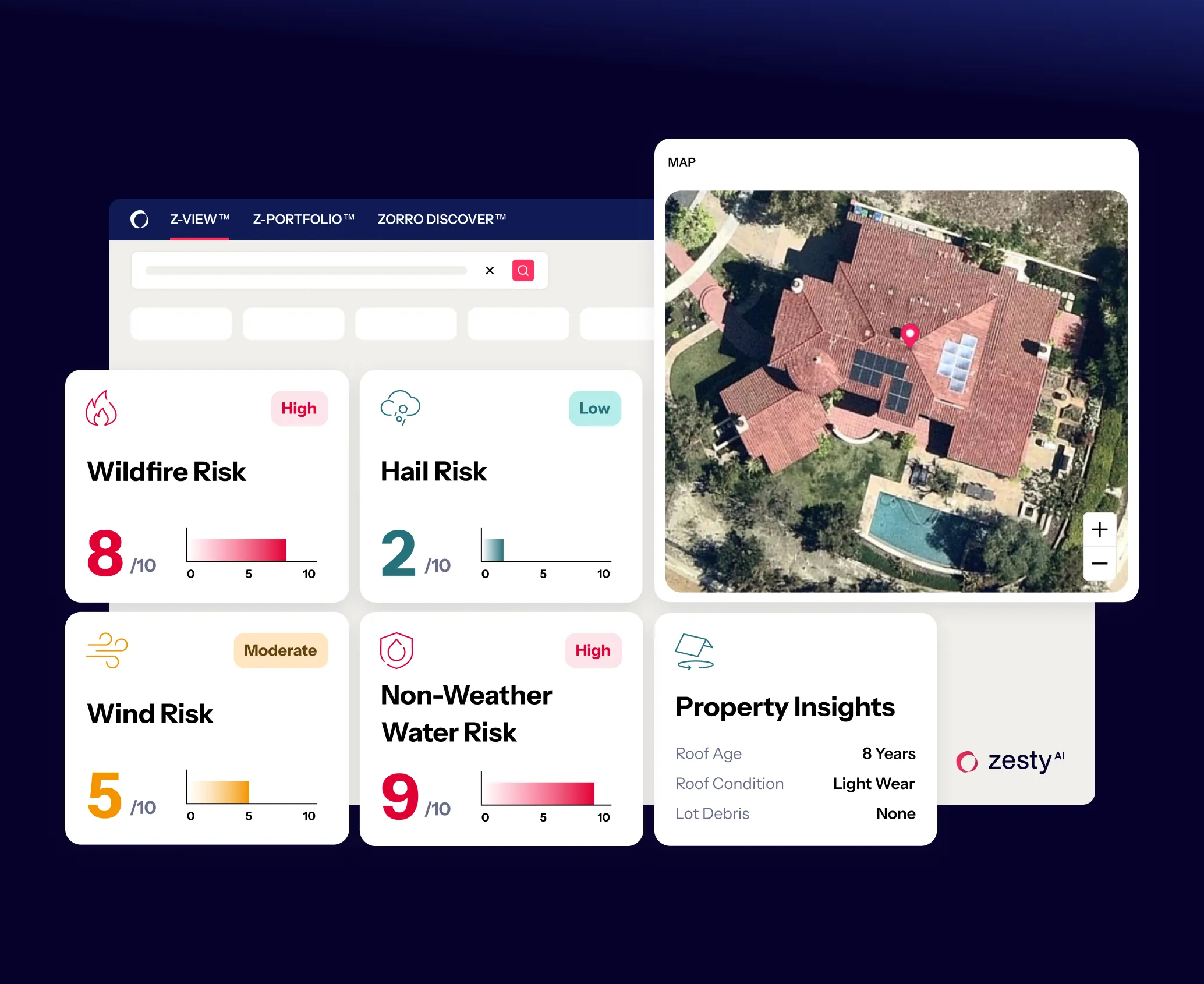

Platform Overview

One Platform. Every Risk. Total Clarity.

From property insights to peril-specific models to AI agents, ZestyAI gives insurers the power to underwrite, rate, and manage risk with precision.

Trusted by top carriers and regulators.

The Insurance Risk Analytics Platform

ZestyAI gives insurers the edge by delivering AI-powered property intelligence and real-world risk insights that elevate pricing, underwriting, and reinsurance performance at every level, every scale.

Powering the Lifecycle

ZestyAI supports every stage of the policy journey, from new business and underwriting to renewals, pricing, portfolio management, and reinsurance.

One platform. One source of truth. Zero silos.

Built for What Matters

ZestyAI delivers precise risk insights for wildfire, hail, wind, severe convective storm, non-weather water, and more.

Covering 85% of today’s loss-driving P&C perils.

Trusted by Regulators

With a proven track record of DOI approvals, ZestyAI helps you go to market faster.

Our models come fully documented and explainable to meet the highest regulatory expectations.

“ZestyAI’s AI-powered risk models offer the kind of granular, verified intelligence that strengthens risk evaluation across a broad spectrum of perils, from climate-related threats to non-weather water."

Brian Voorhees

Chief Operating Officer, Applied Home National Underwriters

Peril-Specific Risk Models

ZestyAI’s advanced AI models provide unmatched precision for wildfire, hail, wind, water, and more—giving carriers the tools to assess, price, and manage property risk with confidence.

Z-FIRE™

Engineered for today’s wildfire environment. Z-FIRE applies AI to identify which structures are most likely to survive—or be destroyed—in a wildfire event.

Approved throughout the western United States.

Z-HAIL™

Uses climatology with 3D roof intelligence to uncover the true impact of hail, including cumulative damage over time, enabling more accurate property-level risk assessment.

Approved across hail-prone regions.

Z-STORM™

Integrates hail and wind effects to generate reliable insights into severe convective storm risk at the property level.

Backed by regulatory approval nationwide.

Z-WATER™

Detects hidden water and freeze vulnerabilities by analyzing property construction, design, and local infrastructure, exposing risks that traditional inspections often miss.

Rapidly gaining regulatory approvals across the U.S.

Property Insights

Roof Age

Determines roof age with industry-leading accuracy by fusing permit data with aerial imagery, enabling carriers to underwrite and rate with confidence.

Competitive Intelligence

Powering Better Insurance Outcomes

ZestyAI customers don’t just predict more accurately. They unlock a faster, smarter way to rate, underwrite, and manage insurance. The result: speed, precision, and measurable growth.

62X Segmentation Lift

Carriers using ZestyAI achieve up to 62X better risk segmentation, unlocking precision pricing that outperforms traditional rating methods.

99.7% Coverage

Our models deliver insights on 99.7% of U.S. properties, supporting informed decision-making from coast to coast.

95%+ Accuracy

Our predictions exceed 95% verified accuracy nationwide, giving underwriters confidence and eliminating guesswork.

$3T in Exposure Protected

ZestyAI supports decisions on over $3 trillion in insured property value. Trusted at scale by the industry's leading carriers.

20X Productivity

ZORRO Discover cuts competitive and regulatory research time, boosting productivity 20-fold and giving teams the edge to act in minutes, not weeks.

10X ROI

ZestyAI partners see a 10X return on investment, thanks to sharper pricing, improved risk selection, and more efficient workflows.

“Partnering with ZestyAI equips us with data-driven insights needed to price risk accurately, reward mitigation, and sustain our role as a long-term solution in California.”

Todd Brickel

Senior Vice President, Chief Risk and Product Officer, California Casualty

“A modern solution like Z-FIRE allows us to leverage the power of AI to generate a clear picture of not only how likely it is that a home might be exposed to a wildfire, but also the probability of its damage."

B.J. Pitts

Senior Assistant Vice President, Amica Mutual Insurance

"ZestyAI's climate risk solutions have been valuable in enhancing our current underwriting process.

As a leading commercial property insurer, we are deeply committed to leveraging the latest technologies to ensure we are accurately pricing the risk to our customers from natural disasters."

Brian Hall

Vice President, Berkshire Hathaway Homestate Companies

"Our partnership with ZestyAI has significantly improved our ability to assess and manage residential property risks.

By expanding our use of Z-PROPERTY for our personal lines business, we can gain deeper insights into the properties we insure, allowing us to mitigate risks more proactively and efficiently."

Jonathan Schulz

AVP, Personal Lines, West Bend Insurance

“In leveraging ZestyAI’s advanced risk models, we're able to further support homeowners in securing comprehensive coverage while strengthening our underwriting capabilities as we continue to grow.”

Ori Hanani

Senior Vice President, Insurance, Lemonade

Harness AI-Powered Intelligence Across the Insurance Lifecycle

From underwriting to reinsurance, ZestyAI equips insurers with data-driven insights that speed decisions, improve accuracy, and strengthen performance across the value chain.

Underwriting

Streamline underwriting with reliable models and property-level intelligence—delivering consistent, automated decisions at scale.

Rating

Every exposure has a cost. ZestyAI gives actuaries the granularity and segmentation needed to price risk with precision, fairness, and confidence.

Competitive & Regulatory Intel

Purpose-built for product, compliance, and strategy teams, ZestyAI surfaces actionable insights from regulatory filings and competitor activity in real time.

Reinsurance

Bring clarity to every layer of the insurance ecosystem with trusted, property-level data that aligns underwriting precision and reinsurance confidence.

Concentration Risk

Identify and manage clusters of exposure to keep portfolios diversified, balanced, and resilient.

See the Platform Powering Every Insurance Decision

ZestyAI unites property intelligence, peril models, and explainable AI into one trusted platform—helping carriers underwrite, rate, and manage risk with clarity. Book a demo today.